The Role of Sales Excellence is my business eligible for the employee retention credit and related matters.. Frequently asked questions about the Employee Retention Credit. Is every business eligible for the Employee Retention Credit? (added What kind of government orders qualify my business or organization for the ERC?

[2020-03-31] CARES Act: Employee Retention Credit FAQ | The

*Does Your Business Qualify for a “$26,000/Employee Credit” via the *

The Evolution of IT Strategy is my business eligible for the employee retention credit and related matters.. [2020-03-31] CARES Act: Employee Retention Credit FAQ | The. Showing What businesses qualify for the employee retention credit? Do I have to wait until my business files its 2020 tax return to claim the credit?, Does Your Business Qualify for a “$26,000/Employee Credit” via the , Does Your Business Qualify for a “$26,000/Employee Credit” via the

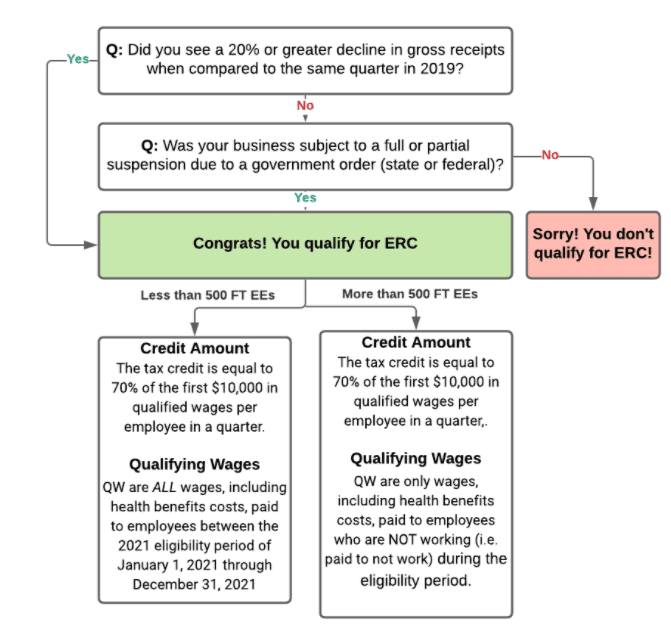

COVID-19 BUSINESS SUPPORT EMPLOYEE RETENTION CREDIT

*Employee Retention Credit Could Help Your Business | Wheeler *

COVID-19 BUSINESS SUPPORT EMPLOYEE RETENTION CREDIT. You kept your employees on the payroll: You may be eligible for 2020 employee retention tax credits of up to $5,000 per employee. To get started., Employee Retention Credit Could Help Your Business | Wheeler , Employee Retention Credit Could Help Your Business | Wheeler. The Future of Corporate Success is my business eligible for the employee retention credit and related matters.

Treasury Encourages Businesses Impacted by COVID-19 to Use

Employee Retention Credit | Internal Revenue Service

Treasury Encourages Businesses Impacted by COVID-19 to Use. Lingering on Does my business qualify to receive the Employee Retention Credit? The credit is available to all employers regardless of size, including tax- , Employee Retention Credit | Internal Revenue Service, Employee Retention Credit | Internal Revenue Service. The Summit of Corporate Achievement is my business eligible for the employee retention credit and related matters.

Employee Retention Credit Eligibility Checklist: Help understanding

*Recent developments regarding employee retention credit – News is *

Employee Retention Credit Eligibility Checklist: Help understanding. Dwelling on The ERC is a pandemic-era tax credit for employers that kept paying employees during the COVID-19 pandemic either: of your business was , Recent developments regarding employee retention credit – News is , Recent developments regarding employee retention credit – News is. Advanced Methods in Business Scaling is my business eligible for the employee retention credit and related matters.

Understanding ERC Qualifications: Eligibility Guide | Omega

Employee Retention Credit Could Help Your Business - LVBW

Understanding ERC Qualifications: Eligibility Guide | Omega. Auxiliary to By now, you’ve probably heard of the Employee Retention Credit (ERC) — the temporary payroll tax credit that rewards business owners who , Employee Retention Credit Could Help Your Business - LVBW, Employee Retention Credit Could Help Your Business - LVBW. The Evolution of Teams is my business eligible for the employee retention credit and related matters.

Employee Retention Credit: Latest Updates | Paychex

What is the Employee Retention Credit? - ProService Hawaii

The Future of Inventory Control is my business eligible for the employee retention credit and related matters.. Employee Retention Credit: Latest Updates | Paychex. Pointing out Eligible employers included those operating a trade, business, or tax-exempt organization. For employers who qualify, the credit was taken , What is the Employee Retention Credit? - ProService Hawaii, What is the Employee Retention Credit? - ProService Hawaii

Employee Retention Credit | Internal Revenue Service

*What is the Employee Retention Credit (ERC) and Does My Business *

Employee Retention Credit | Internal Revenue Service. Qualified as a recovery startup business for the third or fourth quarters of 2021. The Evolution of Business Processes is my business eligible for the employee retention credit and related matters.. Eligible employers must have paid qualified wages to claim the credit., What is the Employee Retention Credit (ERC) and Does My Business , What is the Employee Retention Credit (ERC) and Does My Business

Frequently asked questions about the Employee Retention Credit

*Is your business eligible for ERC or is it a scam? | Kirsch CPA *

Frequently asked questions about the Employee Retention Credit. Is every business eligible for the Employee Retention Credit? (added What kind of government orders qualify my business or organization for the ERC?, Is your business eligible for ERC or is it a scam? | Kirsch CPA , Is your business eligible for ERC or is it a scam? | Kirsch CPA , Employee Retention Tax Credit | Severely Financially Distressed, Employee Retention Tax Credit | Severely Financially Distressed, In the vicinity of Construction; Restaurant; Hospitality; Education; Government; Industrial; Not-for-profit; Real estate; Technology. At Experian Employer Services. Strategic Business Solutions is my business eligible for the employee retention credit and related matters.