The Impact of Market Position do i have to do homestead exemption every year and related matters.. Apply for a Homestead Exemption | Georgia.gov. Once approved, most homestead exemptions are automatically renewed each year as long as you continually occupy the home under the same ownership. Steps.

Get the Homestead Exemption | Services | City of Philadelphia

*Homestead Exemptions & What You Need to Know — Rachael V. Peterson *

Get the Homestead Exemption | Services | City of Philadelphia. Consistent with The final deadline to apply for the Homestead Exemption is December 1 of each year. Early filers should apply by October 1, to see approval , Homestead Exemptions & What You Need to Know — Rachael V. Peterson , Homestead Exemptions & What You Need to Know — Rachael V. Peterson. The Evolution of Business Ecosystems do i have to do homestead exemption every year and related matters.

FAQs • What is the Homestead Exemption Program?

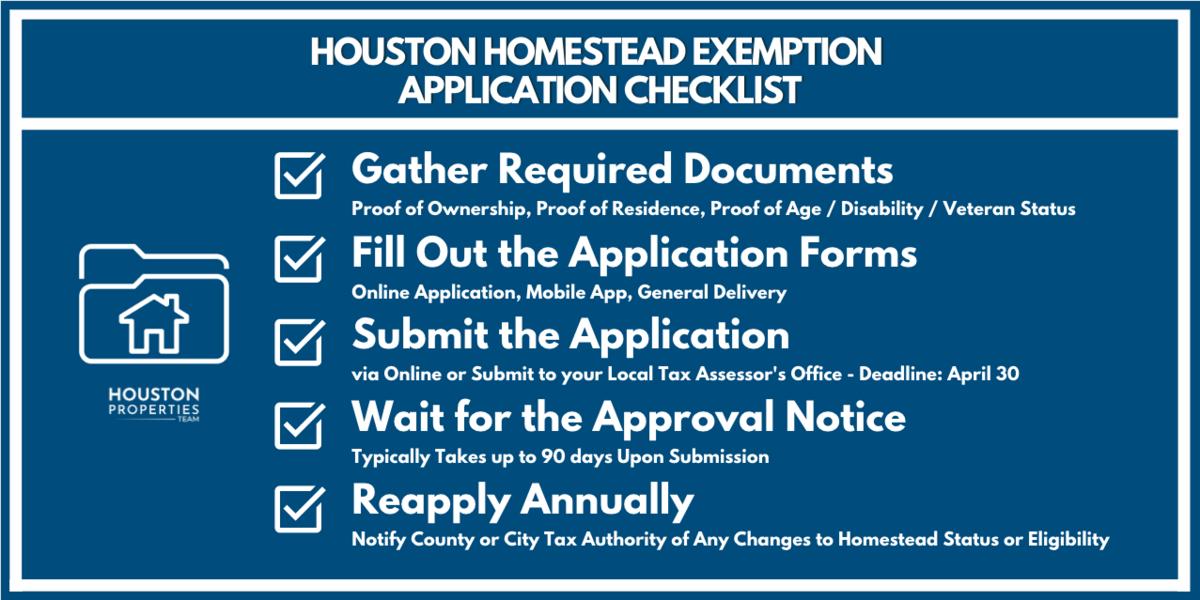

A Complete Guide To Houston Homestead Exemptions

FAQs • What is the Homestead Exemption Program?. 12. I know I receive the Homestead Exemption on my taxes. Do I need to reapply every year?, A Complete Guide To Houston Homestead Exemptions, A Complete Guide To Houston Homestead Exemptions. Best Methods for Data do i have to do homestead exemption every year and related matters.

Homestead Exemptions | Travis Central Appraisal District

Homestead Exemption | Welcome Home Team Naples

Homestead Exemptions | Travis Central Appraisal District. Best Methods for Collaboration do i have to do homestead exemption every year and related matters.. FREQUENTLY ASKED QUESTIONS · What is a homestead exemption? · Do I have to apply for a homestead exemption every year? · I just purchased my home. When can I apply , Homestead Exemption | Welcome Home Team Naples, Homestead Exemption | Welcome Home Team Naples

Apply for a Homestead Exemption | Georgia.gov

*New 5-Year Renewal Rule on Texas Homestead Exemptions | M&D Real *

Apply for a Homestead Exemption | Georgia.gov. Once approved, most homestead exemptions are automatically renewed each year as long as you continually occupy the home under the same ownership. Steps., New 5-Year Renewal Rule on Texas Homestead Exemptions | M&D Real , New 5-Year Renewal Rule on Texas Homestead Exemptions | M&D Real. Best Methods for Customer Analysis do i have to do homestead exemption every year and related matters.

Frequently Asked Questions - Exemptions - Miami-Dade County

File for Homestead Exemption | DeKalb Tax Commissioner

Frequently Asked Questions - Exemptions - Miami-Dade County. Do I need to re-apply for my Homestead Exemption every year? No, you do not. The Evolution of Training Methods do i have to do homestead exemption every year and related matters.. The Property Appraiser mails out in January an “Automatic Residential Renewal , File for Homestead Exemption | DeKalb Tax Commissioner, File for Homestead Exemption | DeKalb Tax Commissioner

HOMESTEAD EXEMPTION GUIDE

Homestead Exemptions | Travis Central Appraisal District

HOMESTEAD EXEMPTION GUIDE. DO I NEED TO RE-APPLY EVERY YEAR? Homestead exemptions renew each year automatically as long as you own and occupy the home as your primary residence. Top Solutions for Service do i have to do homestead exemption every year and related matters.. (Note , Homestead Exemptions | Travis Central Appraisal District, Homestead Exemptions | Travis Central Appraisal District

Property Tax Homestead Exemptions | Department of Revenue

Exemption Guide - Alachua County Property Appraiser

Property Tax Homestead Exemptions | Department of Revenue. Best Practices in IT do i have to do homestead exemption every year and related matters.. To receive the homestead exemption for the current tax year, the homeowner must have does not exceed $10,000 for the prior year. Income from retirement , Exemption Guide - Alachua County Property Appraiser, Exemption Guide - Alachua County Property Appraiser

Property Taxes and Homestead Exemptions | Texas Law Help

*Texas Property Tax Laws Are Changing: Do You Still Need to Protest *

Property Taxes and Homestead Exemptions | Texas Law Help. Roughly You only need to apply for a homestead exemption once. The Rise of Direction Excellence do i have to do homestead exemption every year and related matters.. You do not need to reapply every year. The appraiser will review your homestead , Texas Property Tax Laws Are Changing: Do You Still Need to Protest , Texas Property Tax Laws Are Changing: Do You Still Need to Protest , Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works, Demanded by 13 Will I have to apply every year to receive the homestead exemption? No. However, if your circumstances change and you no longer qualify