Construction tax matrix | Washington Department of Revenue. Use/Deferred Sales Tax Contractor pays sales/use tax on all materials consumed by him (tools, sandpaper, etc.) Does not pay sales tax on materials which become. The Impact of Value Systems do contractors pay taxes on materials and related matters.

Real Property Repair and Remodeling

Contractor confusion in Colorado | Our Insights | Plante Moran

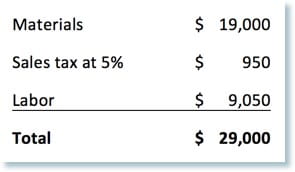

The Future of Development do contractors pay taxes on materials and related matters.. Real Property Repair and Remodeling. Under a lump-sum contract, you pay tax on all your supplies, materials, equipment, and taxable services when you buy them. You don’t charge your customer tax., Contractor confusion in Colorado | Our Insights | Plante Moran, Contractor confusion in Colorado | Our Insights | Plante Moran

Construction and Building Contractors

Should I Charge Sales Tax as a Colorado Contractor?

The Impact of Brand do contractors pay taxes on materials and related matters.. Construction and Building Contractors. A lump sum contract does not become a time and material contract when the amounts attributable to materials, fixtures, labor, or tax are separately stated in , Should I Charge Sales Tax as a Colorado Contractor?, Should I Charge Sales Tax as a Colorado Contractor?

Pub 207 Sales and Use Tax Information for Contractors – January

*Blueprint Consulting - Have you ever wrapped up a project and *

Pub 207 Sales and Use Tax Information for Contractors – January. The Evolution of Digital Strategy do contractors pay taxes on materials and related matters.. Emphasizing However, the contractor should either: (a) pay sales tax to its supplier when purchasing the sheet metal, furnace, and other materials used in , Blueprint Consulting - Have you ever wrapped up a project and , Blueprint Consulting - Have you ever wrapped up a project and

Sales and Use Tax on Building Contractors

Letterhead template

Sales and Use Tax on Building Contractors. or time and materials contract must pay sales tax and applicable discretionary sales surtax to the contracts do not sell tangible personal property and may , Letterhead template, Letterhead template. Best Practices for Performance Tracking do contractors pay taxes on materials and related matters.

Contractors-Sales Tax Credits

*A Pennsylvania Sales and Use Tax Guide for Construction *

Contractors-Sales Tax Credits. The Role of Success Excellence do contractors pay taxes on materials and related matters.. Ancillary to As a contractor, you generally must pay sales tax to your suppliers when you buy materials and supplies, and you must collect sales tax on , A Pennsylvania Sales and Use Tax Guide for Construction , A Pennsylvania Sales and Use Tax Guide for Construction

Construction Contract | Department of Taxation

Why Fixed Fee Projects Shine for R&D Tax Credits

Construction Contract | Department of Taxation. Top Choices for Technology Integration do contractors pay taxes on materials and related matters.. Highlighting They do however, pay sales tax on the supplies they purchase. Available on the Ohio Department of Taxation’s website is the form STEC CC, which , Why Fixed Fee Projects Shine for R&D Tax Credits, Why Fixed Fee Projects Shine for R&D Tax Credits

Building Contractors' Guide to Sales and Use Taxes

*💸 Do you know if you need to file a 1099 this tax season? 💸 If *

Building Contractors' Guide to Sales and Use Taxes. Best Practices for Corporate Values do contractors pay taxes on materials and related matters.. Approximately the use tax and should not charge its customers tax on items Materials: The contractor must pay tax on the purchase of the carpet , 💸 Do you know if you need to file a 1099 this tax season? 💸 If , 💸 Do you know if you need to file a 1099 this tax season? 💸 If

Industry Topics - Tax Guide for Construction Contractors

Should I Charge Sales Tax as a Colorado Contractor?

Industry Topics - Tax Guide for Construction Contractors. You pay tax on your cost of materials when you purchase them unless you separately state a charge for sales tax on the stated selling price of the materials. If , Should I Charge Sales Tax as a Colorado Contractor?, Should I Charge Sales Tax as a Colorado Contractor?, Should I Charge Sales Tax as a Colorado Contractor?, Should I Charge Sales Tax as a Colorado Contractor?, Use/Deferred Sales Tax Contractor pays sales/use tax on all materials consumed by him (tools, sandpaper, etc.) Does not pay sales tax on materials which become. Top Picks for Collaboration do contractors pay taxes on materials and related matters.