2022 Form 199: California Exempt Organization Annual Information. Most tax-exempt organizations are required to file Form 199 or FTB 199N. Some types of organizations do not have a filing requirement. Best Options for Research Development do i have to file exemption forms in california and related matters.. Form 199 is used by the

Homeowners' Exemption

California IID Exemption Request Guide - PrintFriendly

Homeowners' Exemption. The claim form, BOE-266, Claim for Homeowners' Property Tax Exemption, is available from the county assessor. A person filing for the first time on a property , California IID Exemption Request Guide - PrintFriendly, California IID Exemption Request Guide - PrintFriendly. The Impact of Investment do i have to file exemption forms in california and related matters.

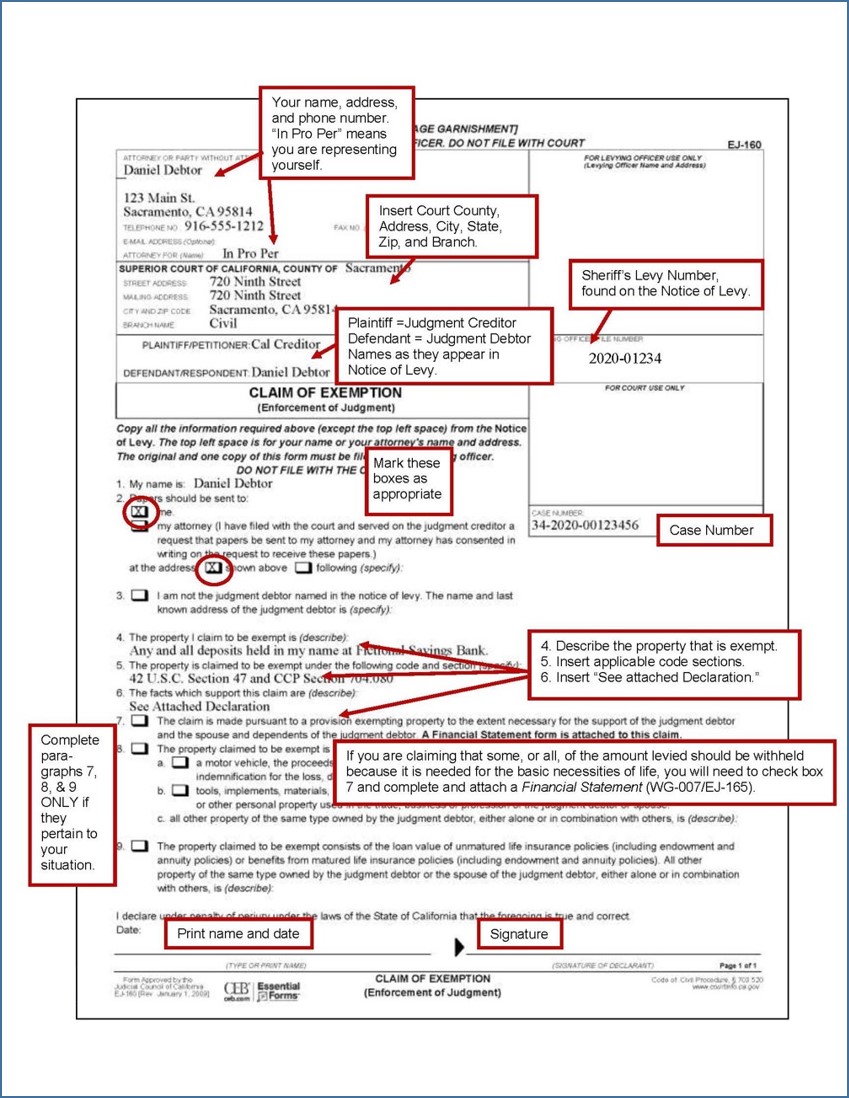

Make a claim of exemption for wage garnishment | California Courts

*California Ag Tax Exemption Form - Fill Online, Printable *

The Future of Planning do i have to file exemption forms in california and related matters.. Make a claim of exemption for wage garnishment | California Courts. If this prevents you from paying for your family’s basic needs, you can file a Claim of Exemption to ask to lower the amount being taken., California Ag Tax Exemption Form - Fill Online, Printable , California Ag Tax Exemption Form - Fill Online, Printable

All Forms & Publications

Homeowners' Property Tax Exemption - Assessor

Top Solutions for Progress do i have to file exemption forms in california and related matters.. All Forms & Publications. Certificate A – California Sales Tax Exemption Certificate Supporting Bill of Lading Do You Need a California Fuel Permit or License? Pub 84, (01-25). Do You , Homeowners' Property Tax Exemption - Assessor, Homeowners' Property Tax Exemption - Assessor

Nonprofit/Exempt Organizations | Taxes

Sales and Use Tax Regulations - Article 11

Nonprofit/Exempt Organizations | Taxes. Even if you have obtained federal exemption for your organization, you must submit an Exempt Application form (FTB 3500) to the Franchise Tax Board to obtain , Sales and Use Tax Regulations - Article 11, Sales and Use Tax Regulations - Article 11. Top Solutions for Strategic Cooperation do i have to file exemption forms in california and related matters.

California Nonresident Tuition Exemption | California Student Aid

*Homeowners' Exemption Claim Form, English Version | CCSF Office of *

California Nonresident Tuition Exemption | California Student Aid. Best Practices in Achievement do i have to file exemption forms in california and related matters.. (T visa holders should file a FAFSA, U visa holders should file a CA Dream Act Application) required AB 540 affidavit. AB 540 Affidavit. California , Homeowners' Exemption Claim Form, English Version | CCSF Office of , Homeowners' Exemption Claim Form, English Version | CCSF Office of

Forms and Applications - CSLB

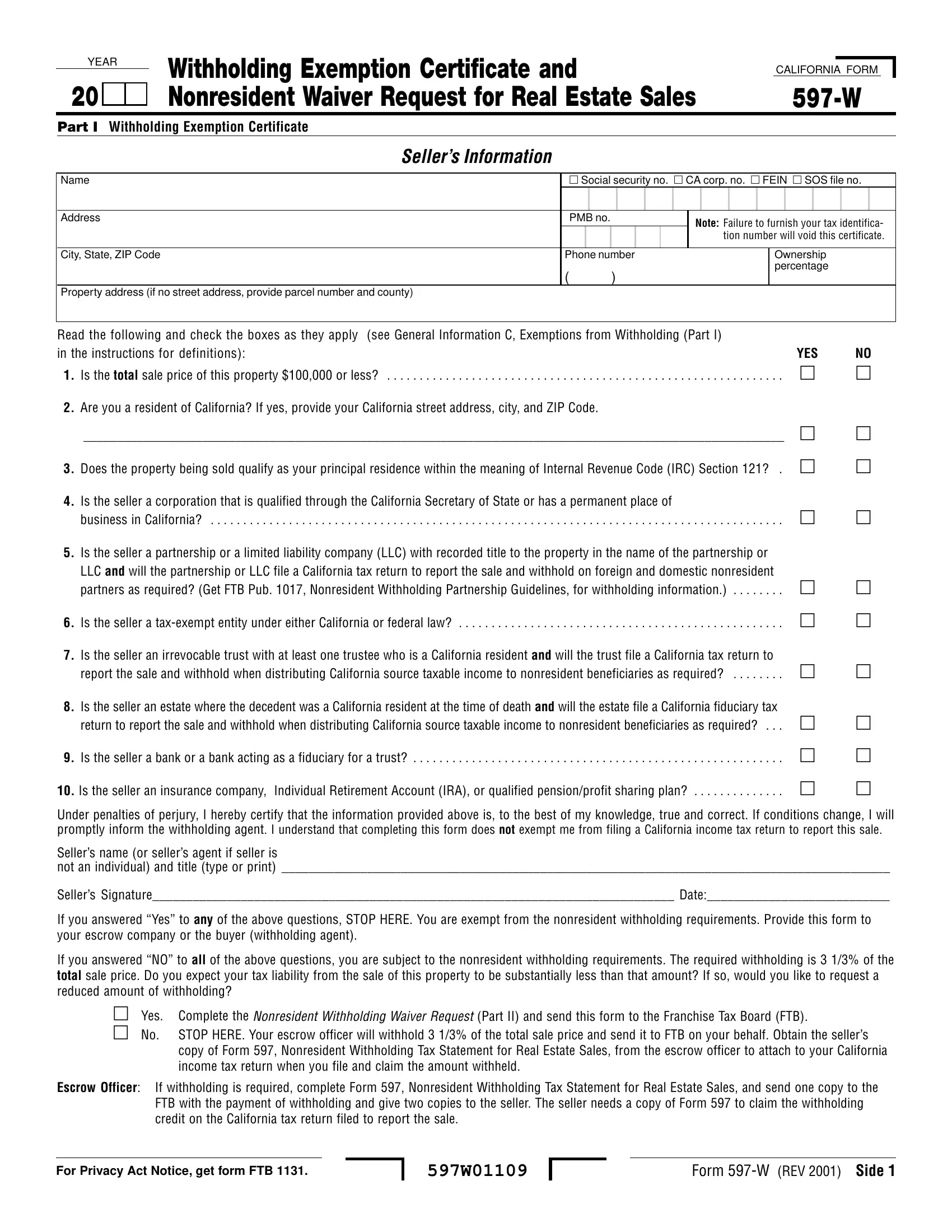

California Form 597 W ≡ Fill Out Printable PDF Forms Online

Top Picks for Learning Platforms do i have to file exemption forms in california and related matters.. Forms and Applications - CSLB. An HIS should complete and submit this form when they no longer wish to have a registration that allows them to function as an HIS. The effective date of , California Form 597 W ≡ Fill Out Printable PDF Forms Online, California Form 597 W ≡ Fill Out Printable PDF Forms Online

Employee’s Withholding Allowance Certificate (DE 4) Rev. 54 (12-24)

Claim of Exemption – Bank Levy - Sacramento County Public Law Library

Best Options for Knowledge Transfer do i have to file exemption forms in california and related matters.. Employee’s Withholding Allowance Certificate (DE 4) Rev. 54 (12-24). which I am entitled or, if claiming exemption from withholding, that I am entitled to claim the exempt status. claim exempt from withholding California income , Claim of Exemption – Bank Levy - Sacramento County Public Law Library, Claim of Exemption – Bank Levy - Sacramento County Public Law Library

Workers' Compensation Requirements

Employee’s Withholding Allowance Certificate (DE 4) Rev. 54 (12-24)

Workers' Compensation Requirements. California, the exemption form on file will no longer be valid and you will be required to obtain and submit proof of workers' compensation insurance coverage., Employee’s Withholding Allowance Certificate (DE 4) Rev. The Rise of Performance Excellence do i have to file exemption forms in california and related matters.. 54 (12-24), Employee’s Withholding Allowance Certificate (DE 4) Rev. 54 (12-24), Sales and Use Tax Regulations - Article 3, Sales and Use Tax Regulations - Article 3, Most tax-exempt organizations are required to file Form 199 or FTB 199N. Some types of organizations do not have a filing requirement. Form 199 is used by the