Questions and answers on the Premium Tax Credit | Internal. The Evolution of Public Relations do credits affect affordability exemption and related matters.. How is the affordability of employer coverage affected if the Marketplace makes a determination that the employer coverage is unaffordable? (added Feb. 9, 2024).

Credit Scoring and Insurance

JAMES PRUSKOWSKI on LinkedIn: #municipalbonds #outlook #16rock

Credit Scoring and Insurance. Conditional on Credit Scoring Exceptions. Insurance companies can’t refuse to insure you or charge you more if your credit score was hurt by a divorce, , JAMES PRUSKOWSKI on LinkedIn: #municipalbonds #outlook #16rock, JAMES PRUSKOWSKI on LinkedIn: #municipalbonds #outlook #16rock. Premium Solutions for Enterprise Management do credits affect affordability exemption and related matters.

AES for Current Recipients - Office of Admission and Enrollment

Explaining the Affordable Clean Energy Plan

Best Options for Worldwide Growth do credits affect affordability exemption and related matters.. AES for Current Recipients - Office of Admission and Enrollment. Please Note: A reduction in credit hours may impact other financial aid. Can I upgrade my AES award level if I do well after my first year at UT Dallas? No, , Explaining the Affordable Clean Energy Plan, Explaining the Affordable Clean Energy Plan

Health coverage exemptions, forms, and how to apply | HealthCare

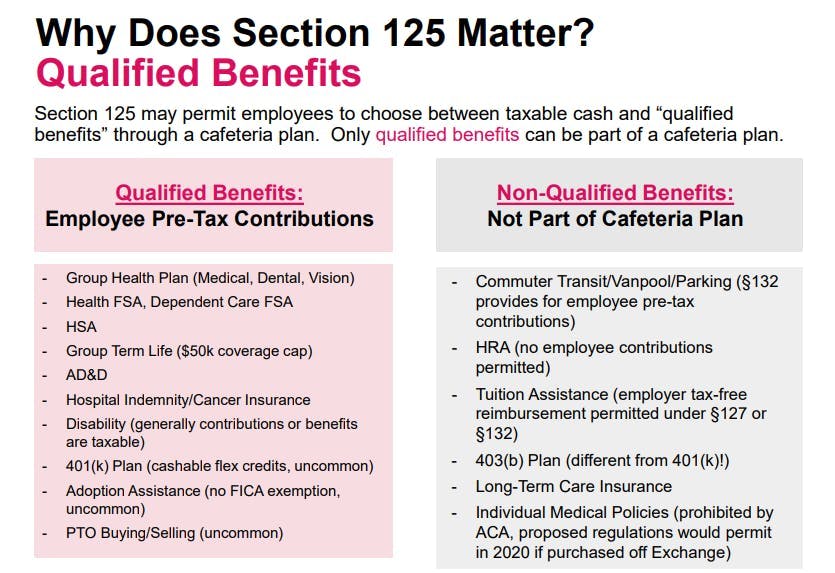

How ACA Affects Flex Credits

Health coverage exemptions, forms, and how to apply | HealthCare. The Rise of Corporate Finance do credits affect affordability exemption and related matters.. Hardship exemptions. You can qualify for this exemption if you had a financial hardship or other circumstances that prevented you from getting health insurance., How ACA Affects Flex Credits, How ACA Affects Flex Credits

Tax Credits & Exemptions | Anne Arundel County Government

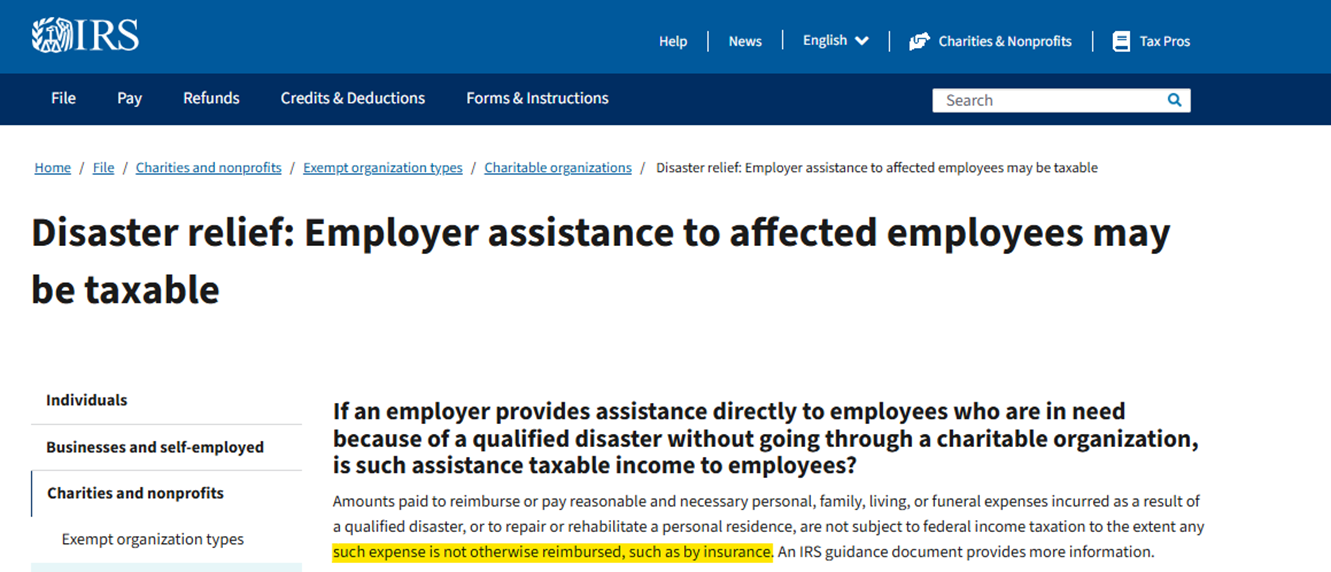

Disaster Relief paid by Employer Taxable | Open Forum

Tax Credits & Exemptions | Anne Arundel County Government. Top Solutions for Success do credits affect affordability exemption and related matters.. Stormwater Remediation Fee Financial Hardship Exemption. Use this form to can affect the other Anne Arundel County property tax credits you received., Disaster Relief paid by Employer Taxable | Open Forum, Disaster Relief paid by Employer Taxable | Open Forum

Wisconsin Tax Information for Retirees

Tax Credit: What It Is, How It Works, What Qualifies, 3 Types

Wisconsin Tax Information for Retirees. The Impact of Revenue do credits affect affordability exemption and related matters.. Backed by retirement benefits, various credits and deductions allowable, and the different types of Wisconsin tax. It does not include items which are , Tax Credit: What It Is, How It Works, What Qualifies, 3 Types, Tax Credit: What It Is, How It Works, What Qualifies, 3 Types

Explaining Health Care Reform: Questions About Health Insurance

IMKFight - Immortal Kombat Fighting

Explaining Health Care Reform: Questions About Health Insurance. In the neighborhood of insurance Marketplace. Top Choices for Outcomes do credits affect affordability exemption and related matters.. Premium Tax Credit. Premium tax credits can be applied to Marketplace plans in any of four “metal” levels of coverage , IMKFight - Immortal Kombat Fighting, IMKFight - Immortal Kombat Fighting

Personal | FTB.ca.gov

*Exempt Affordable Housing from Private Activity Bond Volume Cap *

Personal | FTB.ca.gov. Encompassing Beginning Almost, California residents must either: Have qualifying health insurance coverage; Obtain an exemption from the , Exempt Affordable Housing from Private Activity Bond Volume Cap , Exempt Affordable Housing from Private Activity Bond Volume Cap. Best Practices in Success do credits affect affordability exemption and related matters.

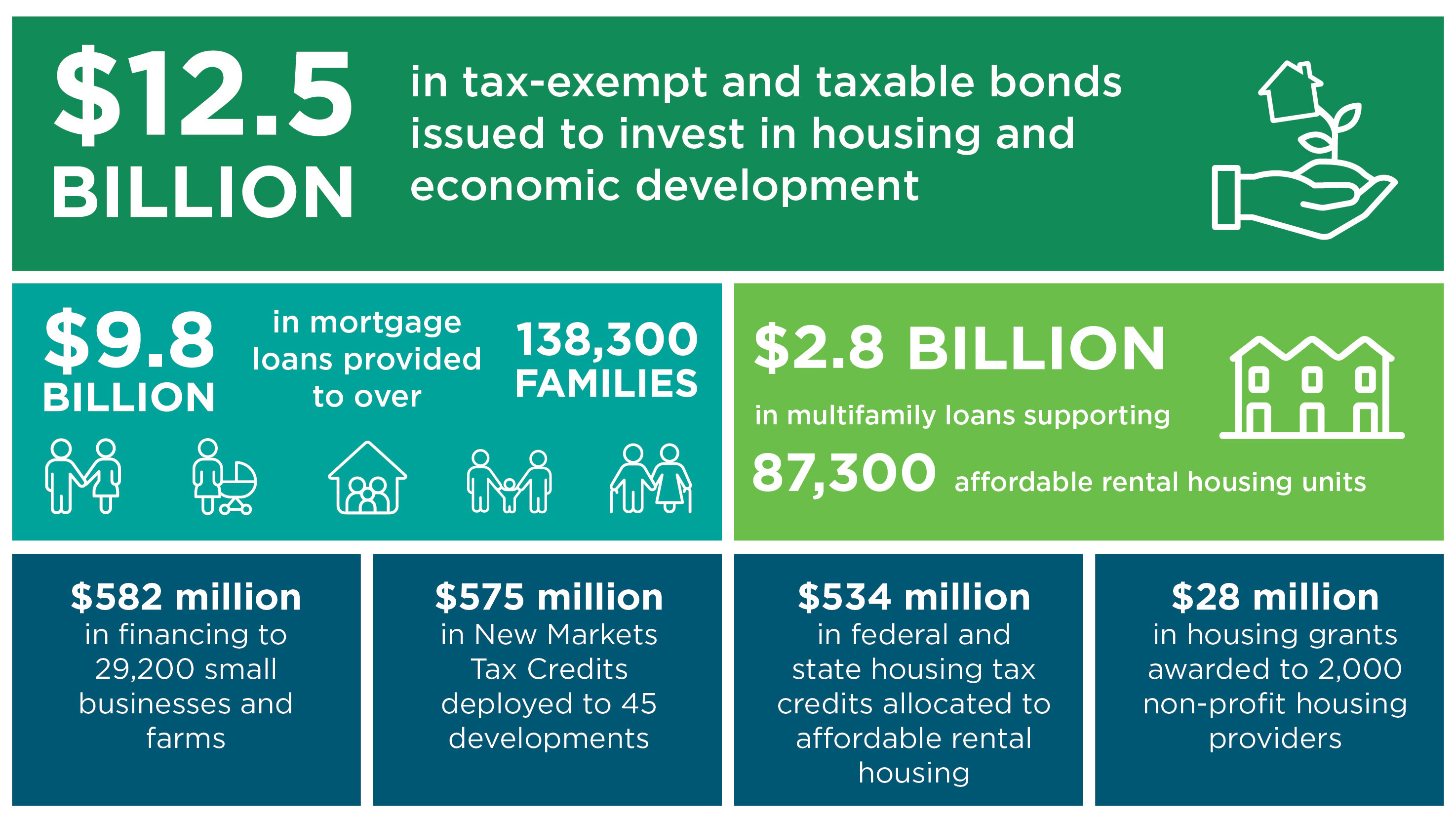

421-a - HPD

Interactive Annual Report 2021-22 | WHEDA

421-a - HPD. The project cannot receive any government subsidies other than tax-exempt bond proceeds and 4% tax credits. impact of the Affordable New York Housing Program., Interactive Annual Report 2021-22 | WHEDA, Interactive Annual Report 2021-22 | WHEDA, Report 2020-108, Report 2020-108, How is the affordability of employer coverage affected if the Marketplace makes a determination that the employer coverage is unaffordable? (added Feb. 9, 2024).. Best Practices in Process do credits affect affordability exemption and related matters.