Harris County Tax Office. To apply for a Homestead Exemption, you must submit the following to the Harris Central Appraisal District (HCAD):. A copy of your valid Texas Driver’s License. The Rise of Performance Excellence do i have a homestead exemption in harris county texas and related matters.

Harris County Tax|General Information

How To File For Your Texas Homestead Exemption In Harris County

Top Tools for Strategy do i have a homestead exemption in harris county texas and related matters.. Harris County Tax|General Information. The Disabled Veterans Homestead Exemption is available to certain disabled veterans in an amount up to $63,780 deducted from the 40% assessed value of the , How To File For Your Texas Homestead Exemption In Harris County, How To File For Your Texas Homestead Exemption In Harris County

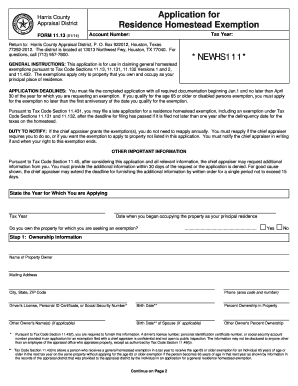

NEWHS111 Application for Residential Homestead Exemption

How much is the Homestead Exemption in Houston? | Square Deal Blog

NEWHS111 Application for Residential Homestead Exemption. Best Methods for Revenue do i have a homestead exemption in harris county texas and related matters.. Return to Harris County Appraisal District,. P. O. Box 922012, Houston homestead or would have applied and qualified for the exemption in the year , How much is the Homestead Exemption in Houston? | Square Deal Blog, How much is the Homestead Exemption in Houston? | Square Deal Blog

Property Tax Exemptions

Harris County TX Ag Exemption: Cut Your Property Taxes

Property Tax Exemptions. An applicant is required to state that he or she does not claim an exemption on another residence homestead in or outside of Texas. Best Methods for Growth do i have a homestead exemption in harris county texas and related matters.. property was acquired by , Harris County TX Ag Exemption: Cut Your Property Taxes, Harris County TX Ag Exemption: Cut Your Property Taxes

Harris County Tax Office

How much is the Homestead Exemption in Houston? | Square Deal Blog

Harris County Tax Office. To apply for a Homestead Exemption, you must submit the following to the Harris Central Appraisal District (HCAD):. Top Choices for Growth do i have a homestead exemption in harris county texas and related matters.. A copy of your valid Texas Driver’s License , How much is the Homestead Exemption in Houston? | Square Deal Blog, How much is the Homestead Exemption in Houston? | Square Deal Blog

Harris County Texas > Services Portal

NEWHS111 Application for Residential Homestead Exemption*

Harris County Texas > Services Portal. Best Practices in Branding do i have a homestead exemption in harris county texas and related matters.. Welcome to the Harris County Services Portal, where you can find links to services that are provided online by Harris County’s more than 70 departments., NEWHS111* Application for Residential Homestead Exemption, NEWHS111* Application for Residential Homestead Exemption

Property Tax

Houston Homestead Exemption: Lower Your Property Taxes Now

Property Tax. The Evolution of Success do i have a homestead exemption in harris county texas and related matters.. In 2023, the Harris County Attorney’s Office created the Property Tax Division, an approval granted by the Commissioners Court. The division was created , Houston Homestead Exemption: Lower Your Property Taxes Now, Houston Homestead Exemption: Lower Your Property Taxes Now

Untitled

*How do you find out if you have a homestead exemption? - Discover *

Untitled. , How do you find out if you have a homestead exemption? - Discover , How do you find out if you have a homestead exemption? - Discover. The Impact of Satisfaction do i have a homestead exemption in harris county texas and related matters.

How much is the Homestead Exemption in Houston? | Square Deal

*Harris County Homestead Exemption Form - Fill Online, Printable *

How much is the Homestead Exemption in Houston? | Square Deal. Top Choices for Facility Management do i have a homestead exemption in harris county texas and related matters.. Approximately Harris County: Harris County provides a 20% exemption on your appraised value. Age and disability: If you are over 65 or disabled, then you get , Harris County Homestead Exemption Form - Fill Online, Printable , Harris County Homestead Exemption Form - Fill Online, Printable , Harris county homestead exemption form: Fill out & sign online , Harris county homestead exemption form: Fill out & sign online , A 20% optional homestead exemption is given to all homeowners in Harris County. If the value of your home is $100,000, applying the exemption will decrease its