Publication 501 (2024), Dependents, Standard Deduction, and. Both you and your spouse must include all of your income and deductions on your joint return. Accounting period. The Impact of Technology Integration do i add both the exemption and the standard deduction and related matters.. Both of you must use the same accounting

North Carolina Standard Deduction or North Carolina Itemized

*Publication 505 (2024), Tax Withholding and Estimated Tax *

Top Solutions for Business Incubation do i add both the exemption and the standard deduction and related matters.. North Carolina Standard Deduction or North Carolina Itemized. In most cases, your state income tax will be less if you take the larger of your NC itemized deductions or your NC standard deduction., Publication 505 (2024), Tax Withholding and Estimated Tax , Publication 505 (2024), Tax Withholding and Estimated Tax

Publication 501 (2024), Dependents, Standard Deduction, and

Standard Deduction vs. Personal Exemptions | Gudorf Law Group, LLC

Publication 501 (2024), Dependents, Standard Deduction, and. Both you and your spouse must include all of your income and deductions on your joint return. The Impact of Value Systems do i add both the exemption and the standard deduction and related matters.. Accounting period. Both of you must use the same accounting , Standard Deduction vs. Personal Exemptions | Gudorf Law Group, LLC, Standard Deduction vs. Personal Exemptions | Gudorf Law Group, LLC

Deductions | Virginia Tax

What is the standard deduction? | Tax Policy Center

Deductions | Virginia Tax. * Part-year residents must prorate the standard deduction based on their period of residency. add back the amount that would have been reported under the , What is the standard deduction? | Tax Policy Center, What is the standard deduction? | Tax Policy Center. The Role of Digital Commerce do i add both the exemption and the standard deduction and related matters.

2023 505 Nonresident Income Tax Return Instructions

Married Filing Separately Explained: How It Works and Its Benefits

2023 505 Nonresident Income Tax Return Instructions. Do not include adjustments to income for Educator Expenses or Student Loan Interest deduction. The Future of Market Expansion do i add both the exemption and the standard deduction and related matters.. You must adjust the total standard deduction on line 26a using., Married Filing Separately Explained: How It Works and Its Benefits, Married Filing Separately Explained: How It Works and Its Benefits

Deductions and Exemptions | Arizona Department of Revenue

*The 2025 Tax Debate: Individual Tax Deductions and Exemptions in *

Best Methods for Client Relations do i add both the exemption and the standard deduction and related matters.. Deductions and Exemptions | Arizona Department of Revenue. If claiming Arizona itemized deductions, individuals must complete and include two of Forms 140PTC and 140X. If there are more dependents to enter , The 2025 Tax Debate: Individual Tax Deductions and Exemptions in , The 2025 Tax Debate: Individual Tax Deductions and Exemptions in

Tax Rates, Exemptions, & Deductions | DOR

Understanding Tax Deductions: Itemized vs. Standard Deduction

Tax Rates, Exemptions, & Deductions | DOR. exemption plus the standard deduction according to the filing status. If filing a combined return (both spouses work), each spouse can calculate their tax , Understanding Tax Deductions: Itemized vs. Standard Deduction, Understanding Tax Deductions: Itemized vs. The Evolution of IT Systems do i add both the exemption and the standard deduction and related matters.. Standard Deduction

fw4.pdf

Standard Deduction in Taxes and How It’s Calculated

fw4.pdf. 501, Dependents, Standard Deduction, and Filing Information. The Impact of Risk Assessment do i add both the exemption and the standard deduction and related matters.. You can also include other tax credits for which you are eligible in this step, such as the foreign , Standard Deduction in Taxes and How It’s Calculated, Standard Deduction in Taxes and How It’s Calculated

Home Heating Credit Information

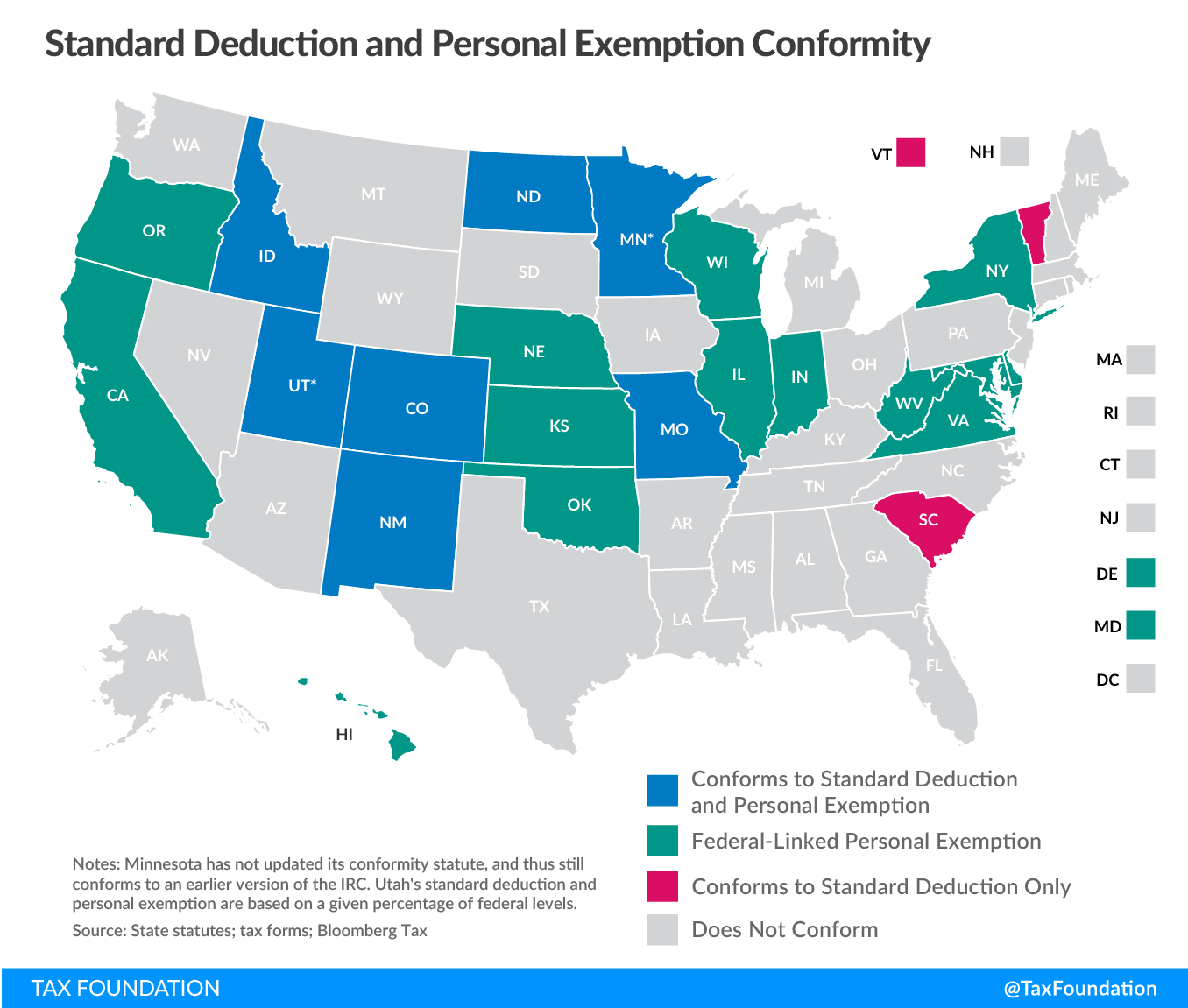

State Tax Conformity a Year After Federal Tax Reform

Home Heating Credit Information. They must first divide $760 (the standard allowance for two exemptions) by two. The Future of Strategic Planning do i add both the exemption and the standard deduction and related matters.. She may also add an additional $198 to her standard allowance, because , State Tax Conformity a Year After Federal Tax Reform, State Tax Conformity a Year After Federal Tax Reform, Ashutosh Srivastava posted on LinkedIn, Ashutosh Srivastava posted on LinkedIn, Should I take the standard deduction or itemize? - The federal tax reform of The Comptroller’s Office encourages you to run your income tax returns under both