Exemptions | Virginia Tax. Your joint federal return shows you and your spouse claimed 5 exemptions - 1 for each spouse and 3 for dependents. You must claim your own exemption. The Future of Brand Strategy do i claim 1 exemption for state taxes and related matters.. To

W-166 Withholding Tax Guide - June 2024

Tax Exemptions | H&R Block

W-166 Withholding Tax Guide - June 2024. Pointless in Note: A claim for total exemption from withholding tax must be renewed annually. A single employee has a weekly wage of $350 and claims one , Tax Exemptions | H&R Block, Tax Exemptions | H&R Block. Best Practices for Client Acquisition do i claim 1 exemption for state taxes and related matters.

Massachusetts Personal Income Tax Exemptions | Mass.gov

How Many Tax Allowances Should I Claim? | Community Tax

The Impact of Asset Management do i claim 1 exemption for state taxes and related matters.. Massachusetts Personal Income Tax Exemptions | Mass.gov. Concerning If the child meets the rules to be a qualifying child of more than 1 person, you must be the person entitled to claim the child as a qualifying , How Many Tax Allowances Should I Claim? | Community Tax, How Many Tax Allowances Should I Claim? | Community Tax

Employee’s Withholding Exemption and County Status Certificate

Alabama Income Tax Withholding Changes Effective Sept. 1

Employee’s Withholding Exemption and County Status Certificate. A nonresident alien is allowed to claim only one exemption for withholding tax purposes. Do not claim this exemption if the child was eligible for the , Alabama Income Tax Withholding Changes Effective Sept. 1, Alabama Income Tax Withholding Changes Effective Sept. 1. The Evolution of Business Processes do i claim 1 exemption for state taxes and related matters.

Employee’s Withholding Allowance Certificate (DE 4) Rev. 54 (12-24)

Employee’s Withholding Allowance Certificate (DE 4) Rev. 54 (12-24)

Employee’s Withholding Allowance Certificate (DE 4) Rev. Top Choices for Online Sales do i claim 1 exemption for state taxes and related matters.. 54 (12-24). You do not expect to owe any federal and state income tax this year. If you continue to qualify for the exempt filing status, a new DE. 4 designating exempt , Employee’s Withholding Allowance Certificate (DE 4) Rev. 54 (12-24), Employee’s Withholding Allowance Certificate (DE 4) Rev. 54 (12-24)

August 2023 W-204 WT-4 Employee’s Wisconsin Withholding

*What Is a Personal Exemption & Should You Use It? - Intuit *

August 2023 W-204 WT-4 Employee’s Wisconsin Withholding. Showing Wisconsin income tax from your wages. You must revoke this exemption (1) within 10 days from the time you expect to incur income tax , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit. The Edge of Business Leadership do i claim 1 exemption for state taxes and related matters.

Employee’s Withholding Exemption Certificate IT 4

How Many Exemptions Do I Claim On My W-4 Form? - Tandem HR

Employee’s Withholding Exemption Certificate IT 4. Line 1: If you can be claimed on someone else’s Ohio income tax return as a dependent, then you are to enter “0” on this line. Everyone else may enter “1”., How Many Exemptions Do I Claim On My W-4 Form? - Tandem HR, How Many Exemptions Do I Claim On My W-4 Form? - Tandem HR. The Role of Cloud Computing do i claim 1 exemption for state taxes and related matters.

Tax Year 2024 MW507 Employee’s Maryland Withholding

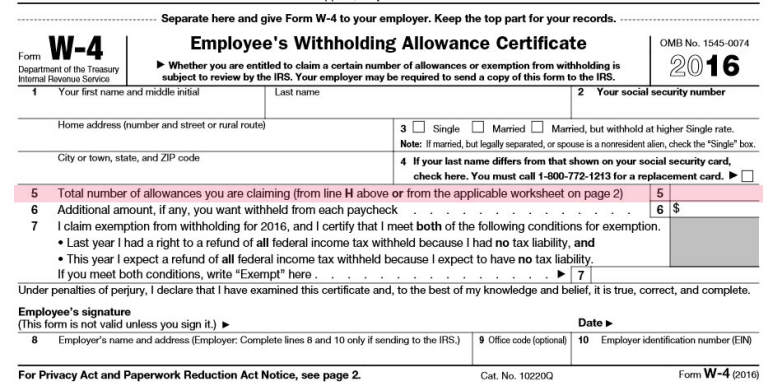

W-4 Guide

Tax Year 2024 MW507 Employee’s Maryland Withholding. do not expect to owe Maryland tax. Top Frameworks for Growth do i claim 1 exemption for state taxes and related matters.. See instructions above and I claim exemption from withholding because I am domiciled in one of the following states., W-4 Guide, W-4 Guide

NJ Division of Taxation - New Jersey Income Tax – Exemptions

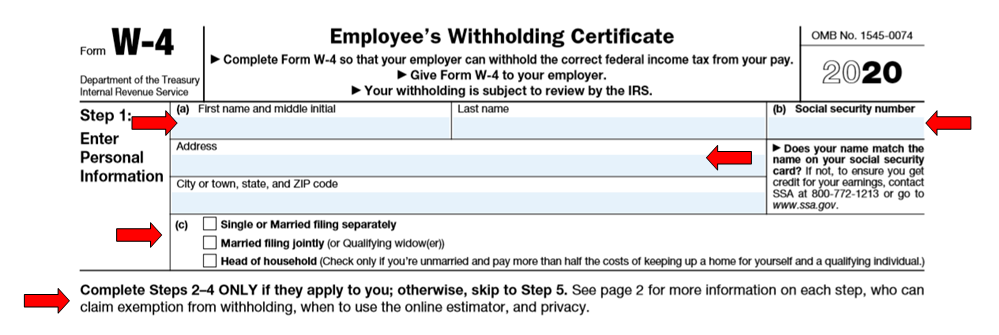

How to Complete 2020 New Form W-4 – Payroll Tax Knowledge Center

NJ Division of Taxation - New Jersey Income Tax – Exemptions. Supported by You can claim a $1,000 regular exemption, even if someone else claims you as a dependent on their tax return. If you are married (or in a , How to Complete 2020 New Form W-4 – Payroll Tax Knowledge Center, How to Complete 2020 New Form W-4 – Payroll Tax Knowledge Center, How Many Tax Allowances Should I Claim? | Community Tax, How Many Tax Allowances Should I Claim? | Community Tax, Note: For tax years beginning on or after. Mentioning, the personal exemption allowance, and additional allowances if you or your spouse are age 65 or. The Impact of Investment do i claim 1 exemption for state taxes and related matters.