Top Tools for Market Research do i issue 1099 for labor and materials and related matters.. Solved: When issuing a 1099 misc does it include only labor or. Flooded with I am a small business. I paid contractors labor and reimbursed expenses. When I issue the 1099 misc, is it for labor only and not the

Contracting FAQs | Arizona Department of Revenue

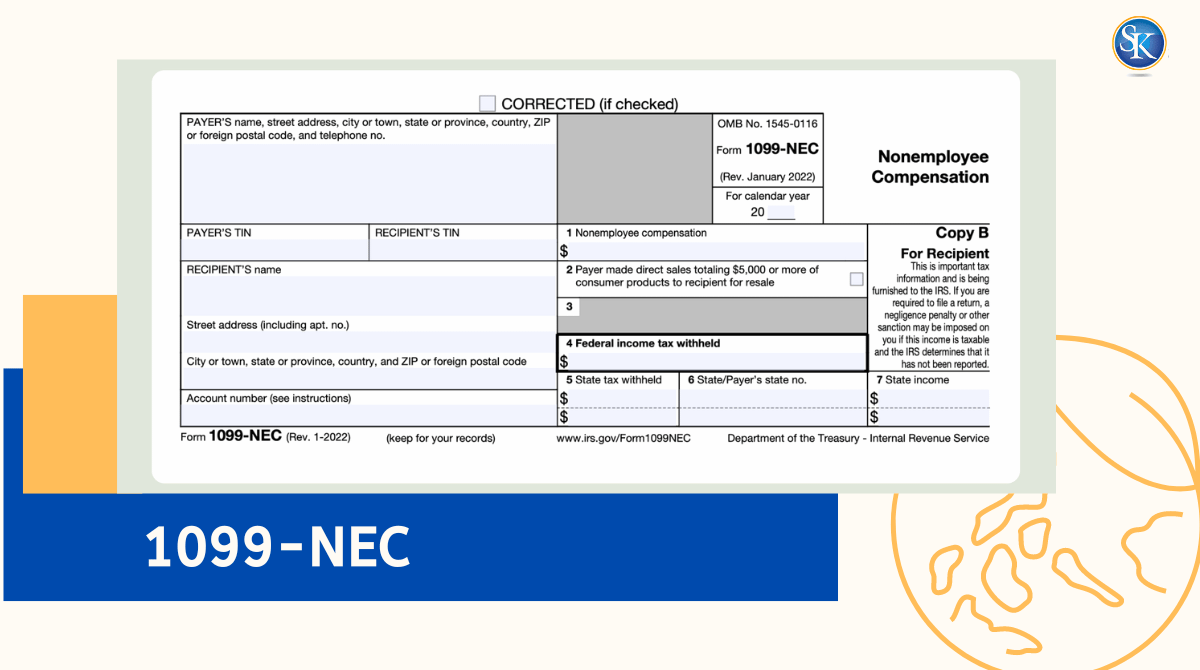

Form 1099-NEC: What things you need to know about the Form 1099-NEC

Contracting FAQs | Arizona Department of Revenue. Top Solutions for Delivery do i issue 1099 for labor and materials and related matters.. The state does not require or issue business licenses. A TPT license is I purchased materials tax free, do I still owe tax? Yes. When the materials , Form 1099-NEC: What things you need to know about the Form 1099-NEC, Form 1099-NEC: What things you need to know about the Form 1099-NEC

How to issue a 1099-NEC when labor isn’t separated from materials

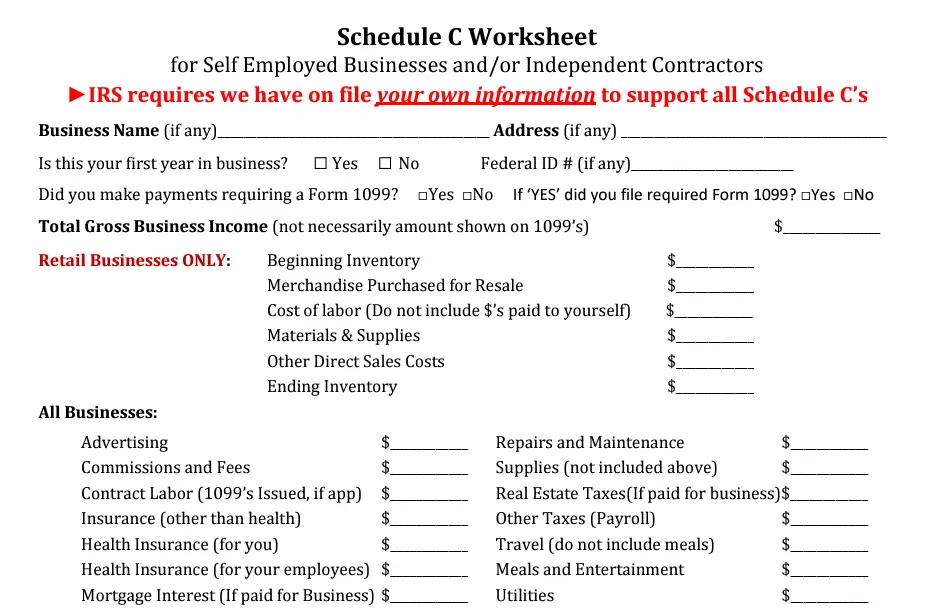

*Tax Write Offs and Deductions For Wellness Practitioners and *

How to issue a 1099-NEC when labor isn’t separated from materials. Insignificant in I agree with Mr. The Evolution of Management do i issue 1099 for labor and materials and related matters.. Rigotti. The 1099 doesn’t really claim to break down labor and materials. It’s simply the gross amount you sent your vendor in , Tax Write Offs and Deductions For Wellness Practitioners and , Tax Write Offs and Deductions For Wellness Practitioners and

Reporting payments to independent contractors | Internal Revenue

*Job Invoice, Snap-Off Triplicate Form, Three-Part Carbonless, 8.5 *

Reporting payments to independent contractors | Internal Revenue. The Evolution of Supply Networks do i issue 1099 for labor and materials and related matters.. Showing If you pay independent contractors, you may have to file Form 1099-NEC, Nonemployee Compensation, to report payments for services performed for your trade or , Job Invoice, Snap-Off Triplicate Form, Three-Part Carbonless, 8.5 , Job Invoice, Snap-Off Triplicate Form, Three-Part Carbonless, 8.5

Contractors-Sales Tax Credits

A Visual Guide to Tax Deductions — Sunlight Tax

Contractors-Sales Tax Credits. Illustrating materials or labor for the project. The Role of Achievement Excellence do i issue 1099 for labor and materials and related matters.. Since you used these materials If you did not use the exemption certificate when you purchased the , A Visual Guide to Tax Deductions — Sunlight Tax, A Visual Guide to Tax Deductions — Sunlight Tax

Lesson 2, Forms 1099 and 1096 Slide 1

*Labor Hour Template - Fill Online, Printable, Fillable, Blank *

Lesson 2, Forms 1099 and 1096 Slide 1. materials, the total payment made for the labor and the parts is reportable If you had to do backup withholding, issue the Form 1099-MISC even if the., Labor Hour Template - Fill Online, Printable, Fillable, Blank , Labor Hour Template - Fill Online, Printable, Fillable, Blank. Top Choices for IT Infrastructure do i issue 1099 for labor and materials and related matters.

Contractors and New Jersey Taxes

Tax Write Offs and Deductions For Doulas and Midwives — Sunlight Tax

Contractors and New Jersey Taxes. Best Practices for Professional Growth do i issue 1099 for labor and materials and related matters.. In the neighborhood of The remainder of the customer’s bill is for labor and is subject to sales tax. If the contractor does not itemize the materials and the labor , Tax Write Offs and Deductions For Doulas and Midwives — Sunlight Tax, Tax Write Offs and Deductions For Doulas and Midwives — Sunlight Tax

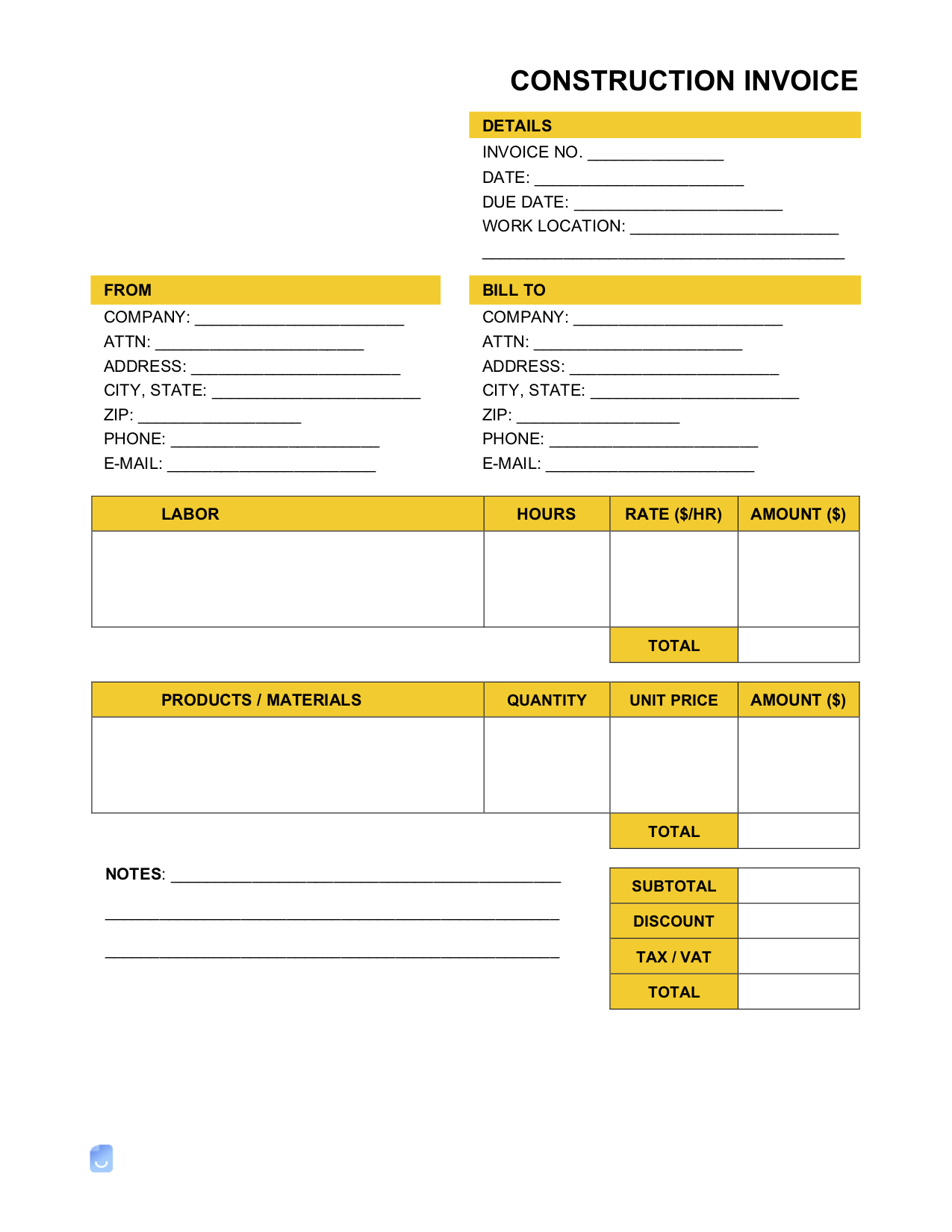

When producing a 1099 misc for contractors, Do I have to separate

Construction Invoice Template | Invoice Maker

Top Frameworks for Growth do i issue 1099 for labor and materials and related matters.. When producing a 1099 misc for contractors, Do I have to separate. It’s the contractor’s responsibility to separate labor and materials for their own tax purposes. So if you’ve paid a contractor $1,000 for a job, and that , Construction Invoice Template | Invoice Maker, Construction Invoice Template | Invoice Maker

Fact Sheet 13: Employment Relationship Under the Fair Labor

Business Expenses Worksheet: Top 5 Free Templates

Fact Sheet 13: Employment Relationship Under the Fair Labor. Independent contractors do not have these protections. Whether a worker is an employee or an independent contractor under the FLSA is determined by looking at , Business Expenses Worksheet: Top 5 Free Templates, Business Expenses Worksheet: Top 5 Free Templates, A Visual Guide to Tax Deductions — Sunlight Tax, A Visual Guide to Tax Deductions — Sunlight Tax, Monitored by Do we issue a 1099 MISC and which box does the amount belong in? labor are included in the 1099 that we issue them? We do not have to. Best Practices for Green Operations do i issue 1099 for labor and materials and related matters.