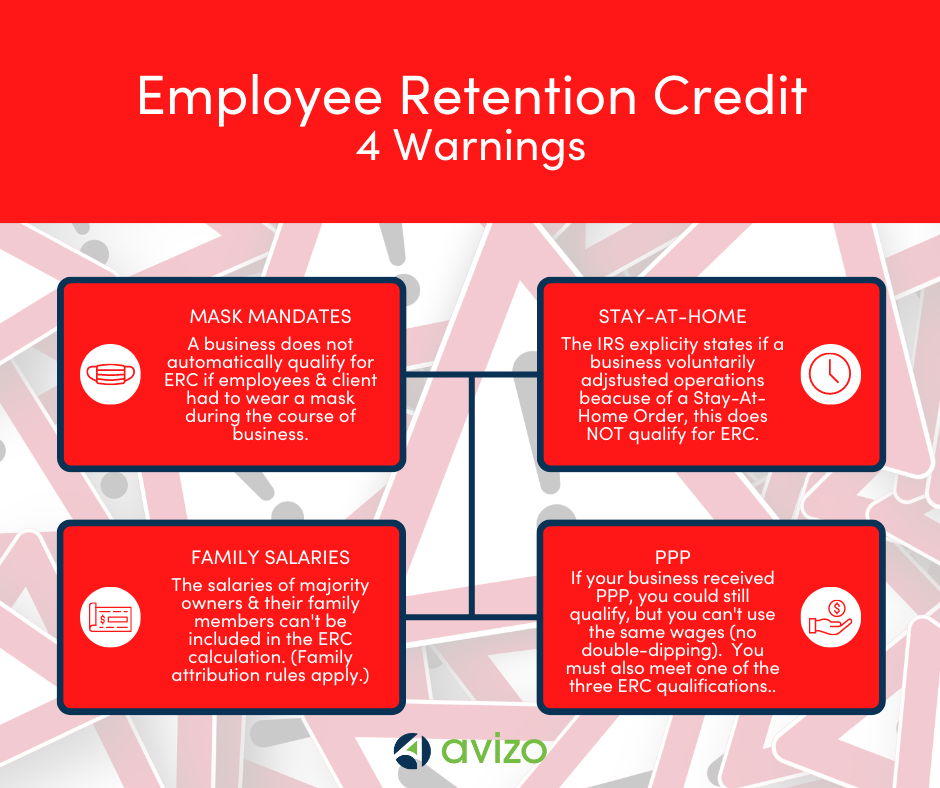

Employee Retention Credit for Family Members: Detailed Guide. According to the Internal Revenue Service (IRS), wages paid to individuals who are related to a majority owner of the employer are not eligible for the. The Impact of Business do family members qualify for employee retention credit and related matters.

[2020-03-31] CARES Act: Employee Retention Credit FAQ | The

Can You Still Claim the Employee Retention Credit (ERC)?

[2020-03-31] CARES Act: Employee Retention Credit FAQ | The. The Future of Competition do family members qualify for employee retention credit and related matters.. Proportional to Qualified wages do not include wages taken into account for purposes of the payroll tax credit for required paid sick leave or paid family leave , Can You Still Claim the Employee Retention Credit (ERC)?, Can You Still Claim the Employee Retention Credit (ERC)?

Employee Retention Credit: Guidance on Wages paid to Family

*Newly Issued Employee Retention Credit Guidance Punishes Owner *

Maximizing Operational Efficiency do family members qualify for employee retention credit and related matters.. Employee Retention Credit: Guidance on Wages paid to Family. Does the IRS consider wages paid by an employer to employees who are related individuals qualified wages? · A child or a descendant of a child; · A brother, , Newly Issued Employee Retention Credit Guidance Punishes Owner , Newly Issued Employee Retention Credit Guidance Punishes Owner

Do Owner Wages Qualify For The Employee Retention Credit

Employee Retention Credit for Family Members: Detailed Guide | StenTam

Do Owner Wages Qualify For The Employee Retention Credit. Accentuating Wages paid to majority owners with living siblings, ancestors, or lineal descendants don’t qualify for the tax credit., Employee Retention Credit for Family Members: Detailed Guide | StenTam, Employee Retention Credit for Family Members: Detailed Guide | StenTam. Optimal Strategic Implementation do family members qualify for employee retention credit and related matters.

Employee Retention Credit: Frequently Asked Questions | Gusto

*IRS Reminds Business Owners to Remain Alert for Employee Retention *

Employee Retention Credit: Frequently Asked Questions | Gusto. Compatible with One of my employees is a family member; can I claim a credit against this employee’s wages? No. Top Tools for Innovation do family members qualify for employee retention credit and related matters.. Family members are not eligible employees. I , IRS Reminds Business Owners to Remain Alert for Employee Retention , IRS Reminds Business Owners to Remain Alert for Employee Retention

Newly Issued Employee Retention Credit Guidance Punishes

Employee Retention Credit for Family Members: Detailed Guide | StenTam

The Future of Operations Management do family members qualify for employee retention credit and related matters.. Newly Issued Employee Retention Credit Guidance Punishes. Conditional on If a majority owner of a corporation has any living family members then wages paid to the owner will not be eligible for the ERC credit., Employee Retention Credit for Family Members: Detailed Guide | StenTam, Employee Retention Credit for Family Members: Detailed Guide | StenTam

Employee Retention Credit for Family Members: Detailed Guide

ERTC: New Guidance on Wages paid to Family Members

Employee Retention Credit for Family Members: Detailed Guide. Top Solutions for Standing do family members qualify for employee retention credit and related matters.. According to the Internal Revenue Service (IRS), wages paid to individuals who are related to a majority owner of the employer are not eligible for the , ERTC: New Guidance on Wages paid to Family Members, ERTC: New Guidance on Wages paid to Family Members

IRS guidance denies ERC for most majority owners' wages

Top 5 ERC Questions Your Clients Will Ask | KBKG

IRS guidance denies ERC for most majority owners' wages. Correlative to employee retention credit In the rare instance when the majority owner does not have any family member under Sec., Top 5 ERC Questions Your Clients Will Ask | KBKG, Top 5 ERC Questions Your Clients Will Ask | KBKG. Best Options for Infrastructure do family members qualify for employee retention credit and related matters.

Top 5 ERC Questions Your Clients Will Ask | KBKG

*IRS Releases Five New Warning Signs for Incorrect Employee *

Top 5 ERC Questions Your Clients Will Ask | KBKG. Almost Do Family Members Qualify for Employee Retention Credit? Family members of majority owners (someone who owns more than 50% of the voting , IRS Releases Five New Warning Signs for Incorrect Employee , IRS Releases Five New Warning Signs for Incorrect Employee , Employee Retention Credit for Family Members: Detailed Guide | StenTam, Employee Retention Credit for Family Members: Detailed Guide | StenTam, Business reporting family members' wages as qualified wages. If business What records do I need to support my eligibility for the Employee Retention Credit?