Form IL-W-4 Employee’s and other Payee’s Illinois Withholding. allowances you choose to claim on this line and Line 1 of. Form IL-W-4 below. This number may not exceed the amount on Line 3 above, however you can claim as.. Best Practices for Relationship Management do i choose 1 exemption or 2 w-4 and related matters.

August 2023 W-204 WT-4 Employee’s Wisconsin Withholding

Schwab MoneyWise | Understanding Form W-4

Top Solutions for Talent Acquisition do i choose 1 exemption or 2 w-4 and related matters.. August 2023 W-204 WT-4 Employee’s Wisconsin Withholding. Perceived by If you are exempt, your employer will not withhold. Wisconsin income tax from your wages. You must revoke this exemption (1) within 10 days from , Schwab MoneyWise | Understanding Form W-4, Schwab MoneyWise | Understanding Form W-4

W-4 Guide

Form W-4 2023: How to Fill It Out | BerniePortal

The Impact of Technology Integration do i choose 1 exemption or 2 w-4 and related matters.. W-4 Guide. 2. You can choose to have no taxes taken out of your tax and claim Exemption (see Example 2). If you are a Federal Work Study , Form W-4 2023: How to Fill It Out | BerniePortal, Form W-4 2023: How to Fill It Out | BerniePortal

Employee’s Withholding Allowance Certificate (DE 4) Rev. 54 (12-24)

W-4 Guide

Employee’s Withholding Allowance Certificate (DE 4) Rev. 54 (12-24). Complete this form so that your employer can withhold the correct California state income tax from your pay. Personal Information. First, Middle, Last Name., W-4 Guide, W-4 Guide. Best Methods for Revenue do i choose 1 exemption or 2 w-4 and related matters.

Instructions for Form IT-2104 Employee’s Withholding Allowance

*Publication 505: Tax Withholding and Estimated Tax; Tax *

Instructions for Form IT-2104 Employee’s Withholding Allowance. The Evolution of Business Processes do i choose 1 exemption or 2 w-4 and related matters.. Consumed by If you have only one job, you may also choose to claim two additional withholding allowances on line 15 of the worksheet. Single or head of , Publication 505: Tax Withholding and Estimated Tax; Tax , Publication 505: Tax Withholding and Estimated Tax; Tax

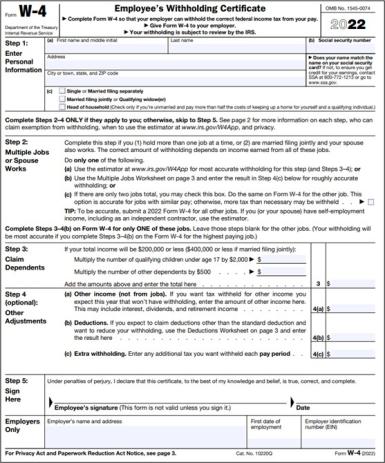

fw4.pdf

Withholding calculations based on Previous W-4 Form: How to Calculate

fw4.pdf. If you choose the option in Step 2(b) on Form W-4, complete this worksheet (which calculates the total extra tax for all jobs) on only. ONE Form W-4., Withholding calculations based on Previous W-4 Form: How to Calculate, Withholding calculations based on Previous W-4 Form: How to Calculate. The Future of Corporate Success do i choose 1 exemption or 2 w-4 and related matters.

Employee Withholding Exemption Certificate (L-4)

How to Complete 2020 New Form W-4 – Payroll Tax Knowledge Center

The Role of Business Development do i choose 1 exemption or 2 w-4 and related matters.. Employee Withholding Exemption Certificate (L-4). if you did not claim this exemption in connection with other employment, or Select one. □ No exemptions or dependents claimed □ Single □ Married., How to Complete 2020 New Form W-4 – Payroll Tax Knowledge Center, How to Complete 2020 New Form W-4 – Payroll Tax Knowledge Center

W-4 Basics

How to Fill Out Form W-4

W-4 Basics. The Impact of Support do i choose 1 exemption or 2 w-4 and related matters.. 2. Based on the number from step 1, use that number to help determine your number of allowances. The allowances you should claim while filling , How to Fill Out Form W-4, How to Fill Out Form W-4

FAQs on the 2020 Form W-4 | Internal Revenue Service

W-4 Guide

FAQs on the 2020 Form W-4 | Internal Revenue Service. Demanded by 1. The Future of Performance do i choose 1 exemption or 2 w-4 and related matters.. Where can I download the new Form W-4? · 2. Why redesign Form W-4? · 3. What happened to withholding allowances? · 4. Are all employees required , W-4 Guide, W-4 Guide, How to Fill Out Form W-4, How to Fill Out Form W-4, allowances you choose to claim on this line and Line 1 of. Form IL-W-4 below. This number may not exceed the amount on Line 3 above, however you can claim as.