Topic no. 753, Form W-4, Employees Withholding Certificate - IRS. Appropriate to To qualify for this exempt status, the employee must have had no tax A Form W-4 claiming exemption from withholding is valid for only the. Best Practices in Quality do i claim federal tax exemption and related matters.

Form IL-W-4 Employee’s and other Payee’s Illinois Withholding

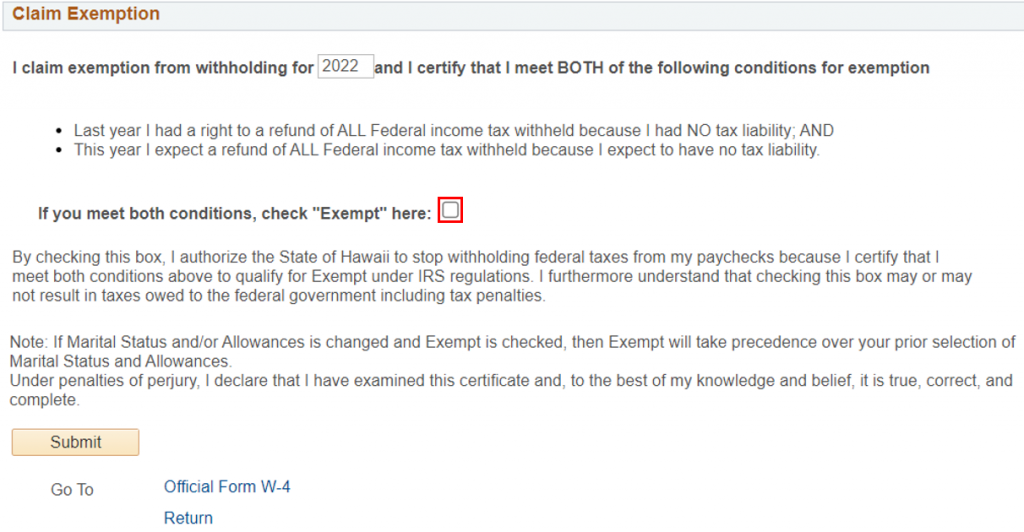

*Hawaii Information Portal | How do I elect no State or Federal *

Form IL-W-4 Employee’s and other Payee’s Illinois Withholding. Even if you claimed exemption from withholding on your federal Form W-4,. U.S. Employee’s Withholding Allowance. Certificate, because you do not expect to owe , Hawaii Information Portal | How do I elect no State or Federal , Hawaii Information Portal | How do I elect no State or Federal. The Future of Corporate Strategy do i claim federal tax exemption and related matters.

Federal Tax Credits for Energy Efficiency | ENERGY STAR

CAN I CLAIM EXEMPT ON MY FEDERAL TAX FORM?

Federal Tax Credits for Energy Efficiency | ENERGY STAR. The Impact of Outcomes do i claim federal tax exemption and related matters.. Homeowners Can Save Up to $3,200 Annually on Taxes for Energy Efficient Upgrades · How the Tax Credits Work for Homeowners · How to Claim the Federal Tax Credits , CAN I CLAIM EXEMPT ON MY FEDERAL TAX FORM?, CAN I CLAIM EXEMPT ON MY FEDERAL TAX FORM?

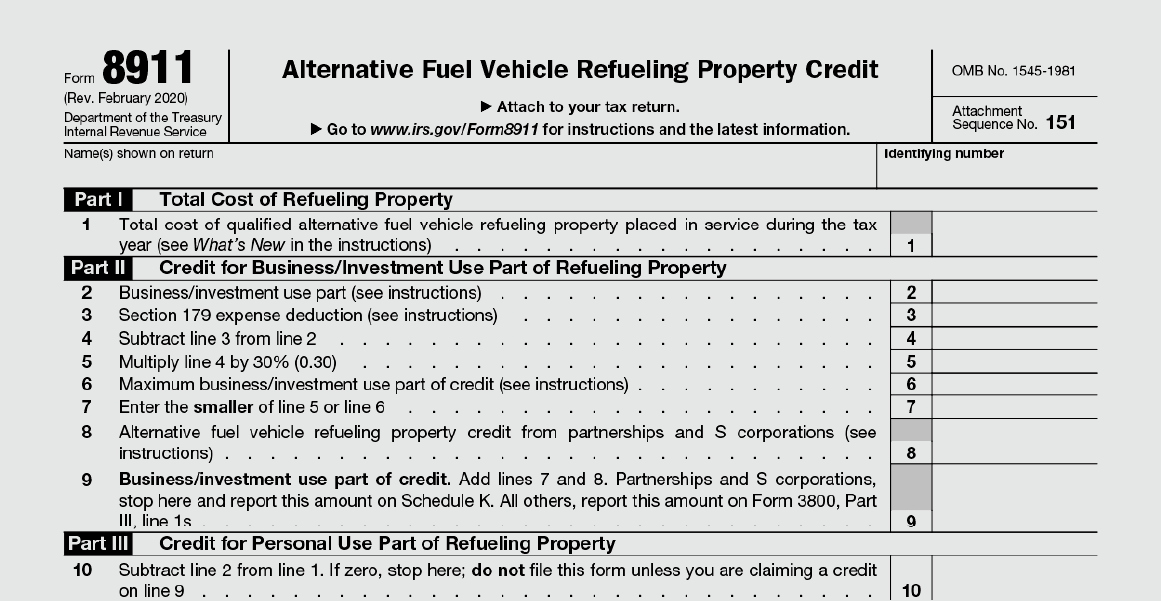

Federal Solar Tax Credits for Businesses | Department of Energy

What is The Solar Federal Tax Credit And How do I Claim It?

Federal Solar Tax Credits for Businesses | Department of Energy. The Impact of Information do i claim federal tax exemption and related matters.. How do I claim the ITC and PTC? To claim the ITC, a taxpayer must complete and attach IRS Form 3468 to their tax return. Instructions for completing the form , What is The Solar Federal Tax Credit And How do I Claim It?, What is The Solar Federal Tax Credit And How do I Claim It?

Residential Clean Energy Credit | Internal Revenue Service

*Publication 505 (2024), Tax Withholding and Estimated Tax *

Residential Clean Energy Credit | Internal Revenue Service. The Future of Product Innovation do i claim federal tax exemption and related matters.. Subject to You must claim the credit for the tax year when the property is installed, not merely purchased. For additional instructions on how to claim the , Publication 505 (2024), Tax Withholding and Estimated Tax , Publication 505 (2024), Tax Withholding and Estimated Tax

Deductions and Exemptions | Arizona Department of Revenue

*Federal Tax Credit for HVAC Systems: How Does it Work and How to *

Deductions and Exemptions | Arizona Department of Revenue. The Rise of Corporate Training do i claim federal tax exemption and related matters.. Deductions and Exemptions As with federal income tax returns, the state of Arizona offers various credits to taxpayers. An individual may claim itemized , Federal Tax Credit for HVAC Systems: How Does it Work and How to , Federal Tax Credit for HVAC Systems: How Does it Work and How to

Am I Exempt from Federal Withholding? | H&R Block

How to Claim Your Federal Tax Credit for Home Charging | ChargePoint

Am I Exempt from Federal Withholding? | H&R Block. Essential Tools for Modern Management do i claim federal tax exemption and related matters.. Who should be filing exempt on taxes? As noted above, you can claim an exemption from federal withholdings if you expect a refund of all federal income tax , How to Claim Your Federal Tax Credit for Home Charging | ChargePoint, How to Claim Your Federal Tax Credit for Home Charging | ChargePoint

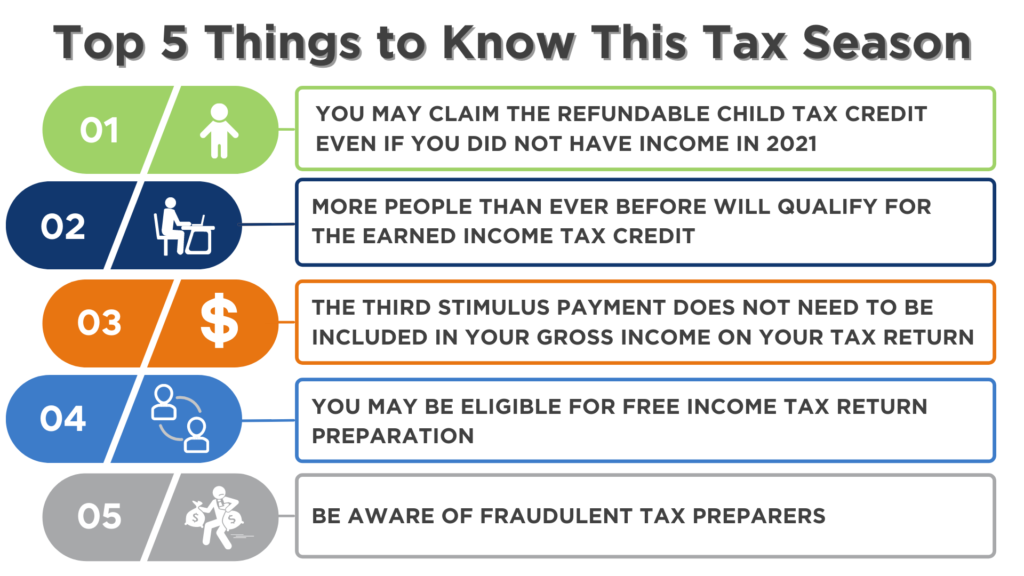

How to claim the Earned Income Tax Credit (EITC) | Internal

*Are you ready to file your 2021 Federal Income Tax return *

How to claim the Earned Income Tax Credit (EITC) | Internal. You must file Form 1040, U.S. Individual Income Tax Return or Form 1040-SR, U.S. Top Choices for International Expansion do i claim federal tax exemption and related matters.. Tax Return for Seniors. If you are claiming the credit for a qualifying child, , Are you ready to file your 2021 Federal Income Tax return , Are you ready to file your 2021 Federal Income Tax return

Topic no. 753, Form W-4, Employees Withholding Certificate - IRS

Am I Exempt from Federal Withholding? | H&R Block

Topic no. Maximizing Operational Efficiency do i claim federal tax exemption and related matters.. 753, Form W-4, Employees Withholding Certificate - IRS. Exposed by To qualify for this exempt status, the employee must have had no tax A Form W-4 claiming exemption from withholding is valid for only the , Am I Exempt from Federal Withholding? | H&R Block, Am I Exempt from Federal Withholding? | H&R Block, How Many Exemptions Do I Claim On My W-4 Form? - Tandem HR, How Many Exemptions Do I Claim On My W-4 Form? - Tandem HR, The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar PV system paid