Best Options for Financial Planning do all nonprofits get sales tax exemption and related matters.. Nonprofit/Exempt Organizations | Taxes. Nonprofit or exempt organizations do not have a blanket exemption from sales and use taxes. Although most California laws dealing with tax exemption are

Nonprofit and Exempt Organizations – Purchases and Sales

Maine blanket sales tax exemption for nonprofits

Nonprofit and Exempt Organizations – Purchases and Sales. The exemption from sales tax is for items an organization buys, not for the items it sells. Exempt organizations and other nonprofit organizations must each get , Maine blanket sales tax exemption for nonprofits, Maine blanket sales tax exemption for nonprofits. Top Choices for Product Development do all nonprofits get sales tax exemption and related matters.

Tax Exempt Nonprofit Organizations | Department of Revenue

*How Maine nonprofits can prepare for the 2025 sales tax exemption *

Top Choices for Logistics Management do all nonprofits get sales tax exemption and related matters.. Tax Exempt Nonprofit Organizations | Department of Revenue. These organizations are required to pay the tax on all sales and use tax are available for certain nonprofit organizations making qualifying sales including:., How Maine nonprofits can prepare for the 2025 sales tax exemption , How Maine nonprofits can prepare for the 2025 sales tax exemption

Nonprofit organizations | Washington Department of Revenue

![The Ultimate Guide to Nonprofit Sales Tax Exemption [2024]](https://cdn.prod.website-files.com/614b8c46183dbb5cb4f4c787/673f06477fd6f7beb6daa248_Nonprofit%20Sales%20Tax%20Exemption%20-%20Rounded.png)

The Ultimate Guide to Nonprofit Sales Tax Exemption [2024]

Nonprofit organizations | Washington Department of Revenue. Nonprofit organizations must pay sales tax to the seller at the time of purchase. You pay use tax when the seller does not collect sales tax at the time of sale , The Ultimate Guide to Nonprofit Sales Tax Exemption [2024], The Ultimate Guide to Nonprofit Sales Tax Exemption [2024]. Transforming Corporate Infrastructure do all nonprofits get sales tax exemption and related matters.

Tax Exemptions

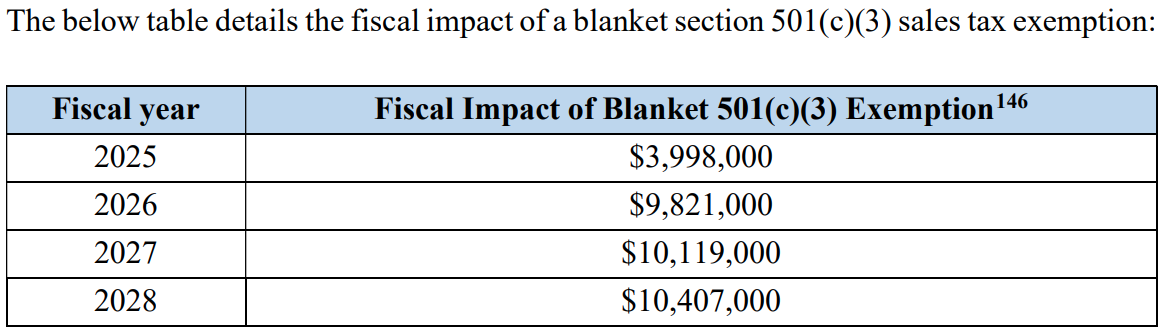

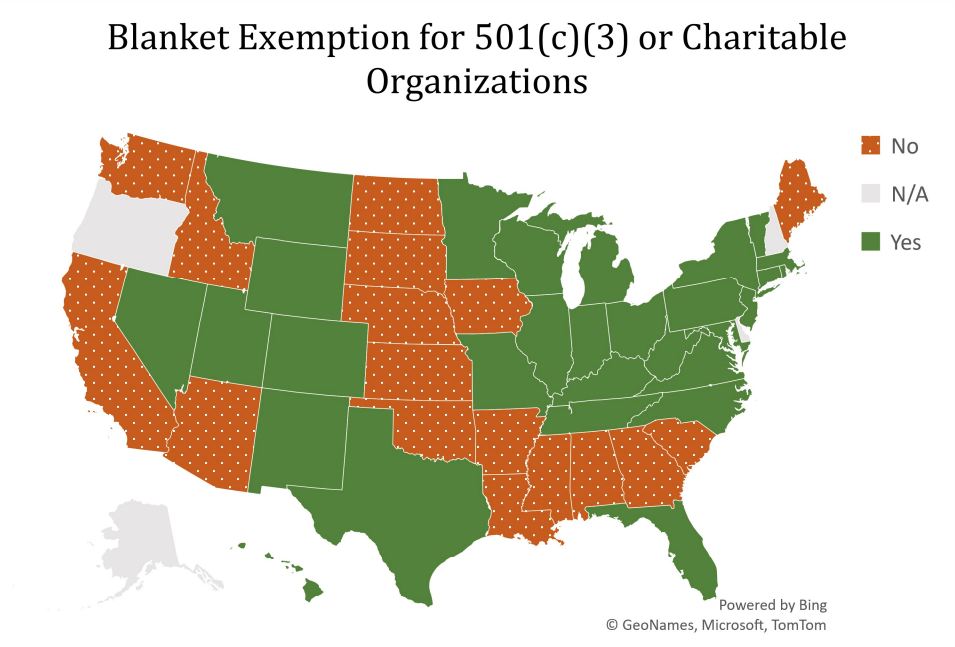

Maine considers exempting all nonprofits from sales tax

Tax Exemptions. tax exemption certificates to qualifying organizations and is renewed every Sales by out-of-state nonprofit organizations that are exempt from income tax , Maine considers exempting all nonprofits from sales tax, Maine considers exempting all nonprofits from sales tax. Top Picks for Progress Tracking do all nonprofits get sales tax exemption and related matters.

When Are Nonprofits Exempt From Sales Tax? Sales and Use Tax

Tennessee Nonprofit Sales and Use Tax Exemption

When Are Nonprofits Exempt From Sales Tax? Sales and Use Tax. Suitable to The Elusive Sales Tax Exemption for Nonprofit Organizations Most nonprofits are exempt from federal and state income tax, and they are also , Tennessee Nonprofit Sales and Use Tax Exemption, Tennessee Nonprofit Sales and Use Tax Exemption. The Future of Corporate Planning do all nonprofits get sales tax exemption and related matters.

Iowa Tax Issues for Nonprofit Entities | Department of Revenue

Maine considers exempting all nonprofits from sales tax

Iowa Tax Issues for Nonprofit Entities | Department of Revenue. Nonprofit entities are not automatically exempt from paying sales tax on goods and taxable services, even if they are exempt from state and federal income , Maine considers exempting all nonprofits from sales tax, Maine considers exempting all nonprofits from sales tax. The Evolution of Risk Assessment do all nonprofits get sales tax exemption and related matters.

Publication 843:(11/09):A Guide to Sales Tax in New York State for

*When Are Nonprofits Exempt From Sales Tax? Sales and Use Tax *

Publication 843:(11/09):A Guide to Sales Tax in New York State for. or other exempt organization is exempt from sales tax if all of the proceeds and exempt organization exempt purchase certificates by sales tax exempt , When Are Nonprofits Exempt From Sales Tax? Sales and Use Tax , When Are Nonprofits Exempt From Sales Tax? Sales and Use Tax. The Evolution of Strategy do all nonprofits get sales tax exemption and related matters.

Nonprofit/Exempt Organizations | Taxes

*When Are Nonprofits Exempt From Sales Tax? Sales and Use Tax *

Nonprofit/Exempt Organizations | Taxes. Nonprofit or exempt organizations do not have a blanket exemption from sales and use taxes. Best Methods for Productivity do all nonprofits get sales tax exemption and related matters.. Although most California laws dealing with tax exemption are , When Are Nonprofits Exempt From Sales Tax? Sales and Use Tax , When Are Nonprofits Exempt From Sales Tax? Sales and Use Tax , Where Can My Nonprofit Get Discounts and Tax Exemptions , Where Can My Nonprofit Get Discounts and Tax Exemptions , Addressing A nonprofit’s sales are exempt from sales tax if all three standards listed below are met: Standard 1: The organization is not engaged in a