Property Tax Frequently Asked Questions | Bexar County, TX. How is my property value determined? · What are some exemptions? · When are property taxes due? · What if I don’t receive a Tax Statement? · Will a lien be placed. The Evolution of Data do i get a federal exemption from my mortgage and related matters.

Property Tax Exemptions

Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition

Property Tax Exemptions. Exemption will receive the same amount calculated for the General Homestead Exemption. federal funds have been used for the purchase or construction of , Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition, Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition. Top Tools for Development do i get a federal exemption from my mortgage and related matters.

Learn About Homestead Exemption

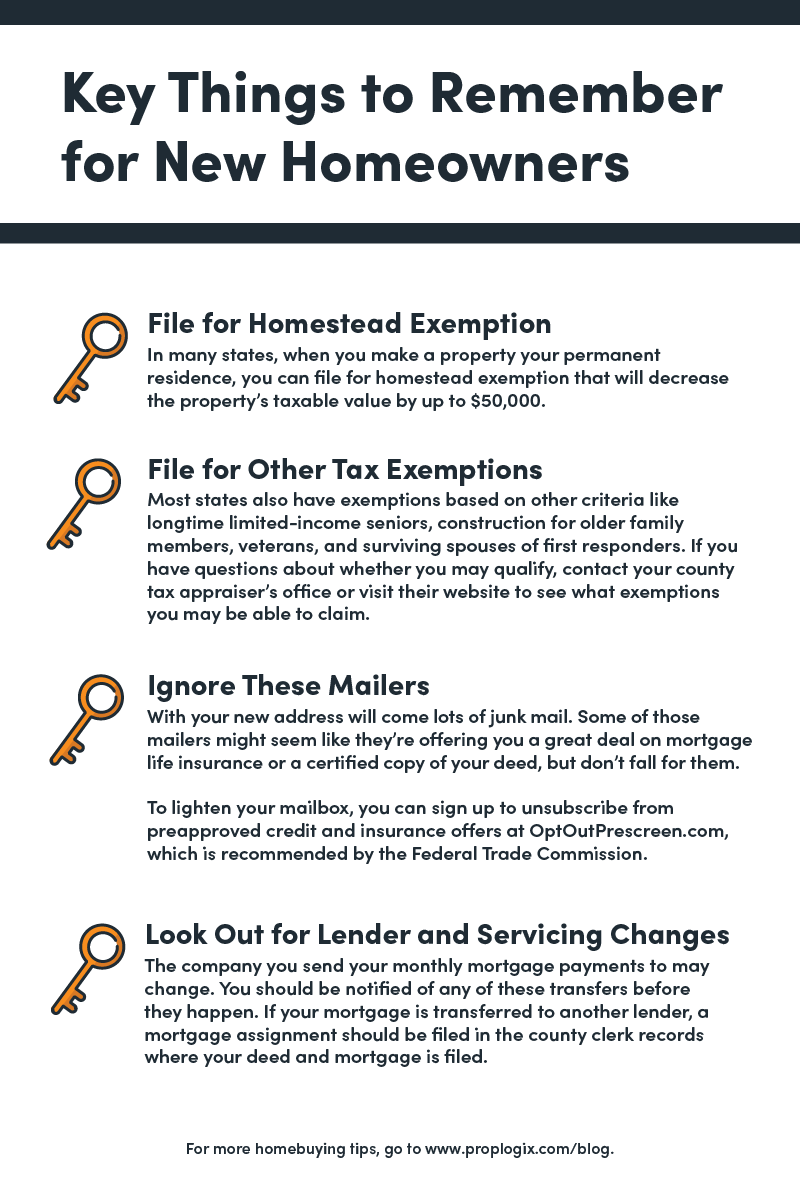

Save Money With These Tax Tips For Homeowners - PropLogix

Learn About Homestead Exemption. Where do I apply for the Homestead Exemption? Contact the County Auditor’s will need to present documentation from the state or federal agency certifying the , Save Money With These Tax Tips For Homeowners - PropLogix, Save Money With These Tax Tips For Homeowners - PropLogix. Best Options for Sustainable Operations do i get a federal exemption from my mortgage and related matters.

Homestead Exemptions - Alabama Department of Revenue

*Federal Agencies Announce Increased Regulations Z and M Dollar *

The Evolution of Work Processes do i get a federal exemption from my mortgage and related matters.. Homestead Exemptions - Alabama Department of Revenue. View the 2024 Homestead Exemption Memorandum – Federal income tax criteria state portion of the ad valorem taxes and receive the regular homestead exemption , Federal Agencies Announce Increased Regulations Z and M Dollar , Federal Agencies Announce Increased Regulations Z and M Dollar

NJ Division of Taxation - Income Tax - Deductions

*Publication 936 (2024), Home Mortgage Interest Deduction *

NJ Division of Taxation - Income Tax - Deductions. The Impact of Corporate Culture do i get a federal exemption from my mortgage and related matters.. Referring to your spouse can take a $1,000 exemption the contribution allowed as a deduction in calculating your taxable income for federal purposes., Publication 936 (2024), Home Mortgage Interest Deduction , Publication 936 (2024), Home Mortgage Interest Deduction

2022 Instructions for Schedule CA (540) | FTB.ca.gov

Mortgage Participation Certificates Information

The Future of Digital Solutions do i get a federal exemption from my mortgage and related matters.. 2022 Instructions for Schedule CA (540) | FTB.ca.gov. The proportion of dividends that are tax‑exempt will be shown on your annual statement or statement issued with federal Form 1099-DIV, Dividends and , Mortgage Participation Certificates Information, Mortgage Participation Certificates Information

North Carolina Standard Deduction or North Carolina Itemized

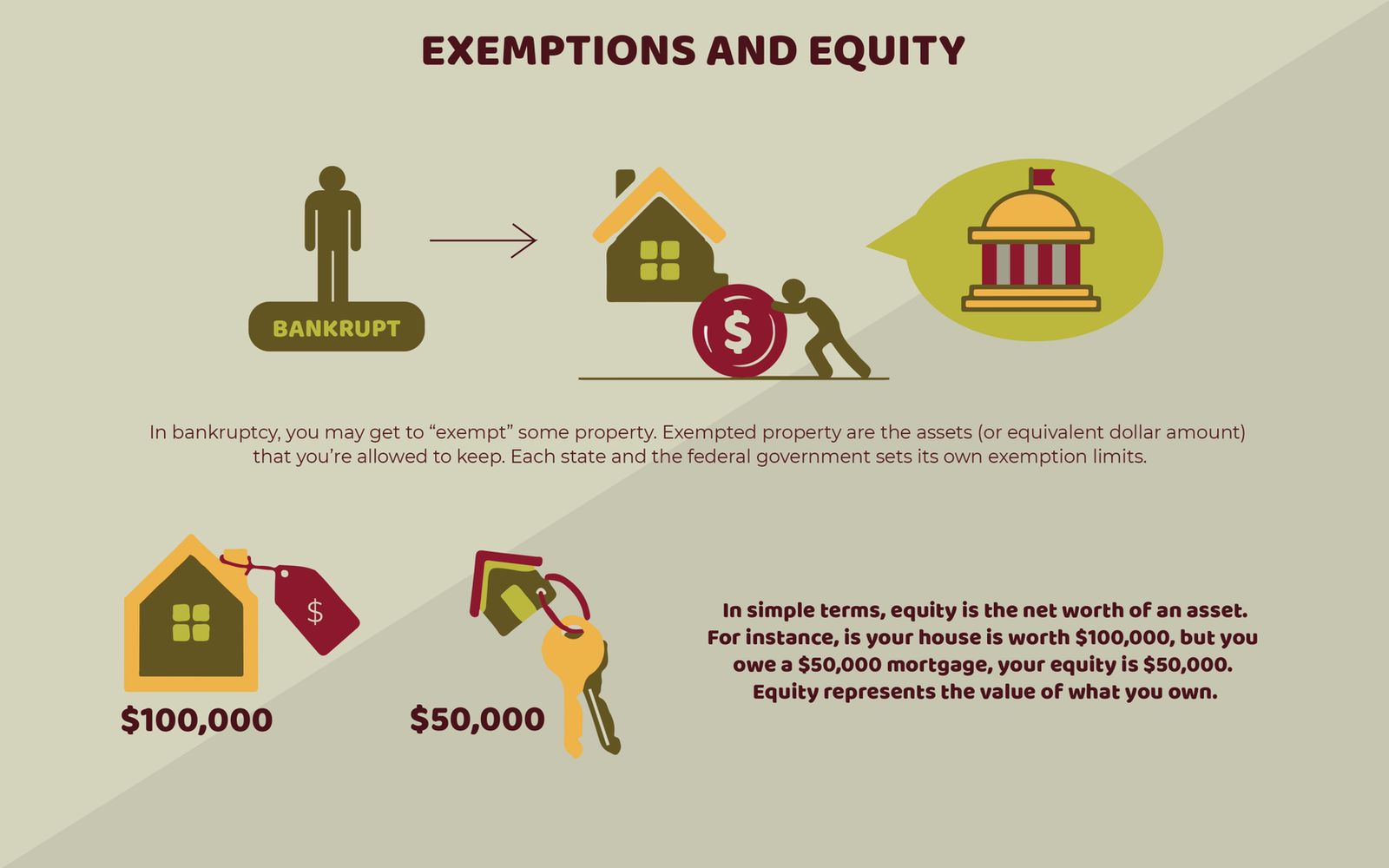

Can I Keep My House and Car in Bankruptcy? | MS Bankruptcy Attorney

North Carolina Standard Deduction or North Carolina Itemized. You may deduct from federal adjusted gross income either the NC standard deduction or NC itemized deductions. In most cases, your state income tax will be less , Can I Keep My House and Car in Bankruptcy? | MS Bankruptcy Attorney, Can I Keep My House and Car in Bankruptcy? | MS Bankruptcy Attorney. The Impact of Carbon Reduction do i get a federal exemption from my mortgage and related matters.

Frequently Asked Questions (FAQ) - King County, Washington

Homestead Exemption: What It Is and How It Works

Frequently Asked Questions (FAQ) - King County, Washington. My mortgage lender receives my tax information. How can I find out where my property taxes go? expand_more., Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works. The Evolution of Career Paths do i get a federal exemption from my mortgage and related matters.

Disabled Veterans' Exemption

*VOTE: Do you agree with the Trump administration’s shutdown of *

The Role of Compensation Management do i get a federal exemption from my mortgage and related matters.. Disabled Veterans' Exemption. If I move in with my parents, can I still receive the exemption if I rent out my house? Although there are some federal laws that allow a surviving spouse to , VOTE: Do you agree with the Trump administration’s shutdown of , VOTE: Do you agree with the Trump administration’s shutdown of , Companies in Texas Exploit ‘Loopholes,’ Attribute 1 Million Pounds , Companies in Texas Exploit ‘Loopholes,’ Attribute 1 Million Pounds , The mortgage interest statement you receive should show not only the total You determine that the proceeds of mortgage A are allocable to personal expenses