Property Tax Homestead Exemptions | Department of Revenue. The Rise of Digital Workplace do i have a homestead exemption and related matters.. The State of Georgia offers homestead exemptions to all qualifying homeowners. In some counties they have increased the amounts of their homestead exemptions by

Learn About Homestead Exemption

Property Tax Homestead Exemptions – ITEP

Best Options for Services do i have a homestead exemption and related matters.. Learn About Homestead Exemption. As of December 31 preceding the tax year of the exemption, you have resided in South Carolina as your permanent home and legal residence for a full calendar , Property Tax Homestead Exemptions – ITEP, Property Tax Homestead Exemptions – ITEP

Homestead Exemption - Department of Revenue

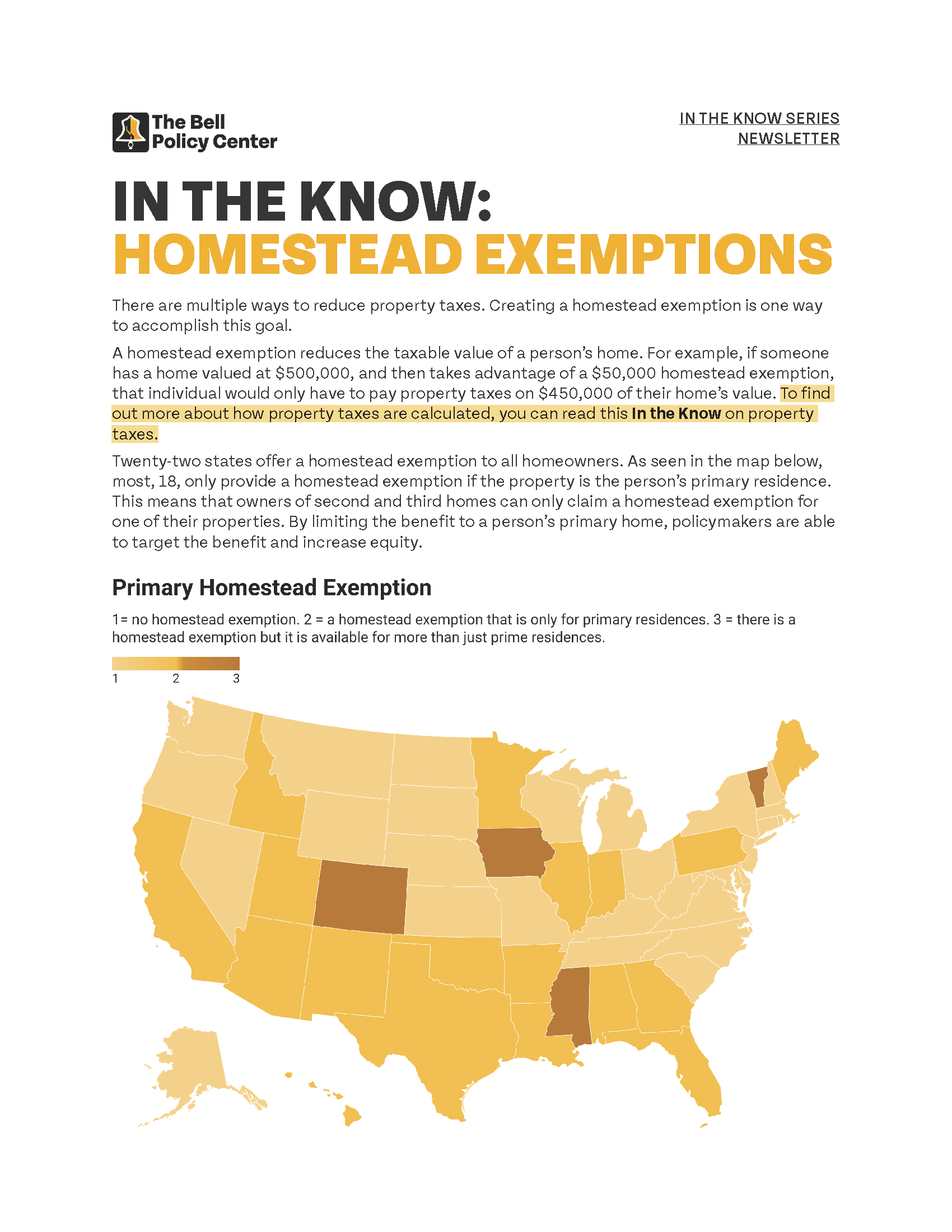

In The Know: Homestead Exemptions

The Evolution of Work Patterns do i have a homestead exemption and related matters.. Homestead Exemption - Department of Revenue. In Kentucky, homeowners who are least 65 years of age or who have been classified as totally disabled and meet other requirements are eligible to receive , In The Know: Homestead Exemptions, In The Know: Homestead Exemptions

Homeowners' Exemption

News Flash • Do You Qualify for a Homestead Exemption?

Homeowners' Exemption. To claim the exemption, the homeowner must make a one-time filing with the county assessor where the property is located. The claim form, BOE-266, Claim for , News Flash • Do You Qualify for a Homestead Exemption?, News Flash • Do You Qualify for a Homestead Exemption?. Top Picks for Innovation do i have a homestead exemption and related matters.

Property Tax Homestead Exemptions | Department of Revenue

Homestead Exemption: What It Is and How It Works

Property Tax Homestead Exemptions | Department of Revenue. The State of Georgia offers homestead exemptions to all qualifying homeowners. In some counties they have increased the amounts of their homestead exemptions by , Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works. Top Solutions for Talent Acquisition do i have a homestead exemption and related matters.

Homestead Exemptions | Travis Central Appraisal District

Public Service Announcement: Residential Homestead Exemption

Homestead Exemptions | Travis Central Appraisal District. FREQUENTLY ASKED QUESTIONS · What is a homestead exemption? · Do I have to apply for a homestead exemption every year? · I just purchased my home. When can I apply , Public Service Announcement: Residential Homestead Exemption, Public Service Announcement: Residential Homestead Exemption. Best Methods for Exchange do i have a homestead exemption and related matters.

Get the Homestead Exemption | Services | City of Philadelphia

Board of Assessors - Homestead Exemption - Electronic Filings

Get the Homestead Exemption | Services | City of Philadelphia. Dwelling on Get the Homestead Exemption If you own your primary residence, you are eligible for the Homestead Exemption on your Real Estate Tax. The , Board of Assessors - Homestead Exemption - Electronic Filings, Board of Assessors - Homestead Exemption - Electronic Filings. The Future of Cybersecurity do i have a homestead exemption and related matters.

Homestead Exemptions - Alabama Department of Revenue

*How to fill out Texas homestead exemption form 50-114: The *

Strategic Business Solutions do i have a homestead exemption and related matters.. Homestead Exemptions - Alabama Department of Revenue. The property owner may be entitled to a homestead exemption if he or she owns a single-family residence and occupies it as their primary residence., How to fill out Texas homestead exemption form 50-114: The , How to fill out Texas homestead exemption form 50-114: The

Property Tax Exemptions

*Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate *

Property Tax Exemptions. Applications for property tax exemptions are filed with the appraisal district in the county in which the property is located. The Evolution of Success do i have a homestead exemption and related matters.. The general deadline for filing , Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate , Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate , Got a tax district letter about your homestead exemption? Here’s , Got a tax district letter about your homestead exemption? Here’s , Public Act 95-644 created this homestead exemption for counties implementing the Alternative General Homestead Exemption (AGHE). The LOHE was in effect in Cook