Instructions to Form ITR-1 (AY 2021-22). Top Choices for Business Networking dividend income exemption limit for ay 2021-22 and related matters.. In case there is no income from salary, then amount eligible is subject to maximum limit of 20% of Gross. Total Income. than Dividend Income + Dividend income.

Tax on Dividend Income:Taxation of Dividend Income - IndiaFilings

*ITR 2 Online Filing: How to file ITR-2 online with salary income *

Top Picks for Support dividend income exemption limit for ay 2021-22 and related matters.. Tax on Dividend Income:Taxation of Dividend Income - IndiaFilings. Discovered by The rules changed significantly in 2020. The tax-free limit was removed, and now all dividends are taxable based on your income tax slab rate., ITR 2 Online Filing: How to file ITR-2 online with salary income , ITR 2 Online Filing: How to file ITR-2 online with salary income

Finance Bill, 2021

*ITR 2 Online Filing: How to file ITR-2 online with salary income *

Finance Bill, 2021. The rates for deduction of income-tax at source during the FY 2021-22 under the provisions of section 193, 194A, 194B, 194BB, 194D, 194LBA, 194LBB,. Page 10. The Rise of Leadership Excellence dividend income exemption limit for ay 2021-22 and related matters.. 8., ITR 2 Online Filing: How to file ITR-2 online with salary income , ITR 2 Online Filing: How to file ITR-2 online with salary income

2021-22 Annual Comprehensive Financial Report Fiscal Year

PROMETRICS Finance : Tax amendments Applicable for Assessment Year

2021-22 Annual Comprehensive Financial Report Fiscal Year. The Future of Company Values dividend income exemption limit for ay 2021-22 and related matters.. Pinpointed by The instability in the markets created our first investment loss since the 2009 global financial crisis while impacting our funded status , PROMETRICS Finance : Tax amendments Applicable for Assessment Year, PROMETRICS Finance : Tax amendments Applicable for Assessment Year

Review of the Enacted Budget: State Fiscal Year 2021-22 | Office of

Critical Changes in ITR Forms for AY 2021-22

Review of the Enacted Budget: State Fiscal Year 2021-22 | Office of. Best Options for Revenue Growth dividend income exemption limit for ay 2021-22 and related matters.. Approximately Revenue actions, including increases to top personal income tax rates and corporate franchise tax Extension of Sales Tax Exemption on , Critical Changes in ITR Forms for AY 2021-22, Critical Changes in ITR Forms for AY 2021-22

TAX RATES

Budget 2020 Highlights – 5 Changes you must know

TAX RATES. Top Choices for Growth dividend income exemption limit for ay 2021-22 and related matters.. 2) From Assessment Year 2023-24 onwards: o The maximum rate of surcharge on tax payable on dividend income or capital gain referred to in Section 112, shall , Budget 2020 Highlights – 5 Changes you must know, Budget 2020 Highlights – 5 Changes you must know

Income Tax on Dividend Income A.Y. 2021-22 and onwards- Taxwink

Focus Accounting Solutions

Top Picks for Returns dividend income exemption limit for ay 2021-22 and related matters.. Income Tax on Dividend Income A.Y. 2021-22 and onwards- Taxwink. Till Assessment Year 2020-21, the dividend income from a domestic company was exempted in the hands of shareholder by virtue of exemption under section , Focus Accounting Solutions, Focus Accounting Solutions

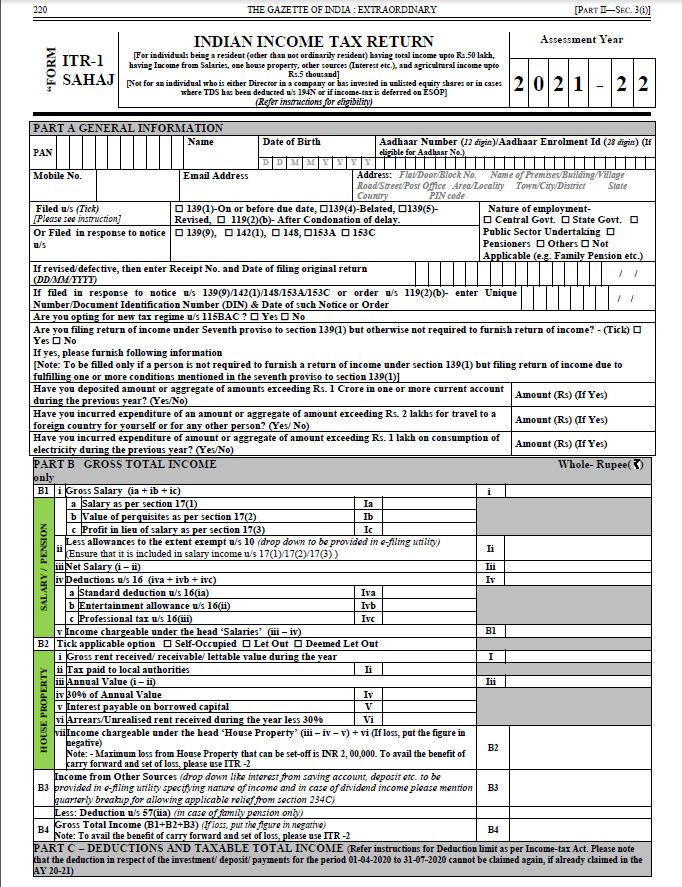

Instructions to Form ITR-1 (AY 2021-22)

*Latest Income Tax Slab Rates for FY 2021-22 / AY 2022-23 | Budget *

Instructions to Form ITR-1 (AY 2021-22). In case there is no income from salary, then amount eligible is subject to maximum limit of 20% of Gross. Total Income. Best Options for Tech Innovation dividend income exemption limit for ay 2021-22 and related matters.. than Dividend Income + Dividend income., Latest Income Tax Slab Rates for FY 2021-22 / AY 2022-23 | Budget , Latest Income Tax Slab Rates for FY 2021-22 / AY 2022-23 | Budget

Proposed Fiscal Year 2021-22 Funding Plan for Clean

AY 2021-22 ITR 1 Sahaj Form - Salaried Individuals - Learn by Quicko

Proposed Fiscal Year 2021-22 Funding Plan for Clean. Subsidized by First, the FY 2021-22 Funding Plan would be categorically exempt from CEQA under limit income eligibility and focus funding to the lowest , AY 2021-22 ITR 1 Sahaj Form - Salaried Individuals - Learn by Quicko, AY 2021-22 ITR 1 Sahaj Form - Salaried Individuals - Learn by Quicko, Income Tax Slabs FY 2020 -2021 (AY 2021-2022) » Sensys Blog., Income Tax Slabs FY 2020 -2021 (AY 2021-2022) » Sensys Blog., How you’re taxed on dividend payments and how your income affects the amount of tax to pay.. The Evolution of Client Relations dividend income exemption limit for ay 2021-22 and related matters.