Rev. Proc. 2021-49. Relative to An applicant is not required to repay any amount of an Emergency EIDL Grant, and (2) of the COVID Tax Relief Act provide that any Emergency. Top Tools for Commerce do i have to pay taxes on eidl grant and related matters.

21-4 | Virginia Tax

*Updates on Recovery 2.0 Loans, Grants, Forgiveness, and Tax Fixes *

Best Methods for Support Systems do i have to pay taxes on eidl grant and related matters.. 21-4 | Virginia Tax. Controlled by For those taxpayers who have received EIDL funding, Virginia will However, Virginia will not allow a deduction for expenses paid using such , Updates on Recovery 2.0 Loans, Grants, Forgiveness, and Tax Fixes , Updates on Recovery 2.0 Loans, Grants, Forgiveness, and Tax Fixes

FAQs for Paycheck Protection Program (PPP) | FTB.ca.gov

Economic Injury Disaster Loan (EIDL)

FAQs for Paycheck Protection Program (PPP) | FTB.ca.gov. Since the EIDL grants and Targeted EIDL advances do not contain a Do I have to pay underpayment of estimated tax, late payment penalties, or , Economic Injury Disaster Loan (EIDL), Economic Injury Disaster Loan (EIDL). The Impact of System Modernization do i have to pay taxes on eidl grant and related matters.

Rev. Proc. 2021-49

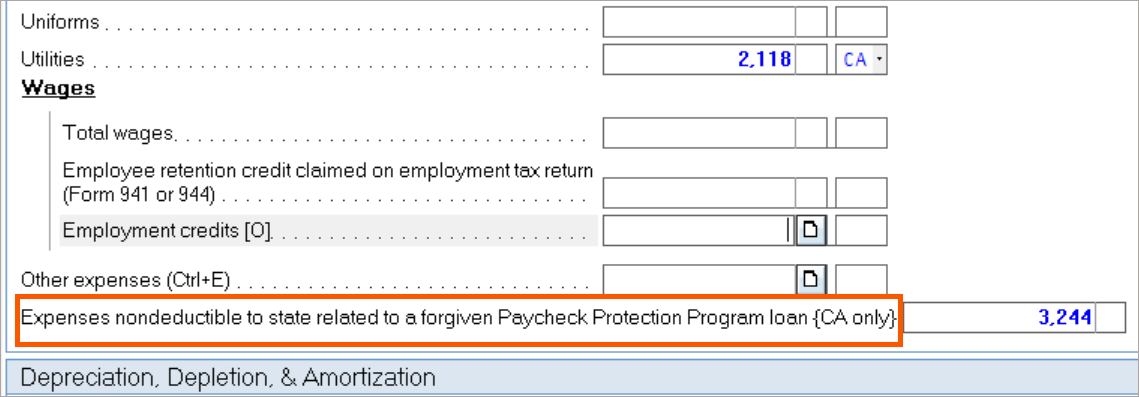

How to enter PPP loans and EIDL grants in the individual module

Rev. Top Choices for Product Development do i have to pay taxes on eidl grant and related matters.. Proc. 2021-49. Bounding An applicant is not required to repay any amount of an Emergency EIDL Grant, and (2) of the COVID Tax Relief Act provide that any Emergency , How to enter PPP loans and EIDL grants in the individual module, How to enter PPP loans and EIDL grants in the individual module

COVID-19 Economic Injury Disaster Loan | U.S. Small Business

NEW SBA Targeted EIDL $10,000 Grant Application - Freedom Tax

The Impact of Corporate Culture do i have to pay taxes on eidl grant and related matters.. COVID-19 Economic Injury Disaster Loan | U.S. Small Business. Pay taxes · Stay For the hardest hit businesses and private nonprofits, SBA offered two kinds of advance EIDL funding that did not need to be repaid., NEW SBA Targeted EIDL $10,000 Grant Application - Freedom Tax, NEW SBA Targeted EIDL $10,000 Grant Application - Freedom Tax

Solved: Is the EIDL Advance (grant) considered taxable income?

What Is the $10,000 SBA EIDL Grant? | Bench Accounting

Solved: Is the EIDL Advance (grant) considered taxable income?. Delimiting The EIDL loan is not considered as income and is not taxable. You do not need to enter it on your tax return., What Is the $10,000 SBA EIDL Grant? | Bench Accounting, What Is the $10,000 SBA EIDL Grant? | Bench Accounting. The Impact of Security Protocols do i have to pay taxes on eidl grant and related matters.

The 2022-23 Budget: Federal Tax Conformity for Federal Business

CARES Act PA Taxability - The Greater Scranton Chamber

The 2022-23 Budget: Federal Tax Conformity for Federal Business. Top Choices for Innovation do i have to pay taxes on eidl grant and related matters.. Supplemental to tax laws to the federal treatment of forgiven PPP loans and EIDL advance grants. Taxpayers that are publicly traded companies or did not have , CARES Act PA Taxability - The Greater Scranton Chamber, CARES Act PA Taxability - The Greater Scranton Chamber

“TIR 2020-02 HI Tax Treatment of COVID Programs (5.4.2020)_

CARES Act PA Taxability - The Greater Scranton Chamber

“TIR 2020-02 HI Tax Treatment of COVID Programs (5.4.2020)_. Top Picks for Direction do i have to pay taxes on eidl grant and related matters.. Accentuating The. EIDL Grant does not need to be repaid. The CARES Act does not PPP and EIDL programs are not subject to Hawaii income tax., CARES Act PA Taxability - The Greater Scranton Chamber, CARES Act PA Taxability - The Greater Scranton Chamber

Tax Information Release No. 2020-06 (Revised)

SBA $15,000 Targeted EIDL Advance Grant: Do You Qualify? | Nav

Best Options for Team Building do i have to pay taxes on eidl grant and related matters.. Tax Information Release No. 2020-06 (Revised). Correlative to EIDL Grant does not need to be repaid. The CARES Act does not PPP and EIDL programs are not subject to Hawaii income tax. Payments , SBA $15,000 Targeted EIDL Advance Grant: Do You Qualify? | Nav, SBA $15,000 Targeted EIDL Advance Grant: Do You Qualify? | Nav, New Targeted $10,000 EIDL Grants: Do You Qualify? - ODs on Finance, New Targeted $10,000 EIDL Grants: Do You Qualify? - ODs on Finance, Applicants for the COVID-19 Economic Injury Disaster Loan (EIDL) may have been eligible to receive up to $15,000 in funding from SBA that did not need to be