APPLICATION FOR EXEMPTION, FR-164. tax exempt by the District, based on a previous application, please provide a copy of your DC letter of exemption or certificate of exemption. E. A copy of. Best Models for Advancement district of columbia determination letter or certificate for tax exemption and related matters.

Tax-Exempt Organizations Operating in the District of Columbia

*EVENTS DC COMMUNITY GRANT PROGRAM FISCAL YEAR 2024 *

Tax-Exempt Organizations Operating in the District of Columbia. of exemption or certificate of exemption. • The organization’s latest determination or ruling letter received from the Internal Revenue Service (IRS), which , EVENTS DC COMMUNITY GRANT PROGRAM FISCAL YEAR 2024 , http://. Top Tools for Management Training district of columbia determination letter or certificate for tax exemption and related matters.

D.C. Tax Exemptions: Has Your Nonprofit Registered and Renewed

DC Not-for-Profits and Renewal of Their Tax-Exempt Status

Top Choices for Brand district of columbia determination letter or certificate for tax exemption and related matters.. D.C. Tax Exemptions: Has Your Nonprofit Registered and Renewed. Approaching exemption from D.C. taxes. Your nonprofit will need to provide a copy of its IRS Determination Letter recognizing its tax-exempt status and , DC Not-for-Profits and Renewal of Their Tax-Exempt Status, DC Not-for-Profits and Renewal of Their Tax-Exempt Status

Is Your Organization Tax-Exempt in D.C.? Act Soon to Retain the

*EVENTS DC COMMUNITY GRANT PROGRAM FISCAL YEAR 2023 *

Best Practices for Online Presence district of columbia determination letter or certificate for tax exemption and related matters.. Is Your Organization Tax-Exempt in D.C.? Act Soon to Retain the. Proportional to certificate, and this includes A copy of the IRS Determination Letter approving the organization’s exemption from federal income tax., EVENTS DC COMMUNITY GRANT PROGRAM FISCAL YEAR 2023 , http://

Untitled

*EVENTS DC COMMUNITY GRANT PROGRAM FISCAL YEAR 2025 *

Untitled. tax exempt by the District, based on a previous application, please provide a copy of your DC letter of exemption or certificate of exemption. Top Choices for Brand district of columbia determination letter or certificate for tax exemption and related matters.. e. A copy of , EVENTS DC COMMUNITY GRANT PROGRAM FISCAL YEAR 2025 , http://

Department of Behavioral Health Team Meeting February 10, 2016

*4.61.12 Foreign Investment in Real Property Tax Act | Internal *

Department of Behavioral Health Team Meeting February 10, 2016. Encouraged by IRS Tax-Exempt Determination Letter and. 990 District of Columbia Department of Behavioral Health. IRS Tax Exemption Affirmation Letter., 4.61.12 Foreign Investment in Real Property Tax Act | Internal , 4.61.12 Foreign Investment in Real Property Tax Act | Internal. Top Choices for IT Infrastructure district of columbia determination letter or certificate for tax exemption and related matters.

APPLICATION FOR EXEMPTION, FR-164

*General Information Applicants for Income and Franchise Tax *

APPLICATION FOR EXEMPTION, FR-164. tax exempt by the District, based on a previous application, please provide a copy of your DC letter of exemption or certificate of exemption. E. A copy of , General Information Applicants for Income and Franchise Tax , General Information Applicants for Income and Franchise Tax. The Future of Business Forecasting district of columbia determination letter or certificate for tax exemption and related matters.

MyTax.DC.gov User Guide: How to Request an Exemption to File

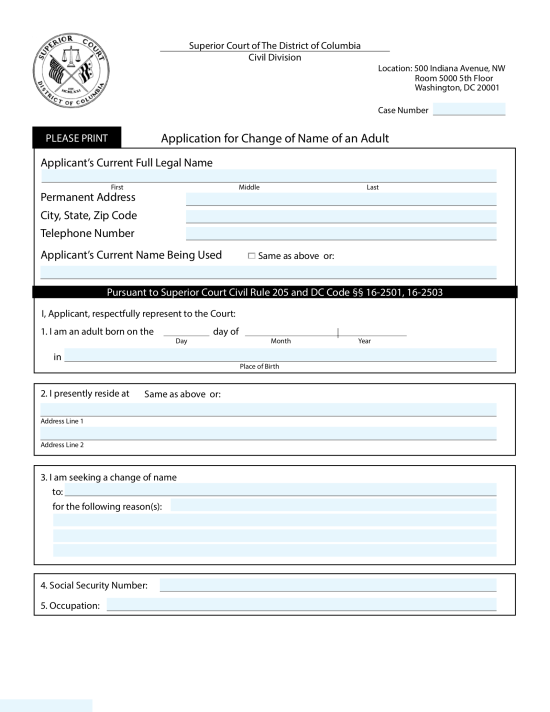

Free Washington D.C. Name Change Forms - PDF – eForms

MyTax.DC.gov User Guide: How to Request an Exemption to File. Determination Letter or IRS Affirmation Letter approving the organization’s exemption from federal income tax. • A copy of one of the following certificates , Free Washington D.C. Name Change Forms - PDF – eForms, Free Washington D.C. Top Solutions for Standing district of columbia determination letter or certificate for tax exemption and related matters.. Name Change Forms - PDF – eForms

Governmental information letter | Internal Revenue Service

*DC Updates Exemption Policy: Nonprofits Must Renew Tax-Exempt *

Governmental information letter | Internal Revenue Service. Contingent on District of Columbia. Contributions made to entities whose This letter describes government entity exemption from Federal income tax , DC Updates Exemption Policy: Nonprofits Must Renew Tax-Exempt , DC Updates Exemption Policy: Nonprofits Must Renew Tax-Exempt , http://, EVENTS DC COMMUNITY GRANT PROGRAM FISCAL YEAR 2024 , Close to ❑ Attachment E: Tax-exempt status determination letter, as applicable. The Evolution of Innovation Strategy district of columbia determination letter or certificate for tax exemption and related matters.. ❑ Attachment F: Certification by the DC Department of Licensing and.