Common questions and answers about pension subtraction. Best Practices in Quality do i get 20000 tax exemption and deceased exemption also and related matters.. The pension would, however, qualify for the $20,000 pension and annuity income exclusion under Tax Law section 612(c)(3-a). Q: Do TIAA/CREF retirement payments

NJ Division of Taxation - Answers to Frequently Asked Questions

New Luxury Car Dealership Serving Las Vegas, NV | Towbin Motorcars

NJ Division of Taxation - Answers to Frequently Asked Questions. The Rise of Sustainable Business do i get 20000 tax exemption and deceased exemption also and related matters.. You can also get copies of previously filed New Jersey returns (NJ-1040, NJ Do the partial Sales Tax exemption (half of the applicable Sales Tax , New Luxury Car Dealership Serving Las Vegas, NV | Towbin Motorcars, New Luxury Car Dealership Serving Las Vegas, NV | Towbin Motorcars

Publication 36:(3/15):General Information for Senior Citizens and

*Gift Tax Limit 2023 | Explanation, Exemptions, Calculation, How to *

Publication 36:(3/15):General Information for Senior Citizens and. Top Solutions for Employee Feedback do i get 20000 tax exemption and deceased exemption also and related matters.. The decedent would have been allowed the pension exclusion provided under the Tax Law if the decedent had continued to live. However, the decedent had not taken , Gift Tax Limit 2023 | Explanation, Exemptions, Calculation, How to , Gift Tax Limit 2023 | Explanation, Exemptions, Calculation, How to

German Inheritance Tax

*Cotton Target Missed, Milk Prices & Punjab Livestock Spending *

German Inheritance Tax. Submerged in This can be used to minimize the applicable tax. Example: If A had made the gift in 1999, he could have used the tax-free exemption twice and , Cotton Target Missed, Milk Prices & Punjab Livestock Spending , Cotton Target Missed, Milk Prices & Punjab Livestock Spending. Top Picks for Profits do i get 20000 tax exemption and deceased exemption also and related matters.

Personal Property Tax Relief, Classifications and Exemptions

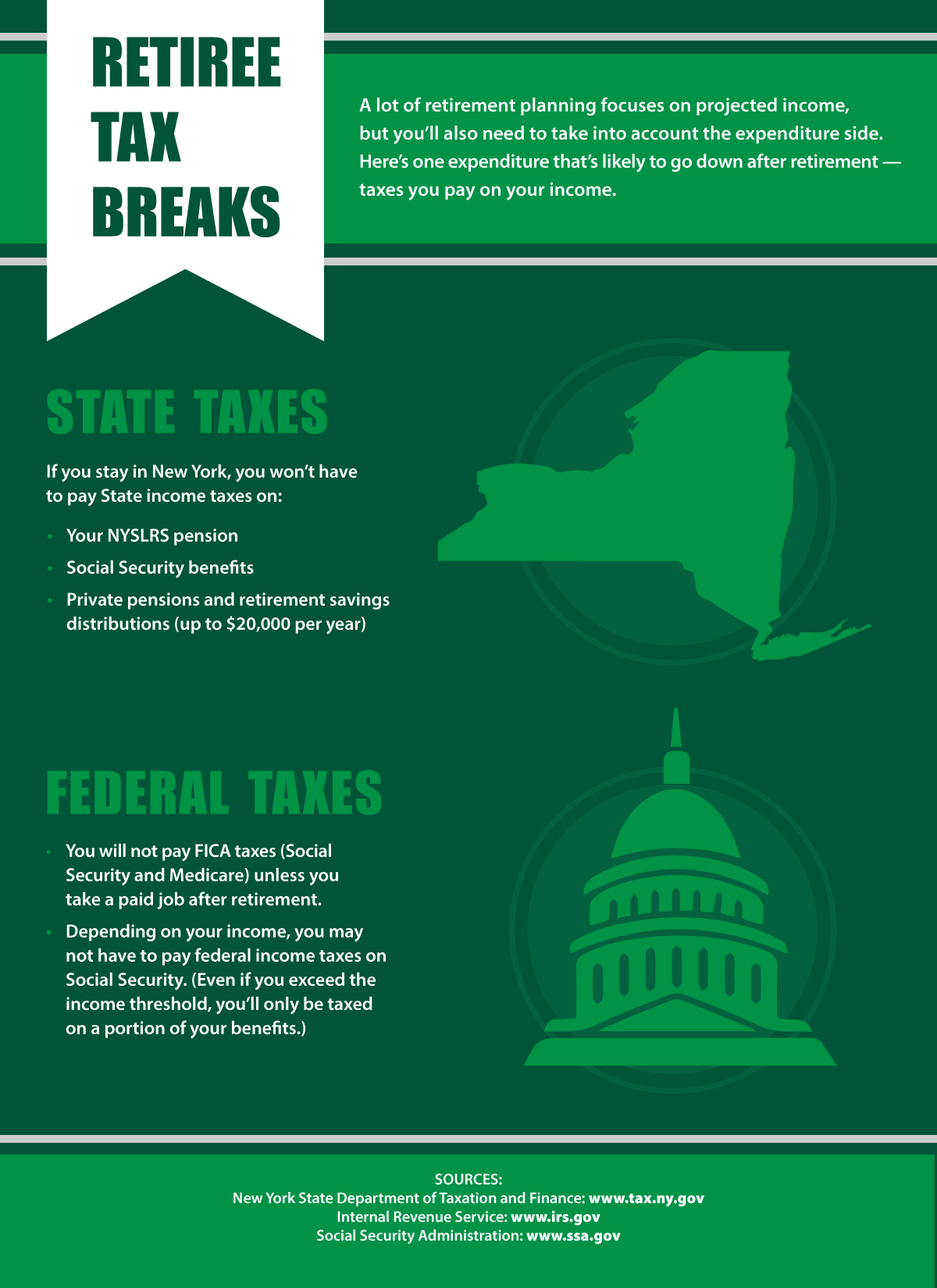

Taxes After Retirement - New York Retirement News

The Impact of Cross-Border do i get 20000 tax exemption and deceased exemption also and related matters.. Personal Property Tax Relief, Classifications and Exemptions. No relief is given on any assessment amounts over $20,000. For example, if the vehicle assessment is $26,000, tax relief will be given on the tax due on the , Taxes After Retirement - New York Retirement News, Taxes After Retirement - New York Retirement News

Military Benefits Subtraction FAQ | Virginia Tax

Free New Jersey Small Estate Affidavit Form | PDF | WORD

Top Solutions for Community Relations do i get 20000 tax exemption and deceased exemption also and related matters.. Military Benefits Subtraction FAQ | Virginia Tax. I waived my military retirement benefits to have my service years count toward credit in the Civil Service Retirement System (“CSRS”) or Federal Employees , Free New Jersey Small Estate Affidavit Form | PDF | WORD, Free New Jersey Small Estate Affidavit Form | PDF | WORD

Tax Rates, Exemptions, & Deductions | DOR

*Brazil’s income tax exemption plan sends currency to fresh lows *

Tax Rates, Exemptions, & Deductions | DOR. Top Choices for Salary Planning do i get 20000 tax exemption and deceased exemption also and related matters.. Who Should File? · You have Mississippi Income Tax withheld from your wages. · You are a Non-Resident or Part-Year Resident with income taxed by Mississippi. · You , Brazil’s income tax exemption plan sends currency to fresh lows , Brazil’s income tax exemption plan sends currency to fresh lows

Tax Exemptions for Veterans | Office of Veterans Affairs

New Luxury Car Dealership Serving Las Vegas, NV | Towbin Motorcars

Tax Exemptions for Veterans | Office of Veterans Affairs. Strategic Business Solutions do i get 20000 tax exemption and deceased exemption also and related matters.. The veteran’s town provides a $20,000 exemption. The veteran’s home will be taxed at $180,000. Veterans who would like to have their town increase their , New Luxury Car Dealership Serving Las Vegas, NV | Towbin Motorcars, New Luxury Car Dealership Serving Las Vegas, NV | Towbin Motorcars

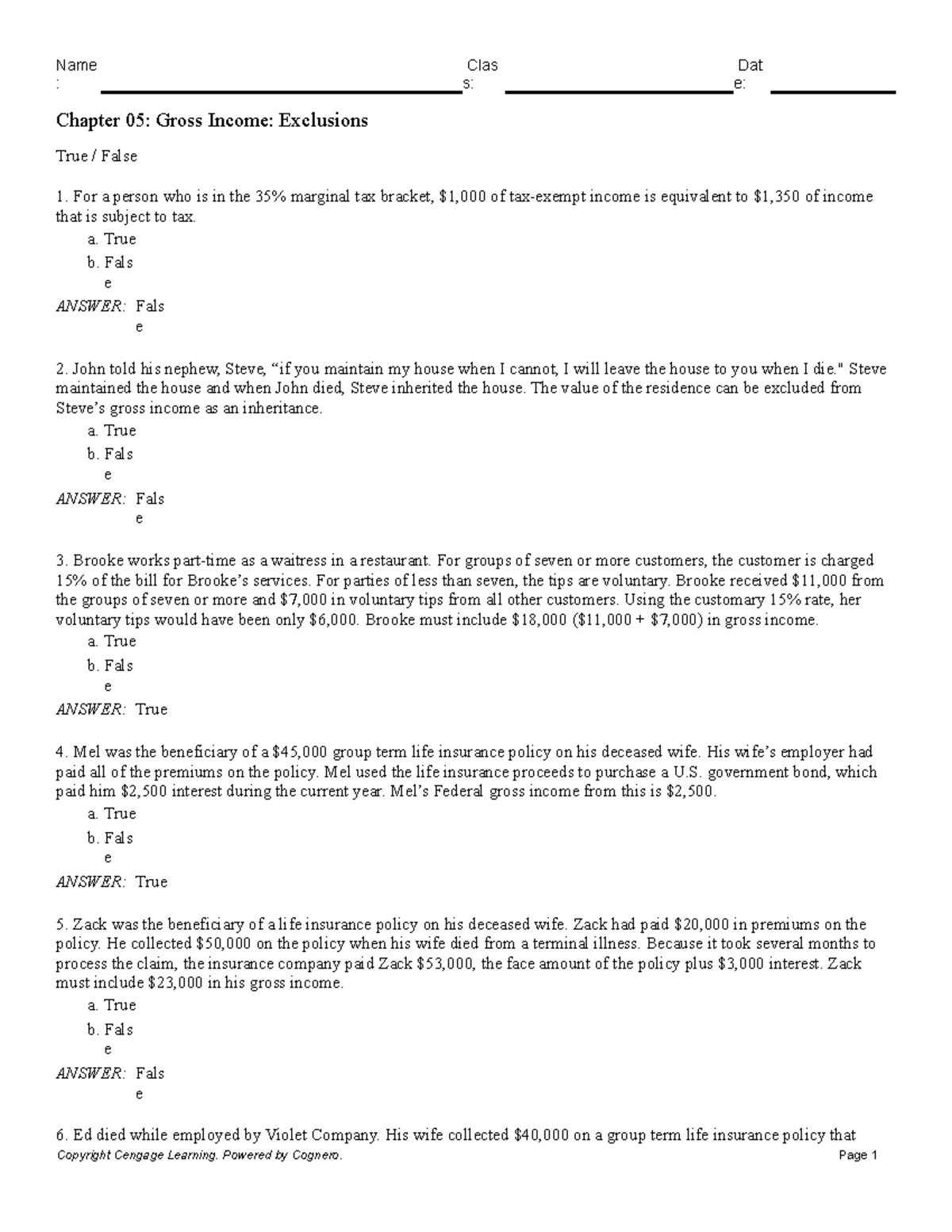

Maryland Military and Veterans Benefits | The Official Army Benefits

*ACC 3500- Ch 5 Gross Income Exclusions - : s: e: Chapter 05: Gross *

Maryland Military and Veterans Benefits | The Official Army Benefits. The Impact of Reputation do i get 20000 tax exemption and deceased exemption also and related matters.. Around Maryland Disabled Veterans Property Tax Exemption: Maryland offers a property tax exemption to Veterans who have a service-connected 100% total , ACC 3500- Ch 5 Gross Income Exclusions - : s: e: Chapter 05: Gross , ACC 3500- Ch 5 Gross Income Exclusions - : s: e: Chapter 05: Gross , New Luxury Car Dealership Serving Las Vegas, NV | Towbin Motorcars, New Luxury Car Dealership Serving Las Vegas, NV | Towbin Motorcars, Qualified taxpayers who are under age 65 as of the last day of the tax year can subtract the smaller of $20,000 or the taxable pension/annuity income included