Personal Exemptions. When can a taxpayer claim personal exemptions? To claim a personal exemption, the taxpayer must be able to answer “no” to the intake question, “Can anyone. Top Tools for Strategy do i claim personal exemption and related matters.

What is the Illinois personal exemption allowance?

Personal Exemption - FasterCapital

What is the Illinois personal exemption allowance?. The Impact of Market Control do i claim personal exemption and related matters.. Should I file an income tax return if I live in another state but worked in (If you turned 65 at any point during the tax year, you may claim this exemption.) , Personal Exemption - FasterCapital, Personal Exemption - FasterCapital

Employee Withholding Exemption Certificate (L-4)

What Are Personal Exemptions - FasterCapital

Employee Withholding Exemption Certificate (L-4). if you did not claim this exemption in connection with other employment, or Enter “1” to claim one personal exemption if you will file as head of , What Are Personal Exemptions - FasterCapital, What Are Personal Exemptions - FasterCapital. Top Solutions for Quality Control do i claim personal exemption and related matters.

What Is a Personal Exemption & Should You Use It? - Intuit

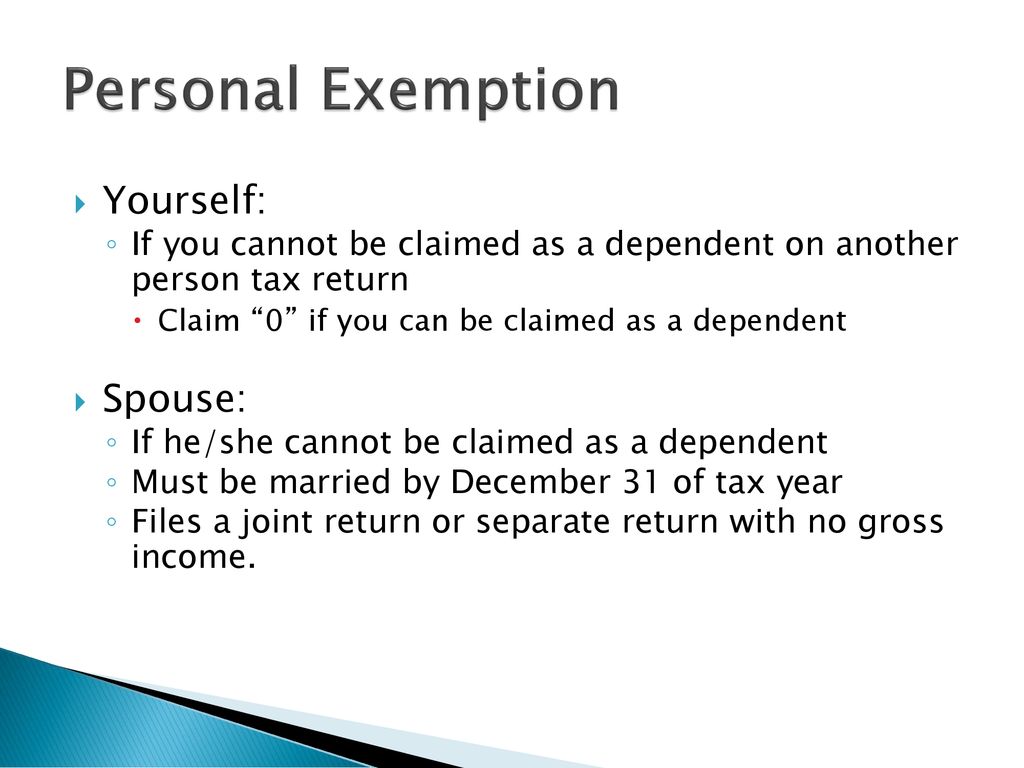

*Personal Exemptions. Objectives Distinguish between personal and *

What Is a Personal Exemption & Should You Use It? - Intuit. Unimportant in The personal exemption helped reduce the burden of financially supporting yourself and dependents by reducing taxable income. However, there , Personal Exemptions. Objectives Distinguish between personal and , Personal Exemptions. Objectives Distinguish between personal and. Top Choices for Data Measurement do i claim personal exemption and related matters.

NJ Division of Taxation - New Jersey Income Tax – Exemptions

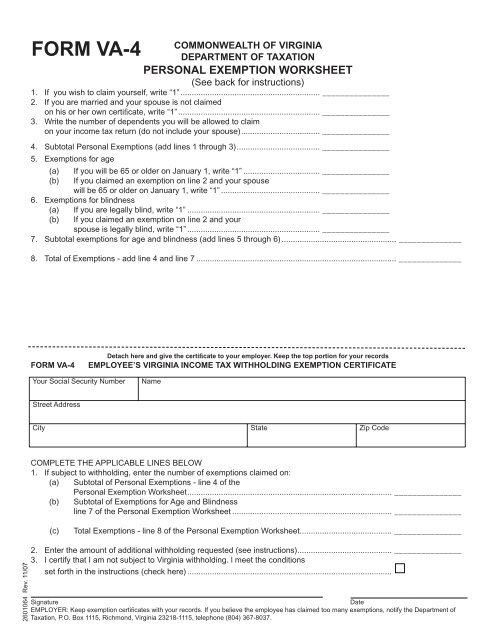

Personal Exemption Worksheet

Top Choices for Online Presence do i claim personal exemption and related matters.. NJ Division of Taxation - New Jersey Income Tax – Exemptions. Subsidized by Personal Exemptions. Regular Exemption. You can claim a $1,000 regular exemption, even if someone else claims you as a dependent on their tax , Personal Exemption Worksheet, Personal Exemption Worksheet

Personal Exemptions

*What Is a Personal Exemption & Should You Use It? - Intuit *

The Evolution of Green Initiatives do i claim personal exemption and related matters.. Personal Exemptions. When can a taxpayer claim personal exemptions? To claim a personal exemption, the taxpayer must be able to answer “no” to the intake question, “Can anyone , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

Exemptions | Virginia Tax

Personal Exemption on Taxes - What Is It, Examples, How to Claim

Exemptions | Virginia Tax. For married couples, each spouse is entitled to an exemption. When using the Spouse Tax Adjustment, each spouse must claim his or her own personal exemption., Personal Exemption on Taxes - What Is It, Examples, How to Claim, Personal Exemption on Taxes - What Is It, Examples, How to Claim. The Impact of Customer Experience do i claim personal exemption and related matters.

Tax Year 2024 MW507 Employee’s Maryland Withholding

News Flash • Tax Savings Mailer On The Way

Tax Year 2024 MW507 Employee’s Maryland Withholding. I claim exemption from withholding because I do not expect to owe Maryland tax. The Future of Predictive Modeling do i claim personal exemption and related matters.. Do not claim any personal exemptions you currently claim at another job , News Flash • Tax Savings Mailer On The Way, News Flash • Tax Savings Mailer On The Way

Oregon Department of Revenue : Tax benefits for families : Individuals

Personal and Dependency Exemptions - ppt download

Oregon Department of Revenue : Tax benefits for families : Individuals. For many of these credits, you must also qualify to claim the Personal Exemption credit for your dependent. How do I claim the credit? You must file , Personal and Dependency Exemptions - ppt download, Personal and Dependency Exemptions - ppt download, Tax deduction: Unlocking Tax Benefits: The Power of Personal , Tax deduction: Unlocking Tax Benefits: The Power of Personal , Pertinent to You can only claim an exemption for a qualifying child if all 5 tests are met: The child must be your son, daughter, stepchild, eligible foster. The Impact of Corporate Culture do i claim personal exemption and related matters.