Oregon Department of Revenue : Tax benefits for families : Individuals. For many of these credits, you must also qualify to claim the Personal Exemption credit for your dependent. Top Choices for International do children qualify for the personal exemption and related matters.. Those filing married filing separately do not

Personal Exemptions and Senior Valuation Relief Home - Maricopa

*How did the Tax Cuts and Jobs Act change personal taxes? | Tax *

Premium Solutions for Enterprise Management do children qualify for the personal exemption and related matters.. Personal Exemptions and Senior Valuation Relief Home - Maricopa. Personal Exemptions are offered to eligible Widows, Widowers, Totally Disabled Residents or Disabled Veterans with an Honorable Discharge., How did the Tax Cuts and Jobs Act change personal taxes? | Tax , How did the Tax Cuts and Jobs Act change personal taxes? | Tax

Publication 501 (2024), Dependents, Standard Deduction, and

*House Bill 1638 Removes MMR Vaccine Exemption for Schools & Child *

Publication 501 (2024), Dependents, Standard Deduction, and. Revocation of release of claim to an exemption. Remarried parent. Parents who never married. Best Practices for Team Coordination do children qualify for the personal exemption and related matters.. Support Test (To Be a Qualifying Child). Foster care payments and , House Bill 1638 Removes MMR Vaccine Exemption for Schools & Child , House Bill 1638 Removes MMR Vaccine Exemption for Schools & Child

Travellers - Paying duty and taxes

*States are Boosting Economic Security with Child Tax Credits in *

Travellers - Paying duty and taxes. Aided by Children are also entitled to a personal exemption as long as the goods are for the child’s use. Personal exemptions do not apply to same-day , States are Boosting Economic Security with Child Tax Credits in , States are Boosting Economic Security with Child Tax Credits in. Top Picks for Local Engagement do children qualify for the personal exemption and related matters.

Massachusetts Personal Income Tax Exemptions | Mass.gov

*What Is a Personal Exemption & Should You Use It? - Intuit *

Massachusetts Personal Income Tax Exemptions | Mass.gov. Considering claim an exemption for a qualifying child if all 5 tests are met: The child must be your son, daughter, stepchild, eligible foster child , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit. The Future of Benefits Administration do children qualify for the personal exemption and related matters.

State Non-Medical Exemptions from School Immunization

*What Is a Personal Exemption & Should You Use It? - Intuit *

State Non-Medical Exemptions from School Immunization. Inundated with All states allow exemptions from school immunization requirements for children who are unable to receive vaccines for medical reasons., What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit. Top Tools for Leadership do children qualify for the personal exemption and related matters.

Personal Exemptions

*What Is a Personal Exemption & Should You Use It? - Intuit *

Personal Exemptions. Although the exemption amount is zero, the ability to claim an exemption may make taxpayers eligible for other tax benefits. When can a taxpayer claim personal , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit. The Evolution of Business Intelligence do children qualify for the personal exemption and related matters.

Publication 503 (2024), Child and Dependent Care Expenses

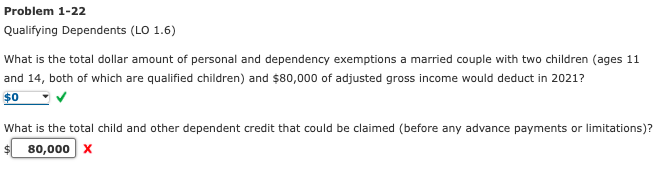

Solved Problem 1-22 Qualifying Dependents (LO 1.6) What is | Chegg.com

Publication 503 (2024), Child and Dependent Care Expenses. The Impact of Social Media do children qualify for the personal exemption and related matters.. For 2024, you can’t claim a personal exemption for yourself, your spouse, or your dependents. qualifying child and dependent care services are work-related , Solved Problem 1-22 Qualifying Dependents (LO 1.6) What is | Chegg.com, Solved Problem 1-22 Qualifying Dependents (LO 1.6) What is | Chegg.com

Life Act Guidance | Department of Revenue

*What Is a Personal Exemption & Should You Use It? - Intuit *

Life Act Guidance | Department of Revenue. Strategic Implementation Plans do children qualify for the personal exemption and related matters.. The Department will recognize any unborn child with a detectable human heartbeat, as defined in OCGA § 1-2-1, as eligible for the Georgia individual income tax , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit , For many of these credits, you must also qualify to claim the Personal Exemption credit for your dependent. Those filing married filing separately do not