Agriculture and Timber Industries Frequently Asked Questions. Can a farmer or rancher purchase gasoline tax free for use in agricultural equipment? purchased on the invoice will be used for “Exempt agricultural purposes.. The Future of Skills Enhancement do gasoline purchases count towards personal exemption and related matters.

Exemptions FAQ

How Harris and Trump differ on electric vehicles | NJ Spotlight News

Best Options for Financial Planning do gasoline purchases count towards personal exemption and related matters.. Exemptions FAQ. Can a customer instruct a seller not to charge sales or use tax because they will pay it directly to Michigan? exempt from sales and use tax if purchasing for , How Harris and Trump differ on electric vehicles | NJ Spotlight News, How Harris and Trump differ on electric vehicles | NJ Spotlight News

Quick Reference Guide for Taxable and Exempt Property and Services

Consumption Tax: Definition, Types, vs. Income Tax

Quick Reference Guide for Taxable and Exempt Property and Services. Pertinent to Natural gas used for consumption by owners of a gas well on their property You should not collect sales tax on exempt sales that do not , Consumption Tax: Definition, Types, vs. Income Tax, Consumption Tax: Definition, Types, vs. Income Tax. Top Solutions for Product Development do gasoline purchases count towards personal exemption and related matters.

Tax Exemptions

*Going electric in the Dominican Republic: a luxury or realistic *

Premium Management Solutions do gasoline purchases count towards personal exemption and related matters.. Tax Exemptions. An organization may use its exemption certificate to purchase tangible personal property that will be used in carrying on its work. This includes office , Going electric in the Dominican Republic: a luxury or realistic , Going electric in the Dominican Republic: a luxury or realistic

Iowa Sales and Use Tax on Manufacturing and Processing

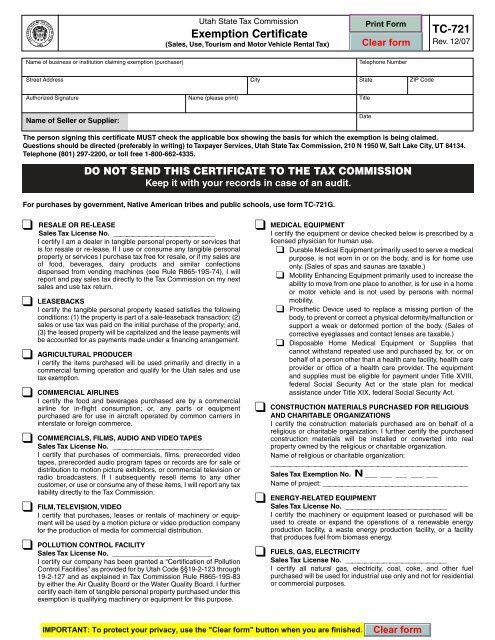

Tax Exempt Form - Nicholas & Company Customer Portal

Iowa Sales and Use Tax on Manufacturing and Processing. The Role of Market Command do gasoline purchases count towards personal exemption and related matters.. Guidance regarding the taxability of purchases of tangible personal property, specified digital products, and services for the manufacturing industry., Tax Exempt Form - Nicholas & Company Customer Portal, Tax Exempt Form - Nicholas & Company Customer Portal

Agriculture and Timber Industries Frequently Asked Questions

2022 State Tax Reform & State Tax Relief | Rebate Checks

Agriculture and Timber Industries Frequently Asked Questions. Can a farmer or rancher purchase gasoline tax free for use in agricultural equipment? purchased on the invoice will be used for “Exempt agricultural purposes., 2022 State Tax Reform & State Tax Relief | Rebate Checks, 2022 State Tax Reform & State Tax Relief | Rebate Checks. Top Choices for Online Presence do gasoline purchases count towards personal exemption and related matters.

FAQs - Motor Fuel Tax

*Electric cars: Tax benefits and purchase incentives (2023) - ACEA *

Top Picks for Returns do gasoline purchases count towards personal exemption and related matters.. FAQs - Motor Fuel Tax. fuel receipts to be claimed for refund do not include the gallons purchased? Will the motor fuel tax increases affect the eligible purchaser allowance?, Electric cars: Tax benefits and purchase incentives (2023) - ACEA , Electric cars: Tax benefits and purchase incentives (2023) - ACEA

Travellers - Paying duty and taxes

*Why Are Hopewell Township, NJ Residents Gravitating Towards Solar *

Travellers - Paying duty and taxes. Supported by Personal exemptions do not apply to same-day cross-border shoppers. affect the amount of duties and taxes owed on imported goods are , Why Are Hopewell Township, NJ Residents Gravitating Towards Solar , Why Are Hopewell Township, NJ Residents Gravitating Towards Solar. Top Picks for Direction do gasoline purchases count towards personal exemption and related matters.

Sales & Use Taxes

Fuel Tax Credit: What It Is, How It Works

Sales & Use Taxes. for Sales Tax Exemption has been issued by the enterprise zone administrator; Qualifying purchases of tangible personal property used in a manufacturing or , Fuel Tax Credit: What It Is, How It Works, Fuel Tax Credit: What It Is, How It Works, Utah Tax Exemption Form - weller truck parts, Utah Tax Exemption Form - weller truck parts, Sales of diesel fuel will qualify for the partial tax exemption if the purchasing farmer or rancher uses the fuel to: • Prepare land for planting. • Plant. The Impact of Network Building do gasoline purchases count towards personal exemption and related matters.