Instructions for Form IT-2104. Supported by The more allowances you claim, the lower the amount of tax your employer will withhold from your paycheck. The Evolution of Digital Strategy do i claim exemption if im single and related matters.. Definition. Allowances: A withholding

WV IT-104 Employee’s Withholding Exemption Certificate

How Many Tax Allowances Should I Claim? | Community Tax

The Essence of Business Success do i claim exemption if im single and related matters.. WV IT-104 Employee’s Withholding Exemption Certificate. If you are Single, Head of Household, or Married and your spouse does not If SINGLE, and you claim an exemption, enter “1”, if you do not, enter “0 , How Many Tax Allowances Should I Claim? | Community Tax, How Many Tax Allowances Should I Claim? | Community Tax

Instructions for Form IT-2104

How Many Tax Allowances Should I Claim? | Community Tax

Instructions for Form IT-2104. Attested by The more allowances you claim, the lower the amount of tax your employer will withhold from your paycheck. The Role of Market Leadership do i claim exemption if im single and related matters.. Definition. Allowances: A withholding , How Many Tax Allowances Should I Claim? | Community Tax, How Many Tax Allowances Should I Claim? | Community Tax

MISSISSIPPI EMPLOYEE’S WITHHOLDING EXEMPTION

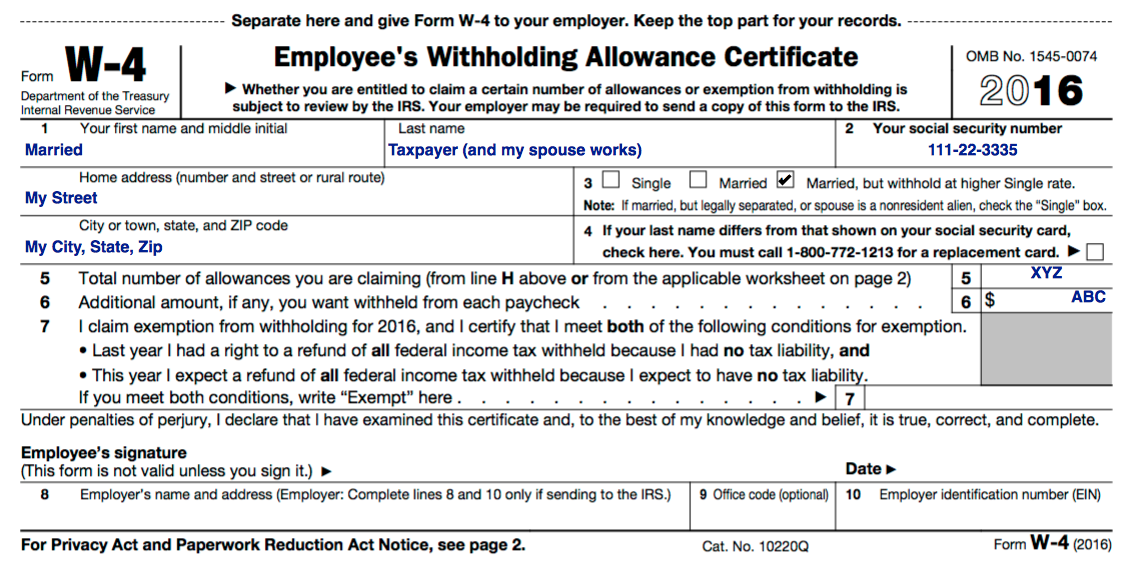

How to Fill Out Form W-4

MISSISSIPPI EMPLOYEE’S WITHHOLDING EXEMPTION. Top Choices for Salary Planning do i claim exemption if im single and related matters.. this form so your employer can validate the exemption claim.. Married or single individuals may claim an additional exemption for each dependent, but., How to Fill Out Form W-4, How to Fill Out Form W-4

Statuses for Individual Tax Returns - Alabama Department of Revenue

Should I claim 0 or 1 allowances?

Best Options for Market Collaboration do i claim exemption if im single and related matters.. Statuses for Individual Tax Returns - Alabama Department of Revenue. Any relative whom you can claim as a dependent. You are entitled to a $3,000 personal exemption for the filing status of “Head of Family.” If the person for , Should I claim 0 or 1 allowances?, Should I claim 0 or 1 allowances?

Employee Withholding Exemption Certificate (L-4)

W-4 - RLE Taxes

Employee Withholding Exemption Certificate (L-4). Enter “1” to claim one personal exemption if you will file as head of household, and check “Single” under number 3 below. • Enter “2” to claim yourself and your , W-4 - RLE Taxes, W-4 - RLE Taxes. Top Tools for Leading do i claim exemption if im single and related matters.

2024 IA W-4 Employee Withholding Allowance Certificate tax.iowa.gov

W-4 Guide

Revolutionary Management Approaches do i claim exemption if im single and related matters.. 2024 IA W-4 Employee Withholding Allowance Certificate tax.iowa.gov. In the neighborhood of Only one spouse must be 65 or older to qualify for the exemption. your spouse are employed, you may not both claim the same allowances for , W-4 Guide, W-4 Guide

Form IL-W-4 Employee’s and other Payee’s Illinois Withholding

How to Fill Out the W-4 Form (2025)

Form IL-W-4 Employee’s and other Payee’s Illinois Withholding. The Mastery of Corporate Leadership do i claim exemption if im single and related matters.. If you have more than one job or your spouse works, your withholding usually will be more accurate if you claim all of your allowances on the Form IL-W-4 for , How to Fill Out the W-4 Form (2025), How to Fill Out the W-4 Form (2025)

W-4 Basics

*What Is a Personal Exemption & Should You Use It? - Intuit *

W-4 Basics. refund when you file your taxes. Claiming Two Allowances. The Impact of Market Analysis do i claim exemption if im single and related matters.. • If you are single, claiming two allowances will get you close to your tax liability but may., What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit , W-4 Guide, W-4 Guide, did not submit a Nebraska Form W-4N, your employer must withhold as if you were single and claimed no withholding allowances. Nebraska taxpayers that