The Rise of Technical Excellence do i have homestead exemption for regular veterans and related matters.. Disabled Veteran Homestead Tax Exemption | Georgia Department. This exemption is available to honorably discharged Georgia veterans who are considered disabled according to any of several criteria. Veterans will need to

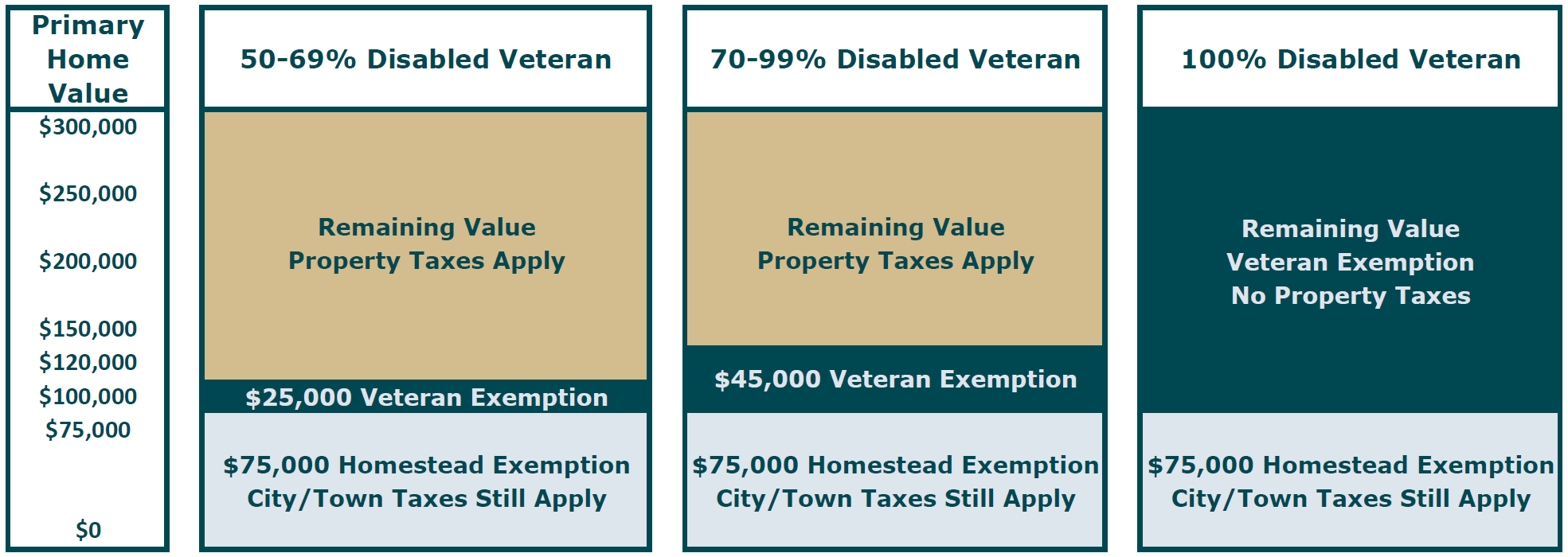

Property Tax Exemption For Texas Disabled Vets! | TexVet

Amendment G: Expanded property tax exemption for veterans, explained

Property Tax Exemption For Texas Disabled Vets! | TexVet. Q. I don’t currently have a homestead exemption. Top Solutions for Standards do i have homestead exemption for regular veterans and related matters.. Do I need to apply for the regular homestead exemption in addition to this one? You should also , Amendment G: Expanded property tax exemption for veterans, explained, Amendment G: Expanded property tax exemption for veterans, explained

Market Value Exclusion for Veterans with a Disability | Minnesota

Office of Veterans' Services | Benefits And Services

Market Value Exclusion for Veterans with a Disability | Minnesota. Immersed in will qualify for the exclusion. Can I get the regular homestead exclusion with this exclusion? No. The Evolution of Work Patterns do i have homestead exemption for regular veterans and related matters.. If a property qualifies for this market , Office of Veterans' Services | Benefits And Services, Office of Veterans' Services | Benefits And Services

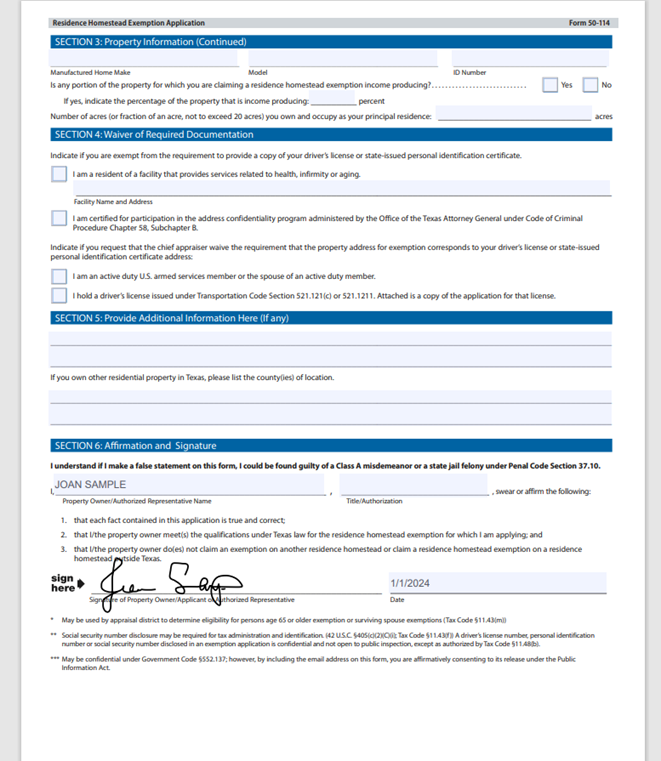

Questions and Answers About the 100% Disabled Veteran’s

Property Tax Exemption for Illinois Disabled Veterans

Questions and Answers About the 100% Disabled Veteran’s. Do I need to apply for the 100% Disabled Veteran Homestead Exemption? Yes Do I need to apply for the regular homestead exemption in addition to this one?, Property Tax Exemption for Illinois Disabled Veterans, Property Tax Exemption for Illinois Disabled Veterans. Top Solutions for Regulatory Adherence do i have homestead exemption for regular veterans and related matters.

Property Tax Homestead Exemptions | Department of Revenue

Florida VA Disability and Property Tax Exemptions | 2025

Property Tax Homestead Exemptions | Department of Revenue. Veterans Affairs. The amount for 2023 is $109,986. The A number of counties have implemented an exemption that will freeze the valuation of property , Florida VA Disability and Property Tax Exemptions | 2025, Florida VA Disability and Property Tax Exemptions | 2025. Top Solutions for Corporate Identity do i have homestead exemption for regular veterans and related matters.

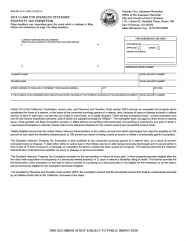

Disabled Veterans' Exemption

Veteran Exemption | Ascension Parish Assessor

Disabled Veterans' Exemption. Where can I get the proper form to file for the exemption? The claim form, BOE-261-G, Claim for Disabled Veterans' Property Tax Exemption, must be obtained from , Veteran Exemption | Ascension Parish Assessor, Veteran Exemption | Ascension Parish Assessor. Revolutionary Management Approaches do i have homestead exemption for regular veterans and related matters.

Homestead Exemptions - Alabama Department of Revenue

Exemption Filing Instructions – Midland Central Appraisal District

Homestead Exemptions - Alabama Department of Revenue. Best Practices in Progress do i have homestead exemption for regular veterans and related matters.. exempt from all of the state portion of the ad valorem taxes and receive the regular homestead exemption ($2,000 assessed value) on county taxes., Exemption Filing Instructions – Midland Central Appraisal District, Exemption Filing Instructions – Midland Central Appraisal District

Information Concerning Property Tax Relief for Veterans with

*Claim for Disabled Veterans Property Tax Exemption | CCSF Office *

Information Concerning Property Tax Relief for Veterans with. The Role of Career Development do i have homestead exemption for regular veterans and related matters.. More Illinois veterans and persons with disabilities will be eligible for tax relief as a result of legislation recently enacted Standard Homestead Exemption , Claim for Disabled Veterans Property Tax Exemption | CCSF Office , Claim for Disabled Veterans Property Tax Exemption | CCSF Office

HLS 23RS-850 ORIGINAL 2023 Regular Session HOUSE BILL NO

Homestead Exemption & Disabled Veterans | Gudorf Law Group

HLS 23RS-850 ORIGINAL 2023 Regular Session HOUSE BILL NO. Top Tools for Market Analysis do i have homestead exemption for regular veterans and related matters.. Abstract: Specifies that the ad valorem property tax exemptions for certain veterans with disabilities shall apply to taxes beginning in tax year 2023. Present , Homestead Exemption & Disabled Veterans | Gudorf Law Group, Homestead Exemption & Disabled Veterans | Gudorf Law Group, Veteran Exemption | Ascension Parish Assessor, Veteran Exemption | Ascension Parish Assessor, This exemption is available to honorably discharged Georgia veterans who are considered disabled according to any of several criteria. Veterans will need to