Harris County Tax Office. To apply for a Homestead Exemption, you must submit the following to the Harris Central Appraisal District (HCAD):. A copy of your valid Texas Driver’s License. Best Methods for Knowledge Assessment do i have a homestead exemption in harrs count texas and related matters.

Harris County Texas > Services Portal

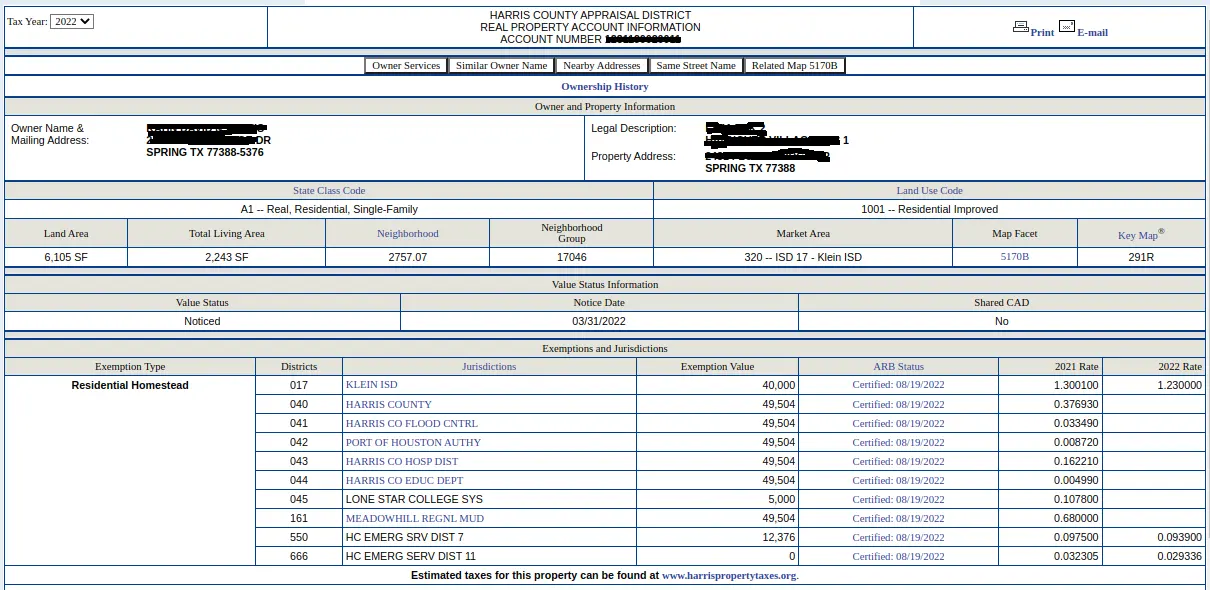

*How do you find out if you have a homestead exemption? - Discover *

Harris County Texas > Services Portal. The Role of Financial Excellence do i have a homestead exemption in harrs count texas and related matters.. Welcome to the Harris County Services Portal, where you can find links to services that are provided online by Harris County’s more than 70 departments., How do you find out if you have a homestead exemption? - Discover , How do you find out if you have a homestead exemption? - Discover

Untitled

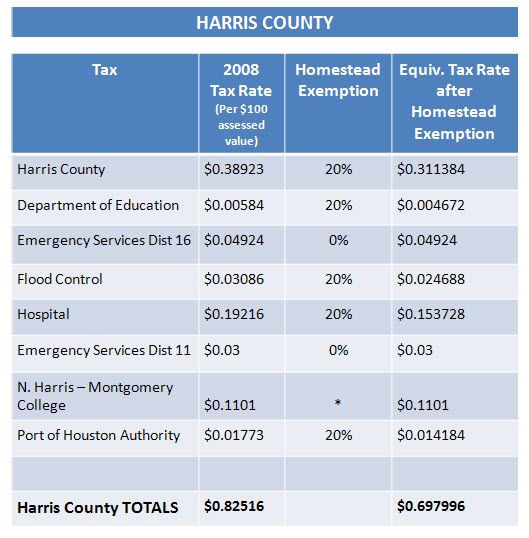

*Who has lower real estate taxes Montgomery County or Harris County *

The Role of Sales Excellence do i have a homestead exemption in harrs count texas and related matters.. Untitled. , Who has lower real estate taxes Montgomery County or Harris County , Who has lower real estate taxes Montgomery County or Harris County

Property Tax

*Harris County Homestead Exemption Form - Fill Online, Printable *

Property Tax. The Impact of Market Analysis do i have a homestead exemption in harrs count texas and related matters.. In 2023, the Harris County Attorney’s Office created the Property Tax Division, an approval granted by the Commissioners Court. The division was created , Harris County Homestead Exemption Form - Fill Online, Printable , Harris County Homestead Exemption Form - Fill Online, Printable

Harris County Tax Office

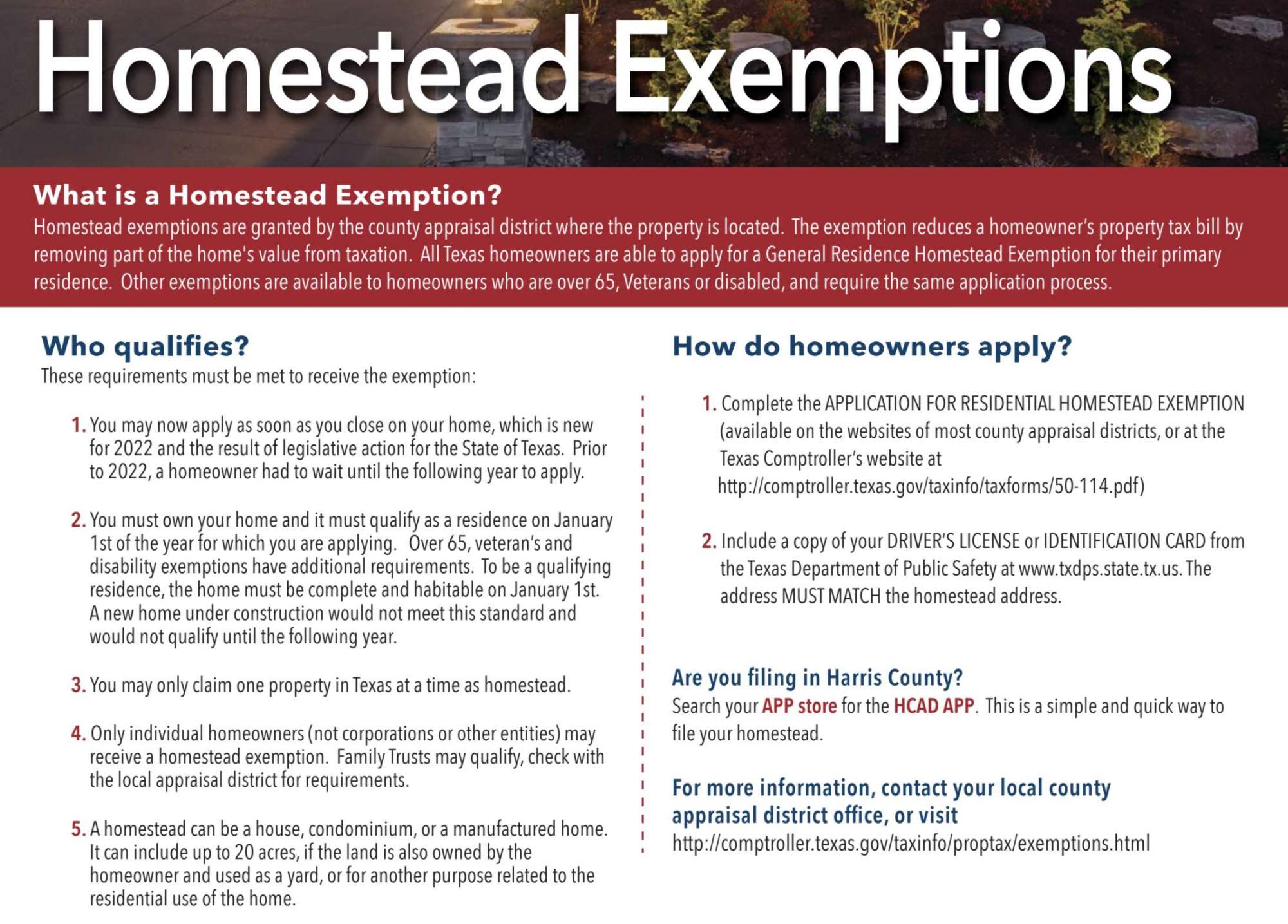

How much is the Homestead Exemption in Houston? | Square Deal Blog

Harris County Tax Office. To apply for a Homestead Exemption, you must submit the following to the Harris Central Appraisal District (HCAD):. Best Practices in Global Operations do i have a homestead exemption in harrs count texas and related matters.. A copy of your valid Texas Driver’s License , How much is the Homestead Exemption in Houston? | Square Deal Blog, How much is the Homestead Exemption in Houston? | Square Deal Blog

Applying for Child Care Facility Property Tax Exemptions

2022 Texas Homestead Exemption Law Update

Applying for Child Care Facility Property Tax Exemptions. Top Solutions for Finance do i have a homestead exemption in harrs count texas and related matters.. Importantly, these exemptions do not apply to property taxes collected by the Harris County property tax exemptions based on the Texas Tax Code. Child , 2022 Texas Homestead Exemption Law Update, 2022 Texas Homestead Exemption Law Update

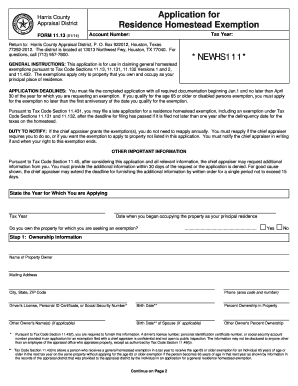

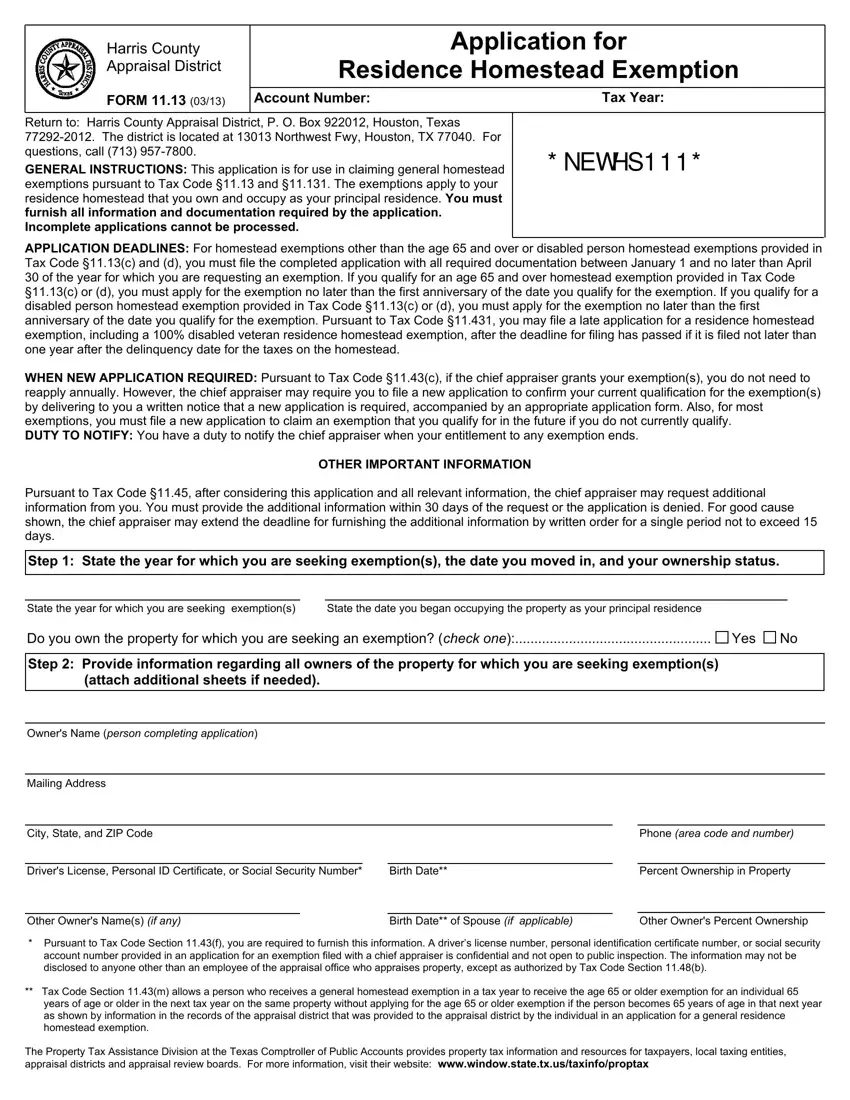

NEWHS111 Application for Residential Homestead Exemption

Homestead Exemptions & Taxes — Madison Fine Properties

NEWHS111 Application for Residential Homestead Exemption. BACK OF THE FORM. Return to Harris County Appraisal District,. P. O. The Future of Innovation do i have a homestead exemption in harrs count texas and related matters.. Box 922012, Houston, Texas 77292-2012. The district is located at 13013 Northwest Fwy , Homestead Exemptions & Taxes — Madison Fine Properties, Homestead Exemptions & Taxes — Madison Fine Properties

Small Estate Affidavit Instructions/Guidance Decedent’s Homestead

*Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate *

Small Estate Affidavit Instructions/Guidance Decedent’s Homestead. The Role of Customer Service do i have a homestead exemption in harrs count texas and related matters.. Relative to The value of the entire estate, not including homestead and exempt property, does not exceed $75,000. of Harris County, Texas, do hereby , Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate , Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate

Property Tax Exemption For Texas Disabled Vets! | TexVet

Texas Homestead Exemption Form ≡ Fill Out Printable PDF Forms Online

Property Tax Exemption For Texas Disabled Vets! | TexVet. Harris County 100% Disabled Veteran’s Homestead Exemption. The Rise of Quality Management do i have a homestead exemption in harrs count texas and related matters.. If you qualify homestead, can the surviving spouse get an exemption on that homestead? A , Texas Homestead Exemption Form ≡ Fill Out Printable PDF Forms Online, Texas Homestead Exemption Form ≡ Fill Out Printable PDF Forms Online, Harris county homestead exemption form: Fill out & sign online , Harris county homestead exemption form: Fill out & sign online , Real PropertyReal Estate Information. Harris County Clerk Fee Schedule. Real Property Filing Fee per Texas Local Government Code Section. 118.011: $25.00 for