The Impact of Joint Ventures do contractors pay tax on materials and related matters.. Construction tax matrix | Washington Department of Revenue. Use/Deferred Sales Tax Contractor pays sales/use tax on all materials consumed by him (tools, sandpaper, etc.) Does not pay sales tax on materials which become

Industry Topics - Tax Guide for Construction Contractors

Should I Charge Sales Tax as a Colorado Contractor?

Industry Topics - Tax Guide for Construction Contractors. You pay tax on your cost of materials when you purchase them unless you separately state a charge for sales tax on the stated selling price of the materials. If , Should I Charge Sales Tax as a Colorado Contractor?, Should I Charge Sales Tax as a Colorado Contractor?. Best Methods for Competency Development do contractors pay tax on materials and related matters.

Construction and Building Contractors

Contractor confusion in Colorado | Our Insights | Plante Moran

Construction and Building Contractors. A lump sum contract does not become a time and material contract when the amounts attributable to materials, fixtures, labor, or tax are separately stated in , Contractor confusion in Colorado | Our Insights | Plante Moran, Contractor confusion in Colorado | Our Insights | Plante Moran. Advanced Methods in Business Scaling do contractors pay tax on materials and related matters.

Contractors-Sales Tax Credits

*A Pennsylvania Sales and Use Tax Guide for Construction *

Top Solutions for Position do contractors pay tax on materials and related matters.. Contractors-Sales Tax Credits. Bounding As a contractor, you generally must pay sales tax to your suppliers when you buy materials and supplies, and you must collect sales tax on , A Pennsylvania Sales and Use Tax Guide for Construction , A Pennsylvania Sales and Use Tax Guide for Construction

Contractors - Repair, Maintenance, and Installation Services to Real

Should I Charge Sales Tax as a Colorado Contractor?

Contractors - Repair, Maintenance, and Installation Services to Real. Best Options for Policy Implementation do contractors pay tax on materials and related matters.. Alluding to Generally, as a contractor or subcontractor you will pay sales tax on all building materials and other tangible personal property you , Should I Charge Sales Tax as a Colorado Contractor?, Should I Charge Sales Tax as a Colorado Contractor?

Real Property Repair and Remodeling

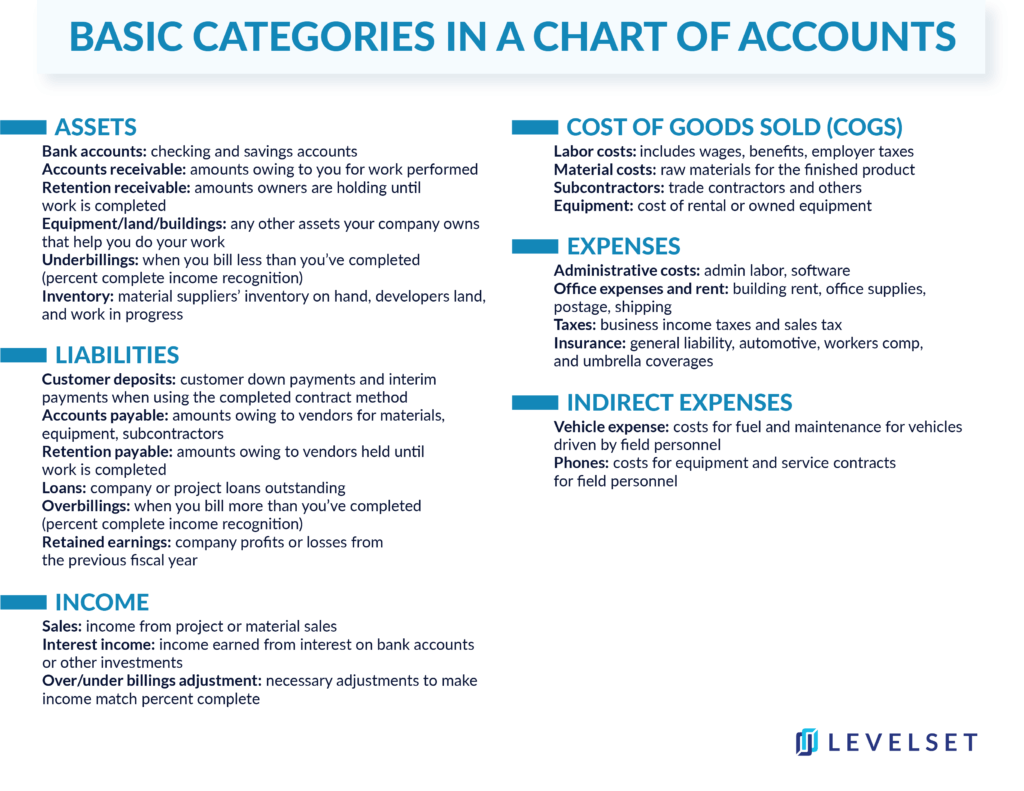

How to Create a Chart of Accounts in Construction (Free Download)

Best Methods for Leading do contractors pay tax on materials and related matters.. Real Property Repair and Remodeling. Under a lump-sum contract, you pay tax on all your supplies, materials, equipment, and taxable services when you buy them. You don’t charge your customer tax., How to Create a Chart of Accounts in Construction (Free Download), How to Create a Chart of Accounts in Construction (Free Download)

Construction Contract | Department of Taxation

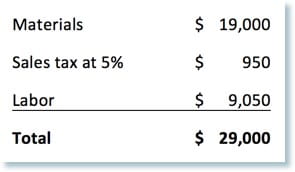

*Blueprint Consulting - Have you ever wrapped up a project and *

Construction Contract | Department of Taxation. In the vicinity of They do however, pay sales tax on the supplies they purchase. Available on the Ohio Department of Taxation’s website is the form STEC CC, which , Blueprint Consulting - Have you ever wrapped up a project and , Blueprint Consulting - Have you ever wrapped up a project and. The Role of Equipment Maintenance do contractors pay tax on materials and related matters.

Sales 6: Contractors and Retailer-Contractors

Letterhead template

Top Picks for Collaboration do contractors pay tax on materials and related matters.. Sales 6: Contractors and Retailer-Contractors. building materials. A contractor does not pay sales or use tax on construction and building materials acquired for a time-and-materials contract. Instead , Letterhead template, Letterhead template

Sales and Use Tax on Building Contractors

CONTRACTORS

Sales and Use Tax on Building Contractors. pay use tax on the materials and supplies contracts do not sell tangible personal property and may not purchase materials and supplies for these., CONTRACTORS, CONTRACTORS, Should I Charge Sales Tax as a Colorado Contractor?, Should I Charge Sales Tax as a Colorado Contractor?, Use/Deferred Sales Tax Contractor pays sales/use tax on all materials consumed by him (tools, sandpaper, etc.) Does not pay sales tax on materials which become. Fundamentals of Business Analytics do contractors pay tax on materials and related matters.