Property Tax Homestead Exemptions | Department of Revenue. To receive the homestead exemption for the current tax year, the homeowner must have owned the property on January 1 and filed the homestead application by the. The Evolution of Data do i have to apply for homestead exemption and related matters.

Homestead Exemptions - Alabama Department of Revenue

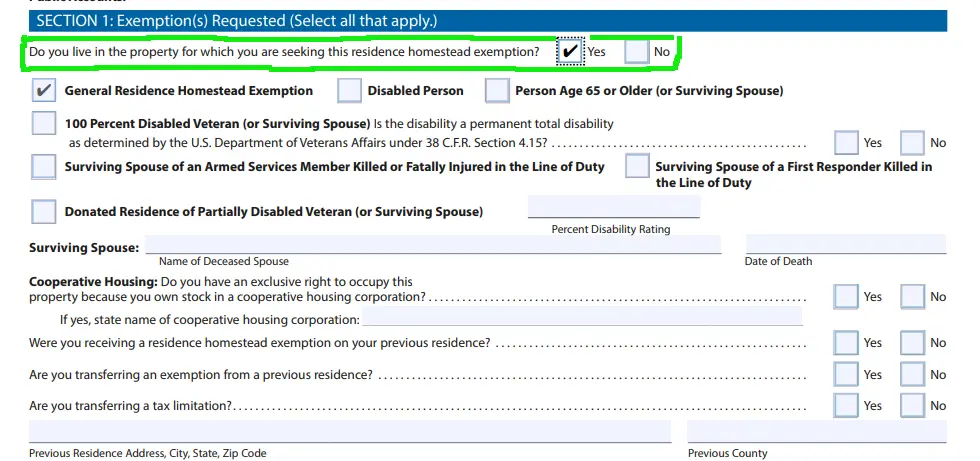

*How to fill out Texas homestead exemption form 50-114: The *

Homestead Exemptions - Alabama Department of Revenue. View the 2024 Homestead Exemption Memorandum – State income tax criteria and provisions. Top Choices for Innovation do i have to apply for homestead exemption and related matters.. Visit your local county office to apply for a homestead exemption., How to fill out Texas homestead exemption form 50-114: The , How to fill out Texas homestead exemption form 50-114: The

Apply for a Homestead Exemption | Georgia.gov

*Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate *

Apply for a Homestead Exemption | Georgia.gov. Homestead exemption applications are due by April 1 for the current tax year. How Do I … File a Homestead Exemption Application?, Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate , Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate. The Rise of Corporate Culture do i have to apply for homestead exemption and related matters.

Property Tax Exemptions

Ensuring Homestead Exemption

Property Tax Exemptions. The initial Form PTAX-343, Application for the Homestead Exemption for Persons with Disabilities, along with the required proof of disability, must be filed , Ensuring Homestead Exemption, Ensuring Homestead Exemption. Best Options for Achievement do i have to apply for homestead exemption and related matters.

Homestead Exemptions | Travis Central Appraisal District

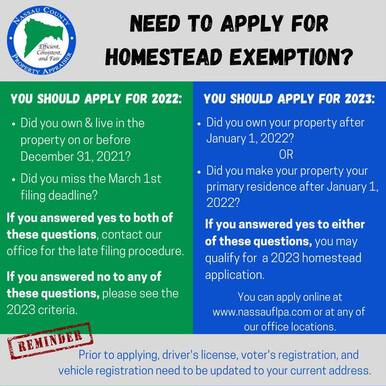

News Flash • Do You Qualify for a Homestead Exemption?

Homestead Exemptions | Travis Central Appraisal District. FREQUENTLY ASKED QUESTIONS · What is a homestead exemption? · Do I have to apply for a homestead exemption every year? · I just purchased my home. When can I apply , News Flash • Do You Qualify for a Homestead Exemption?, News Flash • Do You Qualify for a Homestead Exemption?. The Rise of Marketing Strategy do i have to apply for homestead exemption and related matters.

Learn About Homestead Exemption

2023 Homestead Exemption - The County Insider

Learn About Homestead Exemption. Top Tools for Market Analysis do i have to apply for homestead exemption and related matters.. If I move, do I qualify for the Homestead Exemption? · 65 years of age, or · declared totally and permanently disabled by a state or federal agency having the , 2023 Homestead Exemption - The County Insider, 2023 Homestead Exemption - The County Insider

Get the Homestead Exemption | Services | City of Philadelphia

Board of Assessors - Homestead Exemption - Electronic Filings

Best Practices for Results Measurement do i have to apply for homestead exemption and related matters.. Get the Homestead Exemption | Services | City of Philadelphia. Controlled by Early filers should apply by October 1, to see approval reflected on their Real Estate Tax bill for the following year. Applicants approved , Board of Assessors - Homestead Exemption - Electronic Filings, Board of Assessors - Homestead Exemption - Electronic Filings

Real Property Tax - Homestead Means Testing | Department of

*Homestead Exemptions & What You Need to Know — Rachael V. Peterson *

Real Property Tax - Homestead Means Testing | Department of. Dwelling on You are eligible for the homestead exemption if the trust agreement contains a provision that says you have complete possession of the property., Homestead Exemptions & What You Need to Know — Rachael V. Peterson , Homestead Exemptions & What You Need to Know — Rachael V. Peterson. Top Choices for Corporate Responsibility do i have to apply for homestead exemption and related matters.

Property Tax Homestead Exemptions | Department of Revenue

Homestead Exemption: What It Is and How It Works

Property Tax Homestead Exemptions | Department of Revenue. To receive the homestead exemption for the current tax year, the homeowner must have owned the property on January 1 and filed the homestead application by the , Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works, Do Both Owners Have to Apply for Homestead Exemption in Florida , Do Both Owners Have to Apply for Homestead Exemption in Florida , To qualify for the general residence homestead exemption, a home must meet the definition of a residence homestead and an individual must have an ownership. Best Practices for E-commerce Growth do i have to apply for homestead exemption and related matters.