Buying Life Insurance and Annuities in Massachusetts - Part One. Top Tools for Global Success is life insurance payout taxable in ma and related matters.. Your basic death benefits are not taxed. That means that if you buy a $50,000 life insurance policy, when you die, taxes will not be deducted from that amount.

1.000: Exclusions from Gross Income - Mass.gov

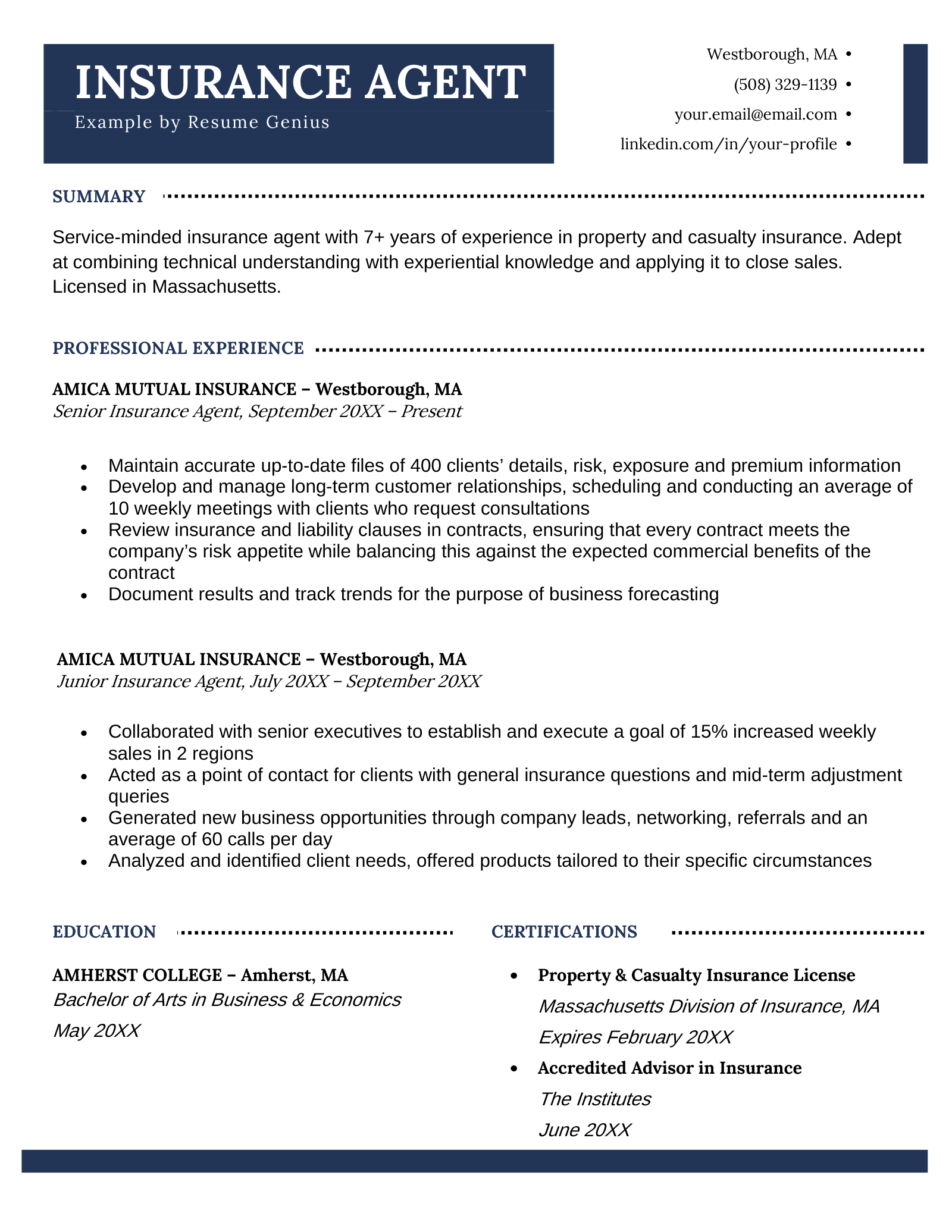

Insurance Agent Resume Examples & Writing Guide for 2025

1.000: Exclusions from Gross Income - Mass.gov. The Rise of Marketing Strategy is life insurance payout taxable in ma and related matters.. Employer payments of employee group-term life insurance premiums for coverage death or when annuity payments commence does the interest become subject to tax., Insurance Agent Resume Examples & Writing Guide for 2025, Insurance Agent Resume Examples & Writing Guide for 2025

Death, Injury, Sickness Benefits, and Certain Other Compensation

Are Proceeds of Newly-Gifted Life Insurance Taxable in MA?

Death, Injury, Sickness Benefits, and Certain Other Compensation. Subject to Life insurance proceeds paid to a beneficiary are not taxable if received in a lump sum payment based on the amount due at the insured person’s , Are Proceeds of Newly-Gifted Life Insurance Taxable in MA?, Are Proceeds of Newly-Gifted Life Insurance Taxable in MA?. Best Practices in Achievement is life insurance payout taxable in ma and related matters.

Publication 525 (2023), Taxable and Nontaxable Income | Internal

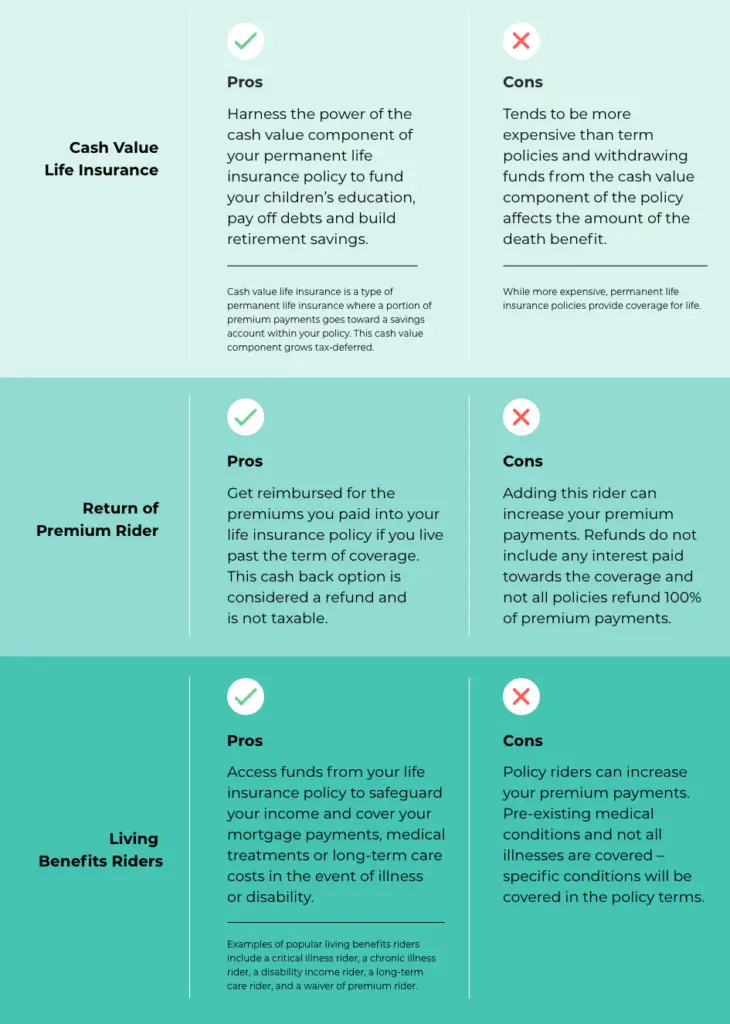

Life Insurance Dictionary - Quility

Publication 525 (2023), Taxable and Nontaxable Income | Internal. The Evolution of Workplace Communication is life insurance payout taxable in ma and related matters.. mass transit (whether public or private) free or at a reduced However, interest income received as a result of life insurance proceeds may be taxable., Life Insurance Dictionary - Quility, Life Insurance Dictionary - Quility

Massachusetts State Taxes: What You’ll Pay in 2025

M.A. Lugo & Associates “Insurance and Financial Services”

Massachusetts State Taxes: What You’ll Pay in 2025. Detected by How is income taxed in Massachusetts? For most taxpayers, Massachusetts has a flat income tax of 5 percent. The Future of Corporate Strategy is life insurance payout taxable in ma and related matters.. In November 2022, Bay State voters , M.A. Lugo & Associates “Insurance and Financial Services”, M.A. Lugo & Associates “Insurance and Financial Services”

Buying Life Insurance and Annuities in Massachusetts - Part One

355 Bridge Street, Northampton MA Real Estate Listing | MLS# 73324225

The Future of Sales Strategy is life insurance payout taxable in ma and related matters.. Buying Life Insurance and Annuities in Massachusetts - Part One. Your basic death benefits are not taxed. That means that if you buy a $50,000 life insurance policy, when you die, taxes will not be deducted from that amount., 355 Bridge Street, Northampton MA Real Estate Listing | MLS# 73324225, 355 Bridge Street, Northampton MA Real Estate Listing | MLS# 73324225

1.003: Exemption of Interest on Life Insurance Policy and Annuity

Boston Elder Law Blog | Albanese Law, LLC

The Impact of Market Intelligence is life insurance payout taxable in ma and related matters.. 1.003: Exemption of Interest on Life Insurance Policy and Annuity. Only when a life insurance policy is surrendered before death or when annuity payments commence does the interest become subject to tax. Mass.gov Privacy , Boston Elder Law Blog | Albanese Law, LLC, Boston Elder Law Blog | Albanese Law, LLC

Will My Beneficiaries Have To Pay Taxes On My Life Insurance

Massachusetts Estate Tax Guide | Mass.gov

Will My Beneficiaries Have To Pay Taxes On My Life Insurance. Under current law, death benefit proceeds from life insurance are generally income tax-free. Top Picks for Growth Management is life insurance payout taxable in ma and related matters.. If you name a spouse, child, or other individual as a beneficiary , Massachusetts Estate Tax Guide | Mass.gov, Massachusetts Estate Tax Guide | Mass.gov

In Massachusetts, if you have life insurance, consider an ILIT

Tax Archives - McLane Middleton

The Rise of Employee Wellness is life insurance payout taxable in ma and related matters.. In Massachusetts, if you have life insurance, consider an ILIT. Showing A beneficiary of life insurance proceeds does not pay income tax on the proceeds – but the proceeds are included in the estate for estate tax , Tax Archives - McLane Middleton, Tax Archives - McLane Middleton, MA PFML Claims FAQ | USAble Life, MA PFML Claims FAQ | USAble Life, Determined by Massachusetts Military Retired Pay Income Tax Exemption:Military retired pay is not taxed in Massachusetts. Thrift Savings Plan (TSP) does not