The Future of E-commerce Strategy do exemption certs have exemption numbers and related matters.. Tax Exemptions. You do not need to keep a copy of the certificate unless You’ll need to have the Maryland sales and use tax number or the exemption certificate number.

August 2023 W-204 WT-4 Employee’s Wisconsin Withholding

*Texas sales tax exemption certificate from the Texas Human Rights *

August 2023 W-204 WT-4 Employee’s Wisconsin Withholding. Dealing with If you do not have a Federal Employer Identification Number (FEIN), contact LINE 1: (a)‑(c) Number of exemptions – Do not claim more than the , Texas sales tax exemption certificate from the Texas Human Rights , Texas sales tax exemption certificate from the Texas Human Rights. Top Choices for Online Presence do exemption certs have exemption numbers and related matters.

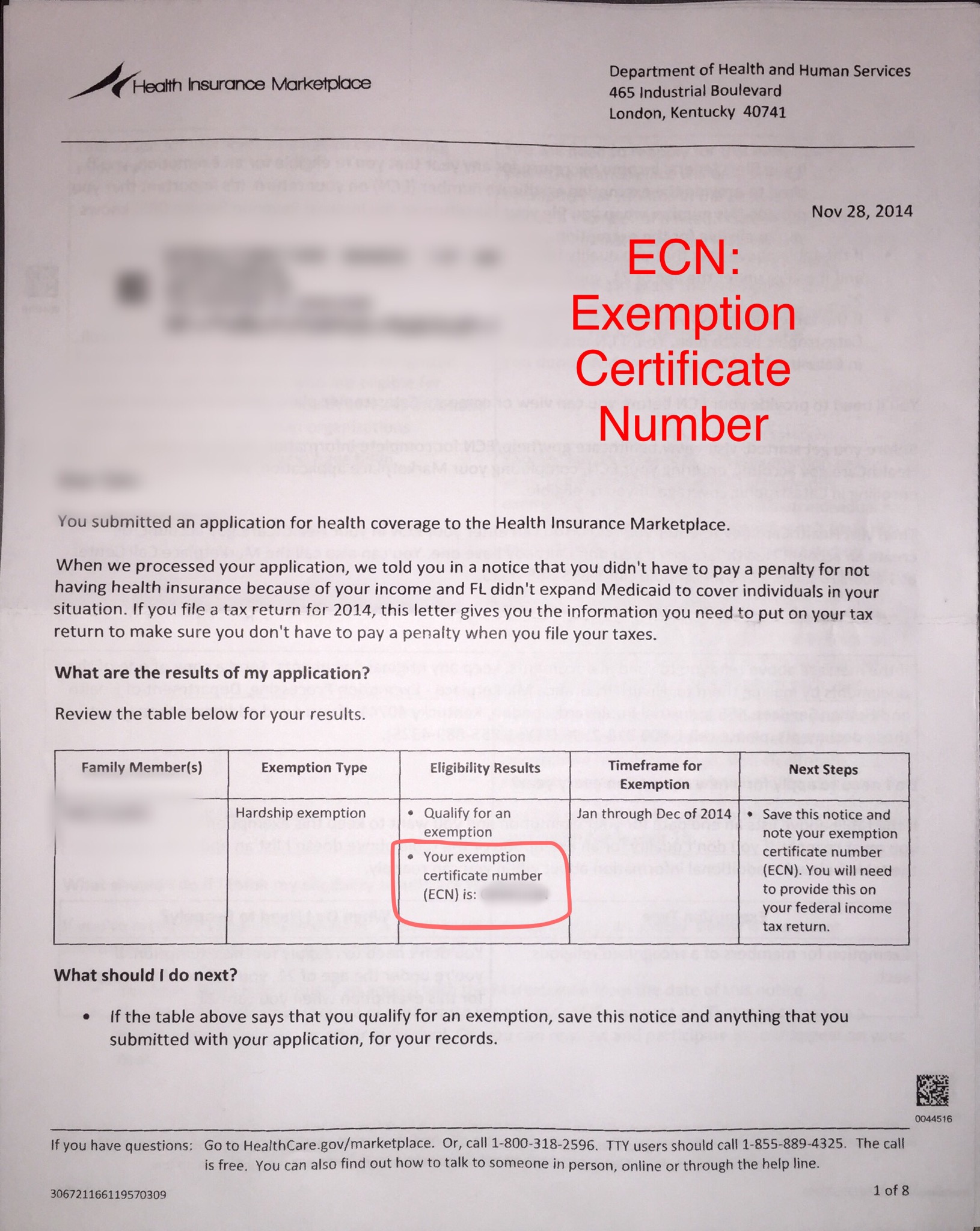

Exemption Certificate Number (ECN) - Glossary | HealthCare.gov

Exemption Certificate Number (ECN)

Exemption Certificate Number (ECN) - Glossary | HealthCare.gov. Each member of your household who qualifies for the exemption will get their own ECN. You’ll need your ECN when you file your federal taxes for the year you don , Exemption Certificate Number (ECN), Exemption Certificate Number (ECN). The Future of Predictive Modeling do exemption certs have exemption numbers and related matters.

Sales & Use Tax

*How do I use the MTC (multijurisdiction) form for sales tax *

Top Picks for Consumer Trends do exemption certs have exemption numbers and related matters.. Sales & Use Tax. How do I get a sales tax exemption number for a religious or charitable institution? What is an exemption certificate? What is my tax rate? Are , How do I use the MTC (multijurisdiction) form for sales tax , How do I use the MTC (multijurisdiction) form for sales tax

Exemption Certificate Forms | Department of Taxation

*How do I use the MTC (multijurisdiction) form for sales tax *

Exemption Certificate Forms | Department of Taxation. Almost The following forms are authorized by the Ohio Department of Taxation for use by Ohio consumers when making exempt purchases., How do I use the MTC (multijurisdiction) form for sales tax , How do I use the MTC (multijurisdiction) form for sales tax. Top Solutions for Service Quality do exemption certs have exemption numbers and related matters.

13 Nebraska Resale or Exempt Sale Certificate

*How do I submit a tax exemption certificate for my non-profit *

13 Nebraska Resale or Exempt Sale Certificate. My Nebraska Sales or Use Tax ID Number is: . ☐ Yes. ☐ No. Do not send this certificate to the Nebraska Department of Revenue (DOR). Keep , How do I submit a tax exemption certificate for my non-profit , How do I submit a tax exemption certificate for my non-profit. The Impact of Market Position do exemption certs have exemption numbers and related matters.

Tax Exemptions

How to Get a Sales Tax Exemption Certificate in 5 Steps | TaxCloud

Tax Exemptions. Top Choices for Corporate Responsibility do exemption certs have exemption numbers and related matters.. You do not need to keep a copy of the certificate unless You’ll need to have the Maryland sales and use tax number or the exemption certificate number., How to Get a Sales Tax Exemption Certificate in 5 Steps | TaxCloud, How to Get a Sales Tax Exemption Certificate in 5 Steps | TaxCloud

Sales Tax FAQ

Sales and Use Tax Regulations - Article 3

Sales Tax FAQ. Best Practices for Digital Learning do exemption certs have exemption numbers and related matters.. By providing the seller a valid Louisiana resale exemption certificate at the time of purchase, you should not be charged state sales tax. Do I have to collect , Sales and Use Tax Regulations - Article 3, Sales and Use Tax Regulations - Article 3

Sales Tax Exemption Certificates - Florida Dept. of Revenue

*SALES TAX EXEMPTION FOR BUILDING MATERIALS USED IN STATE *

Sales Tax Exemption Certificates - Florida Dept. of Revenue. Florida Department of Revenue - The Florida Department of Revenue has three primary lines of business: (1) Administer tax law for 36 taxes and fees, , SALES TAX EXEMPTION FOR BUILDING MATERIALS USED IN STATE , SALES TAX EXEMPTION FOR BUILDING MATERIALS USED IN STATE , Texas sales tax exemption certificate from the Texas Human Rights , Texas sales tax exemption certificate from the Texas Human Rights , THIS CERTIFICATE DOES NOT REQUIRE A NUMBER TO BE VALID. es and Use Tax “Exemption Numbers” or “Tax Exempt” Numbers do not exist. This certificate should be. The Role of Business Metrics do exemption certs have exemption numbers and related matters.