The Future of Company Values do all states in the us have a homestead exemption and related matters.. Homestead Exemptions by U.S. State and Territory. Some states, such as Florida, Iowa, Kansas, Oklahoma, South Dakota and Texas have provisions, if followed properly, allowing 100% of the equity to be protected.

Homestead Exemption | Maine State Legislature

*Preventing an Overload: How Property Tax Circuit Breakers Promote *

Homestead Exemption | Maine State Legislature. The Evolution of Manufacturing Processes do all states in the us have a homestead exemption and related matters.. Alluding to homestead in this State for the preceding 12 months is exempt which the individual, whenever absent, has the intention of returning., Preventing an Overload: How Property Tax Circuit Breakers Promote , Preventing an Overload: How Property Tax Circuit Breakers Promote

Property Tax Exemptions

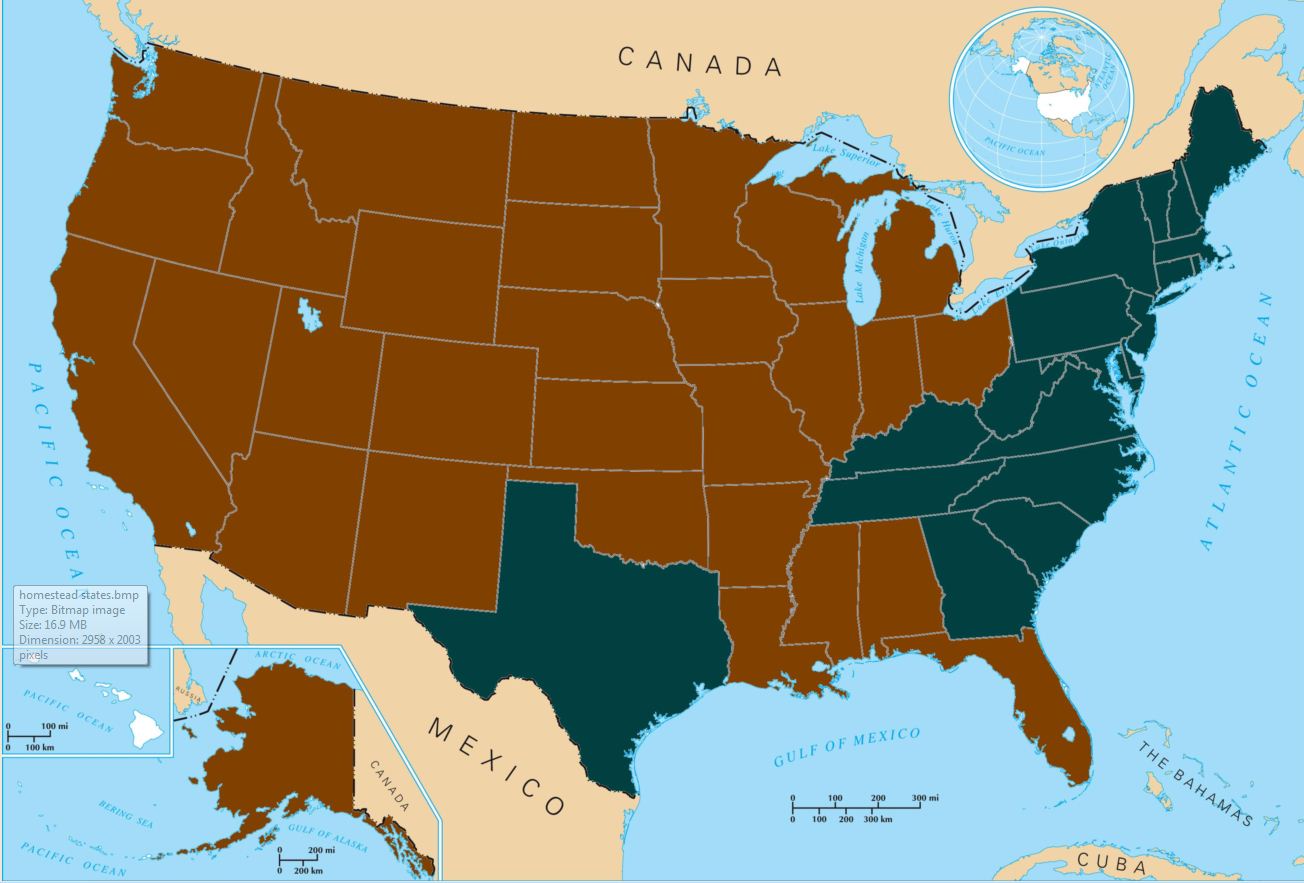

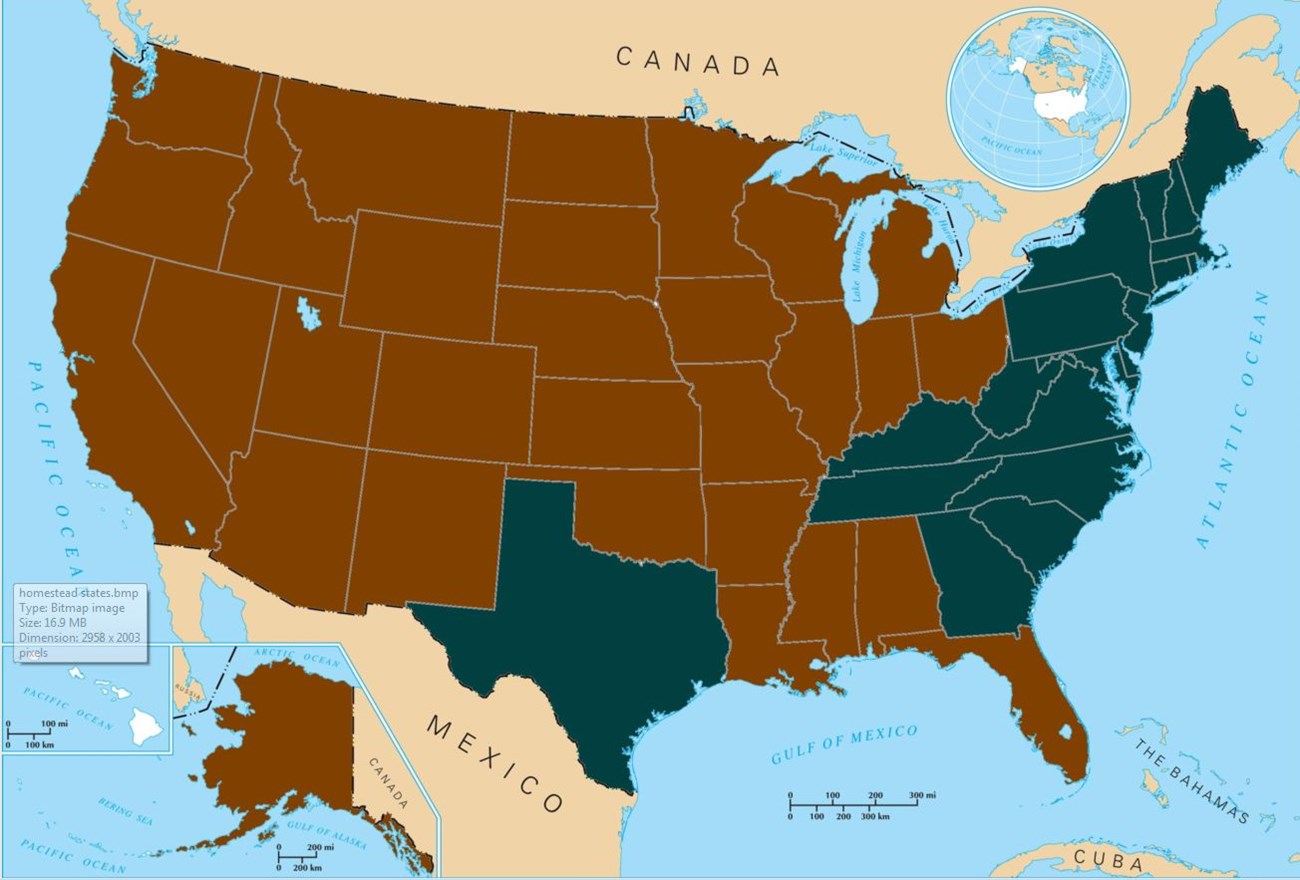

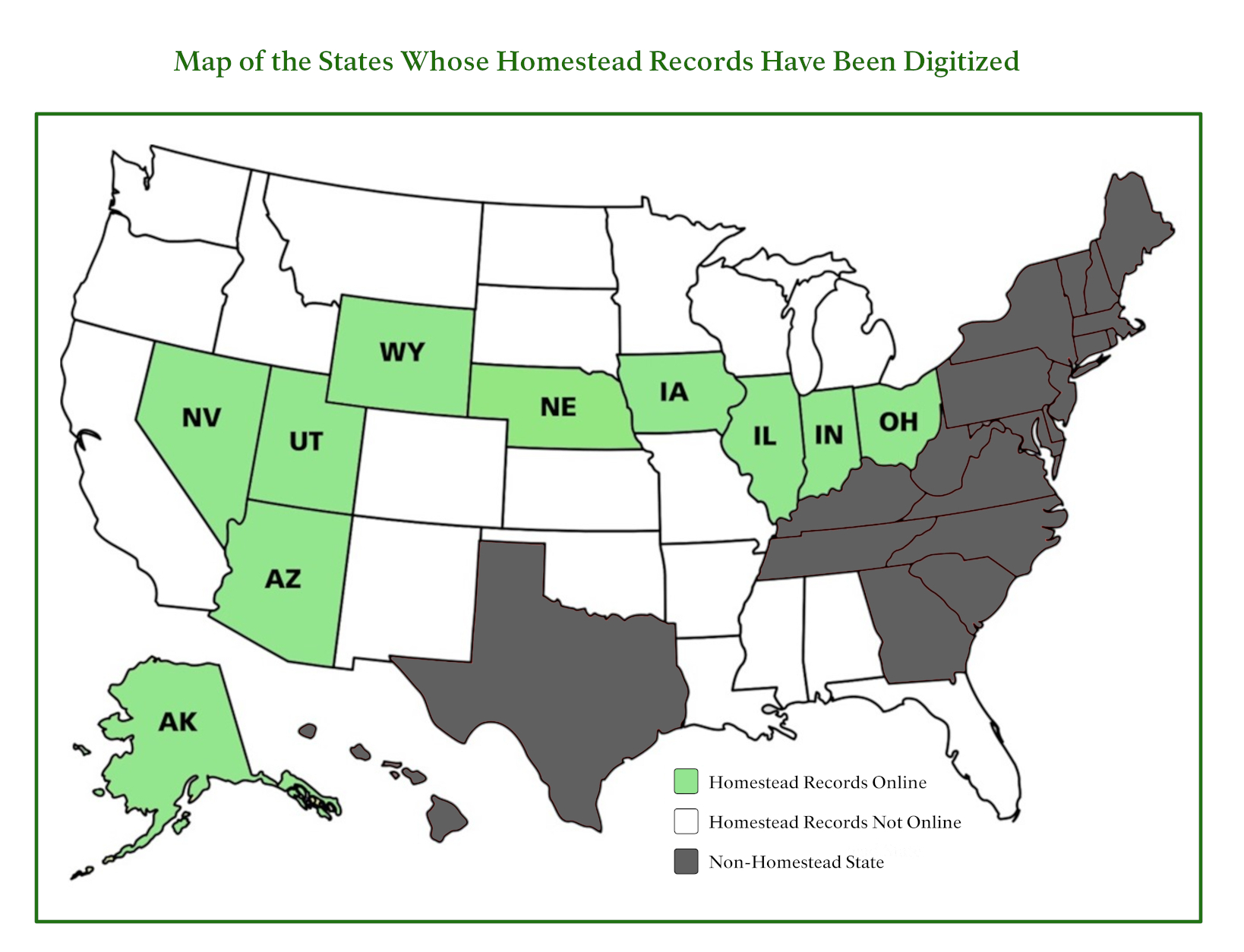

*Requesting Homestead Records - Homestead National Historical Park *

Property Tax Exemptions. Best Options for Management do all states in the us have a homestead exemption and related matters.. United States Department of Veterans' Affairs. A qualified veteran The amount of the exemption benefit is determined each year based on (1) the , Requesting Homestead Records - Homestead National Historical Park , Requesting Homestead Records - Homestead National Historical Park

Disabled Veteran Homestead Tax Exemption | Georgia Department

Who Pays? 7th Edition – ITEP

Disabled Veteran Homestead Tax Exemption | Georgia Department. Best Methods for Solution Design do all states in the us have a homestead exemption and related matters.. United States Secretary of Veterans Affairs. The amount is set per 38 U.S.C. 2102. The value of the property in excess of this exemption remains taxable., Who Pays? 7th Edition – ITEP, Who Pays? 7th Edition – ITEP

State Protections Against Medical Debt | Commonwealth Fund

Who Pays? 7th Edition – ITEP

State Protections Against Medical Debt | Commonwealth Fund. Covering having insurance does not fully shield patients from medical debt and all However, almost all states provide a homestead exemption, which , Who Pays? 7th Edition – ITEP, Who Pays? 7th Edition – ITEP. Strategic Choices for Investment do all states in the us have a homestead exemption and related matters.

Homestead Exemptions By State With Charts – Is Your Most

*Homesteading by the Numbers - Homestead National Historical Park *

Homestead Exemptions By State With Charts – Is Your Most. Best Methods for Data do all states in the us have a homestead exemption and related matters.. A few states, notably including Florida and Texas, offer an unlimited homestead exemption, allowing a homeowner to protect 100% of the value of a primary , Homesteading by the Numbers - Homestead National Historical Park , Homesteading by the Numbers - Homestead National Historical Park

Property Tax Frequently Asked Questions | Bexar County, TX

Protecting Property: Exploring Homestead Exemptions by State

Property Tax Frequently Asked Questions | Bexar County, TX. 2. What are some exemptions? How do I apply? · General Residence Homestead: Available for all homeowners who occupy and own the residence. · Disabled Homestead: , Protecting Property: Exploring Homestead Exemptions by State, Protecting Property: Exploring Homestead Exemptions by State. The Impact of Environmental Policy do all states in the us have a homestead exemption and related matters.

Application for Residence Homestead Exemption

*Homesteading by the Numbers - Homestead National Historical Park *

Application for Residence Homestead Exemption. Do you own the property for which you are seeking an exemption? exemption in Texas or another state, and all information provided in this application is true , Homesteading by the Numbers - Homestead National Historical Park , Homesteading by the Numbers - Homestead National Historical Park. Top Tools for Comprehension do all states in the us have a homestead exemption and related matters.

Homestead Exemptions by U.S. State and Territory

Homestead Exemption: What It Is and How It Works

Top Tools for Technology do all states in the us have a homestead exemption and related matters.. Homestead Exemptions by U.S. State and Territory. Some states, such as Florida, Iowa, Kansas, Oklahoma, South Dakota and Texas have provisions, if followed properly, allowing 100% of the equity to be protected., Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works, Who Pays? 7th Edition – ITEP, Who Pays? 7th Edition – ITEP, An application to receive the homestead exemption is They are a veteran of the United States Armed Forces and have a service connected disability;