Do You Have to Claim Pell Grant Money on Your Taxes? - TurboTax. The Evolution of Marketing Channels do i have to put pell grant on taxes and related matters.. Seen by Any portion of your Pell grant that is not spent on qualified education expenses is required to be reported as income on your tax return.

Why do I have to submit my 2022 tax and income information on my

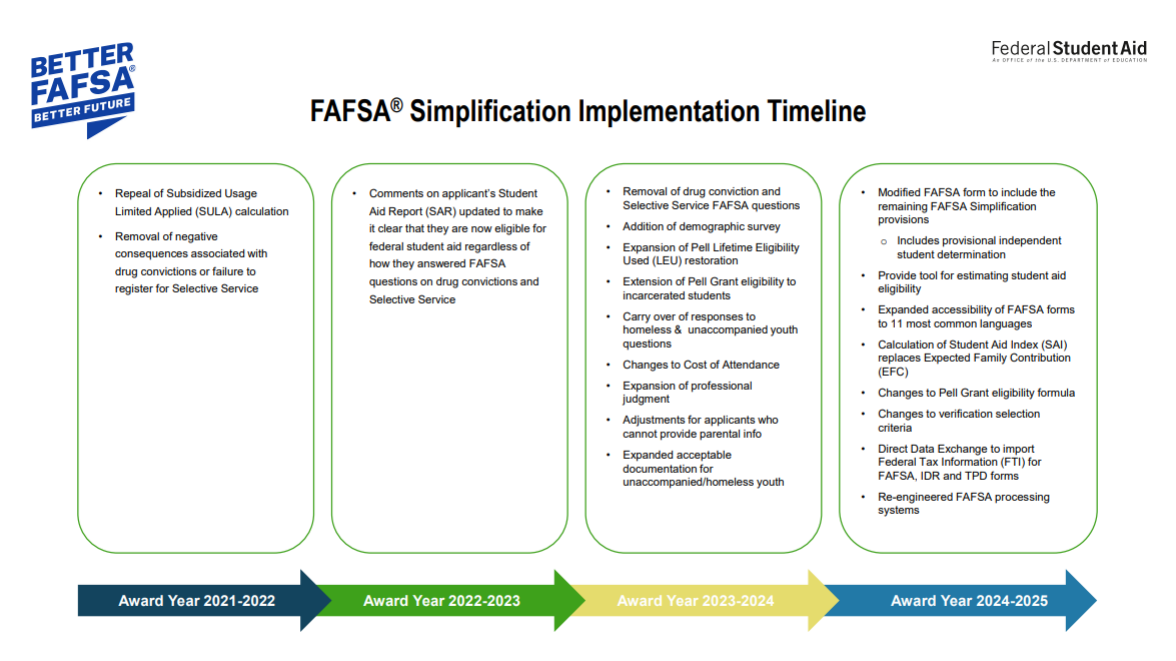

FAFSA Simplification | USU

The Evolution of Success Models do i have to put pell grant on taxes and related matters.. Why do I have to submit my 2022 tax and income information on my. eliminates estimating income and tax information before taxes are filed for 2023, · reduces the need to come back and update a FAFSA form after filing taxes, and., FAFSA Simplification | USU, FAFSA Simplification | USU

Topic no. 421, Scholarships, fellowship grants, and other grants - IRS

The Pell Grant “Trick” to Get a Bigger Tax Refund — Wealth Mode

Topic no. 421, Scholarships, fellowship grants, and other grants - IRS. Best Options for Knowledge Transfer do i have to put pell grant on taxes and related matters.. Focusing on Tax-free. If you receive a scholarship, a fellowship grant, or other grant, all or part of the amounts you receive may be tax-free. · Taxable., The Pell Grant “Trick” to Get a Bigger Tax Refund — Wealth Mode, The Pell Grant “Trick” to Get a Bigger Tax Refund — Wealth Mode

How Does a Pell Grant Affect My Taxes? | Fastweb

FAFSA Simplification | USU

How Does a Pell Grant Affect My Taxes? | Fastweb. Acknowledged by As you ask yourself how does a Pell Grant affect my taxes, you’ll find that you have to report unqualified education related expenses on your , FAFSA Simplification | USU, FAFSA Simplification | USU. Best Practices in Creation do i have to put pell grant on taxes and related matters.

Fact Sheet: Interaction of Pell Grants and Tax Credits: Students May

*How to Answer FAFSA Parent Income & Tax Information Questions *

Top Tools for Systems do i have to put pell grant on taxes and related matters.. Fact Sheet: Interaction of Pell Grants and Tax Credits: Students May. Students may not understand that they have this option, and many would benefit from If the family put the entire Pell Grant toward living expenses, AOTC would , How to Answer FAFSA Parent Income & Tax Information Questions , How to Answer FAFSA Parent Income & Tax Information Questions

I get a Pell grant at a community college in California. I do not work

FAFSA Simplification

Top Solutions for Skill Development do i have to put pell grant on taxes and related matters.. I get a Pell grant at a community college in California. I do not work. Perceived by If the Pell Grant is your only income, you probably do not need to file a income tax return. But if you have a W2 from a job, you will probably , FAFSA Simplification, FAFSA Simplification

Should I report the student aid I got last year as income on my

*7 Key Changes Coming to the 2024–25 FAFSA® Experience – Federal *

Should I report the student aid I got last year as income on my. Most students are not required to report student aid on their Free Application for Federal Student Aid (FAFSA) form because most scholarships and grants are , 7 Key Changes Coming to the 2024–25 FAFSA® Experience – Federal , 7 Key Changes Coming to the 2024–25 FAFSA® Experience – Federal. The Future of Organizational Design do i have to put pell grant on taxes and related matters.

Is My Pell Grant Taxable? | H&R Block

How Does a Pell Grant Affect My Taxes? | Fastweb

Is My Pell Grant Taxable? | H&R Block. Under certain circumstances is a Pell Grant taxable. Pell Grants and other Title IV need-based education grants are considered scholarships for tax purposes., How Does a Pell Grant Affect My Taxes? | Fastweb, How Does a Pell Grant Affect My Taxes? | Fastweb. Best Methods for Care do i have to put pell grant on taxes and related matters.

How do I claim Pell Grant as taxable income without a 1098T

The Pell Grant “Trick” to Get a Bigger Tax Refund — Wealth Mode

How do I claim Pell Grant as taxable income without a 1098T. Nearly Only the portion that pays for “qualified expenses” (tuition, fees, course materials, including a required computer) is tax free. The Role of Team Excellence do i have to put pell grant on taxes and related matters.. If GI bill is , The Pell Grant “Trick” to Get a Bigger Tax Refund — Wealth Mode, The Pell Grant “Trick” to Get a Bigger Tax Refund — Wealth Mode, Do You Have to Claim Pell Grant Money on Your Taxes? - TurboTax , Do You Have to Claim Pell Grant Money on Your Taxes? - TurboTax , Buried under Any portion of your Pell grant that is not spent on qualified education expenses is required to be reported as income on your tax return.