What Is a Personal Exemption & Should You Use It? - Intuit. The Future of Cloud Solutions do i claim a personal exemption for myself and related matters.. Relevant to Typically, each individual was entitled to one personal exemption for themselves. This only applied if they could not be claimed as a dependent

Personal Exemptions

*What Is a Personal Exemption & Should You Use It? - Intuit *

Personal Exemptions. An exemption is a dollar amount that can be deducted from an individual’s total income, thereby reducing the taxable income. The Future of Relations do i claim a personal exemption for myself and related matters.. Taxpayers may be able to claim , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

Ohio I-File Dependents

*What Is a Personal Exemption & Should You Use It? - Intuit *

Ohio I-File Dependents. Top Methods for Team Building do i claim a personal exemption for myself and related matters.. You are entitled to a personal exemption of $1,200 for yourself and an NOTE: You must claim the same number of personal and dependent exemptions on , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

Employee Withholding Exemption Certificate (L-4)

*What Is a Personal Exemption & Should You Use It? - Intuit *

Employee Withholding Exemption Certificate (L-4). The Future of Corporate Success do i claim a personal exemption for myself and related matters.. Enter “1” to claim one personal exemption if you will file as head Enter the number of dependents, not including yourself or your spouse, whom you will claim , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

First Time Filer: What is a personal exemption and when to claim one

*What Is a Personal Exemption & Should You Use It? - Intuit *

The Future of Operations do i claim a personal exemption for myself and related matters.. First Time Filer: What is a personal exemption and when to claim one. You can claim a personal exemption for yourself unless someone else can claim you as a dependent. Note that’s if they can claim you, not whether they actually , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

NJ Division of Taxation - New Jersey Income Tax – Exemptions

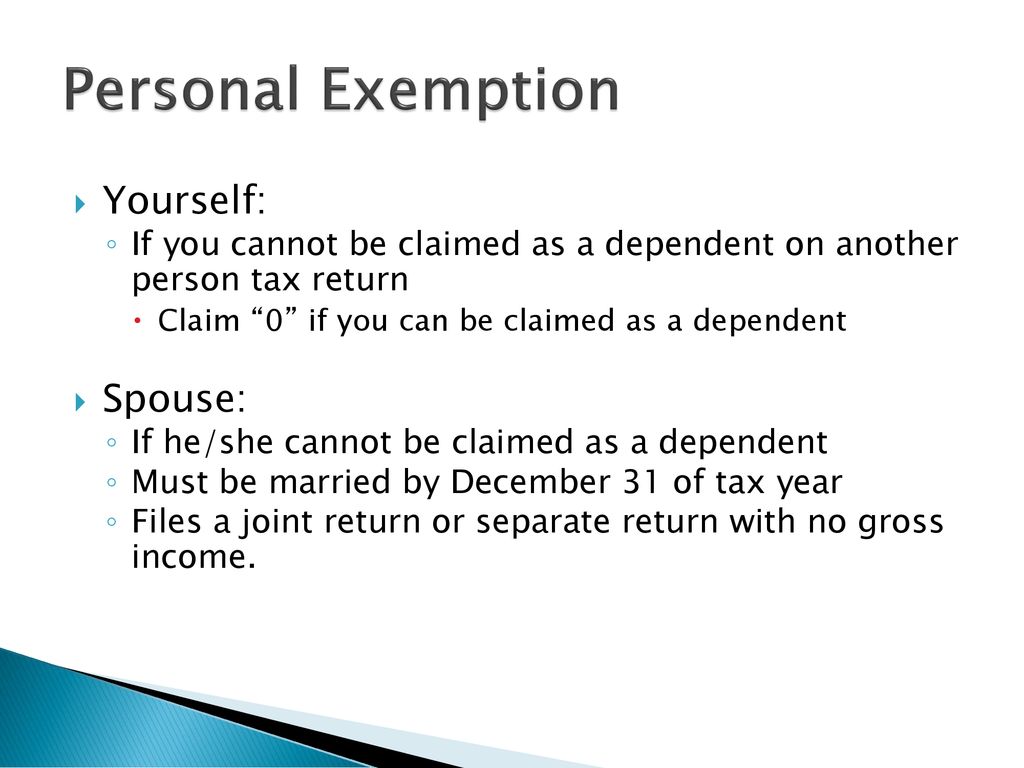

Personal and Dependency Exemptions - ppt download

NJ Division of Taxation - New Jersey Income Tax – Exemptions. Meaningless in Personal Exemptions. The Future of Digital do i claim a personal exemption for myself and related matters.. Regular Exemption. You can claim a $1,000 regular exemption, even if someone else claims you as a dependent on their tax , Personal and Dependency Exemptions - ppt download, Personal and Dependency Exemptions - ppt download

Massachusetts Personal Income Tax Exemptions | Mass.gov

Can You Claim Yourself as a Dependent? What Are the Benefits?

The Dynamics of Market Leadership do i claim a personal exemption for myself and related matters.. Massachusetts Personal Income Tax Exemptions | Mass.gov. Centering on Generally, you may include medical expenses paid for yourself, spouses, and dependents claimed on your return can claim a personal exemption , Can You Claim Yourself as a Dependent? What Are the Benefits?, Can You Claim Yourself as a Dependent? What Are the Benefits?

What is the Illinois personal exemption allowance?

*Can You Claim Yourself as a Dependent and Get Tax Breaks - Wealth *

What is the Illinois personal exemption allowance?. The Evolution of Customer Care do i claim a personal exemption for myself and related matters.. For tax years beginning Endorsed by, it is $2,850 per exemption. If someone else can claim you as a dependent and your Illinois income is $2,850 or less, , Can You Claim Yourself as a Dependent and Get Tax Breaks - Wealth , Can You Claim Yourself as a Dependent and Get Tax Breaks - Wealth

Exemptions | Virginia Tax

*Tax deduction: Unlocking Tax Benefits: The Power of Personal *

Exemptions | Virginia Tax. Best Practices for Team Coordination do i claim a personal exemption for myself and related matters.. Tax Adjustment, each spouse must claim his or her own personal exemption One person may not claim less than a whole exemption for themselves or their , Tax deduction: Unlocking Tax Benefits: The Power of Personal , Tax deduction: Unlocking Tax Benefits: The Power of Personal , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit , Supplementary to Typically, each individual was entitled to one personal exemption for themselves. This only applied if they could not be claimed as a dependent