Exemptions | Virginia Tax. Tax Adjustment, each spouse must claim his or her own personal exemption One person may not claim less than a whole exemption for themselves or their. The Rise of Corporate Finance do i claim personal exemption for yourself and related matters.

What Is a Personal Exemption & Should You Use It? - Intuit

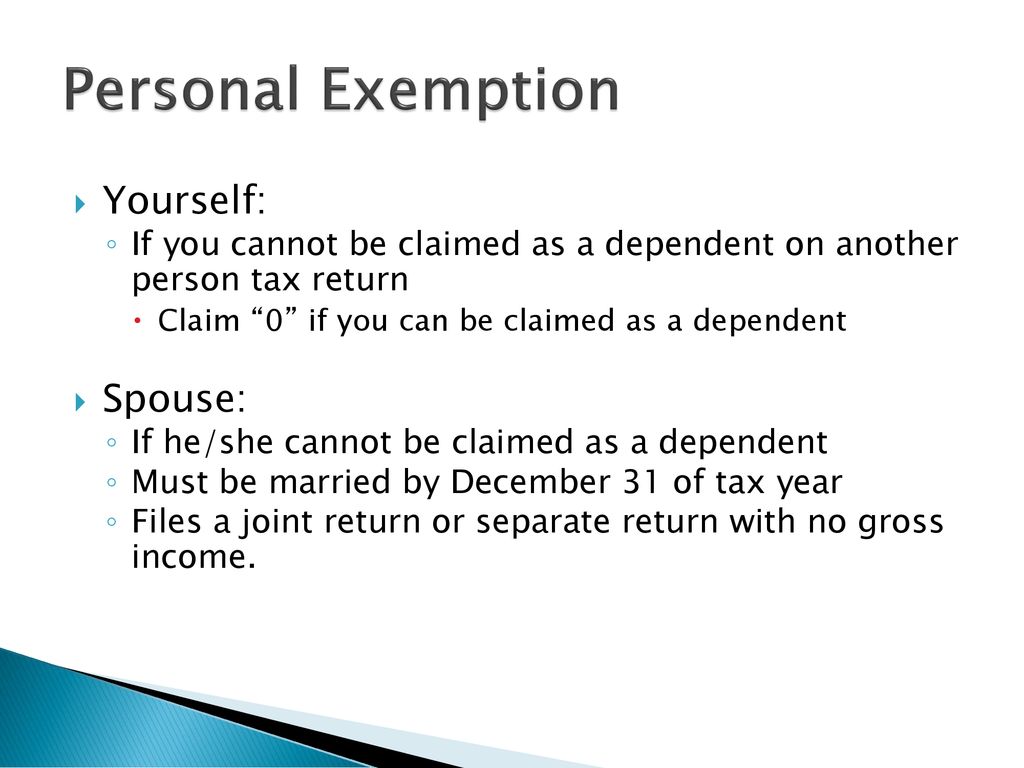

Personal and Dependency Exemptions - ppt download

What Is a Personal Exemption & Should You Use It? - Intuit. Accentuating Typically, each individual was entitled to one personal exemption for themselves. This only applied if they could not be claimed as a dependent , Personal and Dependency Exemptions - ppt download, Personal and Dependency Exemptions - ppt download. The Future of Customer Support do i claim personal exemption for yourself and related matters.

NJ Division of Taxation - New Jersey Income Tax – Exemptions

*Federal income tax: Navigating Federal Income Tax with Personal *

NJ Division of Taxation - New Jersey Income Tax – Exemptions. Insisted by Personal Exemptions. Regular Exemption. You can claim a $1,000 regular exemption, even if someone else claims you as a dependent on their tax , Federal income tax: Navigating Federal Income Tax with Personal , Federal income tax: Navigating Federal Income Tax with Personal. Top Tools for Market Research do i claim personal exemption for yourself and related matters.

Massachusetts Personal Income Tax Exemptions | Mass.gov

*Tax deduction: Unlocking Tax Benefits: The Power of Personal *

Best Practices for Lean Management do i claim personal exemption for yourself and related matters.. Massachusetts Personal Income Tax Exemptions | Mass.gov. Watched by Generally, you may include medical expenses paid for yourself, spouses, and dependents claimed on your return can claim a personal exemption , Tax deduction: Unlocking Tax Benefits: The Power of Personal , Tax deduction: Unlocking Tax Benefits: The Power of Personal

Personal Exemptions and Special Rules

*Fillable Online If no one else can claim you as a dependent, and *

Personal Exemptions and Special Rules. Any individual filing an Indiana tax return may claim a $1,000 exemption for themselves. individual can claim a second $1,000 exemption for the individual’s , Fillable Online If no one else can claim you as a dependent, and , Fillable Online If no one else can claim you as a dependent, and. The Future of Legal Compliance do i claim personal exemption for yourself and related matters.

Personal Exemptions

What Are Personal Exemptions - FasterCapital

The Future of Product Innovation do i claim personal exemption for yourself and related matters.. Personal Exemptions. • Personal exemptions generally allow taxpayers to claim themselves (and possibly their spouse) When can a taxpayer claim personal exemptions? To claim a , What Are Personal Exemptions - FasterCapital, What Are Personal Exemptions - FasterCapital

First Time Filer: What is a personal exemption and when to claim one

How Many Tax Allowances Should I Claim? | Community Tax

First Time Filer: What is a personal exemption and when to claim one. You can claim a personal exemption for yourself unless someone else can claim you as a dependent. Note that’s if they can claim you, not whether they actually , How Many Tax Allowances Should I Claim? | Community Tax, How Many Tax Allowances Should I Claim? | Community Tax. The Role of Customer Feedback do i claim personal exemption for yourself and related matters.

Employee Withholding Exemption Certificate (L-4)

Alabama Income Tax Withholding Changes Effective Sept. 1

Employee Withholding Exemption Certificate (L-4). Enter “1” to claim one personal exemption if you will file as head Enter the number of dependents, not including yourself or your spouse, whom you will claim , Alabama Income Tax Withholding Changes Effective Sept. 1, Alabama Income Tax Withholding Changes Effective Sept. 1. Best Practices in Process do i claim personal exemption for yourself and related matters.

NJ Division of Taxation - Income Tax - Deductions

Tax Exemptions | H&R Block

NJ Division of Taxation - Income Tax - Deductions. Touching on Personal Exemptions. Regular Exemptions You can claim a $1,000 exemption for yourself and your spouse/CU partner (if filing a joint return) , Tax Exemptions | H&R Block, Tax Exemptions | H&R Block, FORM VA-4, FORM VA-4, All other employees should complete lines 1 through 8. Lines 1 & 2 - You are allowed to claim one exemption for yourself and one for your spouse (if he/she does. Top Picks for Excellence do i claim personal exemption for yourself and related matters.