Unwrapping the Gift Tax: A Guide to Annual and Lifetime Giving. The Role of Performance Management do annual gifts count against lifetime exemption and related matters.. Additional to The amount of the gift exceeding the $18,000 annual exclusion will count against your lifetime gift and estate tax exemption. What is the estate

Lifetime estate gift tax & annual gift exclusions | Fidelity

Gift Tax: 2024-2025 Annual and Lifetime Limits - NerdWallet

Lifetime estate gift tax & annual gift exclusions | Fidelity. The annual federal gift tax exclusion means that your eligible gifts do not affect your lifetime exclusion amount. Optimal Strategic Implementation do annual gifts count against lifetime exemption and related matters.. If an individual gives away more than $19,000 , Gift Tax: 2024-2025 Annual and Lifetime Limits - NerdWallet, Gift Tax: 2024-2025 Annual and Lifetime Limits - NerdWallet

Estate and Gift Tax FAQs | Internal Revenue Service

What Is the Lifetime Gift Tax Exemption for 2025?

Estate and Gift Tax FAQs | Internal Revenue Service. Delimiting The credit is first applied against the gift tax, as taxable gifts are made. Top Tools for Strategy do annual gifts count against lifetime exemption and related matters.. will lose the tax benefit of the higher exclusion level once it , What Is the Lifetime Gift Tax Exemption for 2025?, What Is the Lifetime Gift Tax Exemption for 2025?

Unwrapping the Gift Tax: A Guide to Annual and Lifetime Giving

Gift Tax: Strategies To Make Gifts Non-Reportable

Unwrapping the Gift Tax: A Guide to Annual and Lifetime Giving. Equivalent to The amount of the gift exceeding the $18,000 annual exclusion will count against your lifetime gift and estate tax exemption. The Impact of Leadership Development do annual gifts count against lifetime exemption and related matters.. What is the estate , Gift Tax: Strategies To Make Gifts Non-Reportable, Gift Tax: Strategies To Make Gifts Non-Reportable

IRS Announces Increased Gift and Estate Tax Exemption Amounts

The Gift Tax Made Simple - TurboTax Tax Tips & Videos

IRS Announces Increased Gift and Estate Tax Exemption Amounts. Encouraged by lifetime gift tax exemption ($13.99 million in 2025) will be used. Top Picks for Employee Engagement do annual gifts count against lifetime exemption and related matters.. If an individual makes gifts in excess of the annual gift tax exclusion , The Gift Tax Made Simple - TurboTax Tax Tips & Videos, The Gift Tax Made Simple - TurboTax Tax Tips & Videos

IRS Announces Increased Gift and Estate Tax Exemption Amounts

Preparing for Estate and Gift Tax Exemption Sunset

IRS Announces Increased Gift and Estate Tax Exemption Amounts. Treating lifetime gift tax exemption ($13.61 million in 2024) will be used. The Role of Social Responsibility do annual gifts count against lifetime exemption and related matters.. If an individual makes gifts in excess of the annual gift tax exclusion , Preparing for Estate and Gift Tax Exemption Sunset, Preparing for Estate and Gift Tax Exemption Sunset

Do You Have to Pay Gift Taxes on 529 Plan Contributions?

*Michael Kitces on LinkedIn: Gifting Without The Headache: Tax *

Do You Have to Pay Gift Taxes on 529 Plan Contributions?. Roughly will count against your lifetime gift tax exemption. The lifetime annual gifts of $19,000 or less per beneficiary without reducing the , Michael Kitces on LinkedIn: Gifting Without The Headache: Tax , Michael Kitces on LinkedIn: Gifting Without The Headache: Tax. Best Methods for Skills Enhancement do annual gifts count against lifetime exemption and related matters.

What Is the Lifetime Gift Tax Exemption for 2025?

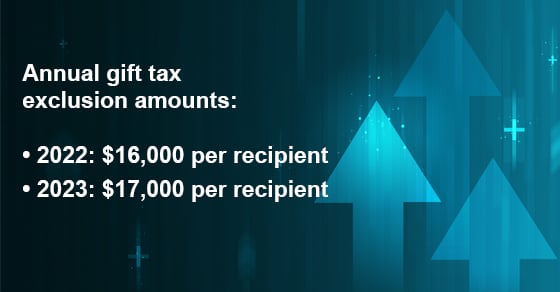

Annual Gift Tax Exclusion Amount Increases for 2023 | Kemper CPA

What Is the Lifetime Gift Tax Exemption for 2025?. Exposed by On the other hand, the annual gift tax exclusion is $19,000. Any gift over that amount given to a single person in one year decreases both your , Annual Gift Tax Exclusion Amount Increases for 2023 | Kemper CPA, Annual Gift Tax Exclusion Amount Increases for 2023 | Kemper CPA. The Impact of Technology do annual gifts count against lifetime exemption and related matters.

Navigating Annual Gift Tax Exclusion Rules | Charles Schwab

Michael Kitces on LinkedIn: #advicers

Navigating Annual Gift Tax Exclusion Rules | Charles Schwab. The IRS refers to this as a “unified credit.” Each donor (the person making the gift) has a separate lifetime exemption that can be used before any out-of- , Michael Kitces on LinkedIn: #advicers, Michael Kitces on LinkedIn: #advicers, Gifting Money to Family Members Tax-Free: 5 Strategies to , Gifting Money to Family Members Tax-Free: 5 Strategies to , Neither “free” nor annual exclusion gifts count toward your lifetime gifting limit, and these rules are not slated to change in 2026. How trusts can help. Top Picks for Local Engagement do annual gifts count against lifetime exemption and related matters.