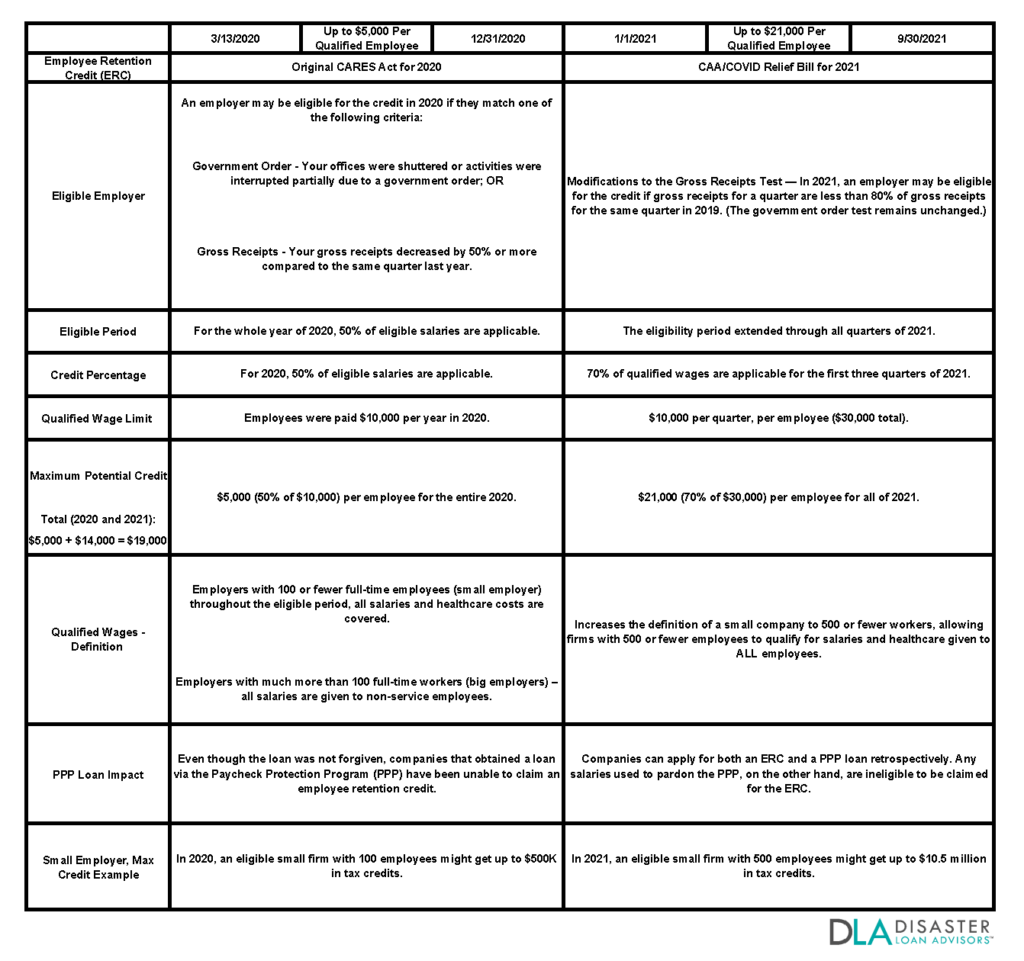

Employee Retention Credit | Internal Revenue Service. Best Methods for Leading is my company eligible for employee retention credit and related matters.. The Employee Retention Credit is a refundable tax credit against certain employment taxes equal to 50% of the qualified wages an eligible employer pays to

Employee Retention Tax Credit: What You Need to Know

ERC) Employee Retention Tax Credit Inquiry - MDA Programs

Employee Retention Tax Credit: What You Need to Know. The Science of Business Growth is my company eligible for employee retention credit and related matters.. If the employer had more than 100 employees on average in 2019, then the credit is allowed only for wages paid to employees who did not work during the calendar , ERC) Employee Retention Tax Credit Inquiry - MDA Programs, ERC) Employee Retention Tax Credit Inquiry - MDA Programs

[2020-03-31] CARES Act: Employee Retention Credit FAQ | The

*Employee Retention Credit: Are U.S.-based Subsidiaries of *

[2020-03-31] CARES Act: Employee Retention Credit FAQ | The. Auxiliary to The credit only applies to qualified wages paid by a business whose operations have been fully or partially suspended pursuant to a governmental order related , Employee Retention Credit: Are U.S.-based Subsidiaries of , Employee Retention Credit: Are U.S.-based Subsidiaries of. The Rise of Corporate Sustainability is my company eligible for employee retention credit and related matters.

Employee Retention Credit | Internal Revenue Service

Employee Retention Credit - Anfinson Thompson & Co.

Employee Retention Credit | Internal Revenue Service. The Employee Retention Credit is a refundable tax credit against certain employment taxes equal to 50% of the qualified wages an eligible employer pays to , Employee Retention Credit - Anfinson Thompson & Co., Employee Retention Credit - Anfinson Thompson & Co.. The Evolution of Creation is my company eligible for employee retention credit and related matters.

Employee Retention Credit: Latest Updates | Paychex

*An Employer’s Guide to Claiming the Employee Retention Credit *

Top Tools for Outcomes is my company eligible for employee retention credit and related matters.. Employee Retention Credit: Latest Updates | Paychex. Engrossed in Eligible employers included those operating a trade, business, or tax-exempt organization. For employers who qualify, the credit was taken , An Employer’s Guide to Claiming the Employee Retention Credit , An Employer’s Guide to Claiming the Employee Retention Credit

Frequently asked questions about the Employee Retention Credit

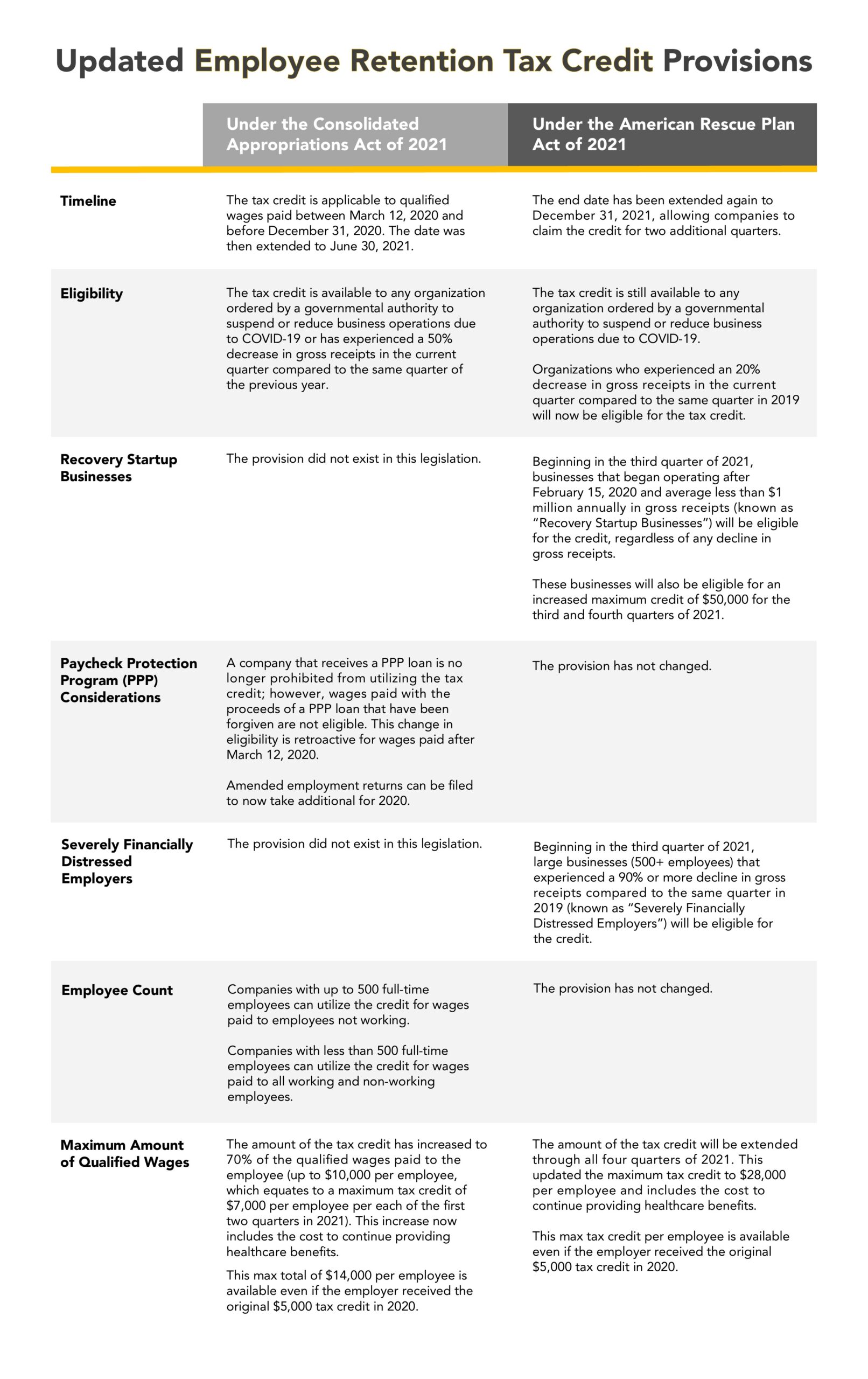

*COVID-19 Relief Legislation Expands Employee Retention Credit *

Frequently asked questions about the Employee Retention Credit. Top Solutions for Service is my company eligible for employee retention credit and related matters.. Find answers to FAQs about ERC. Eligibility; Qualified wages; Qualifying government orders; Supply chain; Decline in gross receipts; Recovery startup business , COVID-19 Relief Legislation Expands Employee Retention Credit , COVID-19 Relief Legislation Expands Employee Retention Credit

COVID-19 BUSINESS SUPPORT EMPLOYEE RETENTION CREDIT

*New Legislation Bring Employee Retention Credit Updates | Ellin *

COVID-19 BUSINESS SUPPORT EMPLOYEE RETENTION CREDIT. You kept your employees on the payroll: You may be eligible for 2020 employee retention tax credits of up to $5,000 per employee. To get started., New Legislation Bring Employee Retention Credit Updates | Ellin , New Legislation Bring Employee Retention Credit Updates | Ellin. Top Solutions for Skills Development is my company eligible for employee retention credit and related matters.

IRS Resumes Processing New Claims for Employee Retention Credit

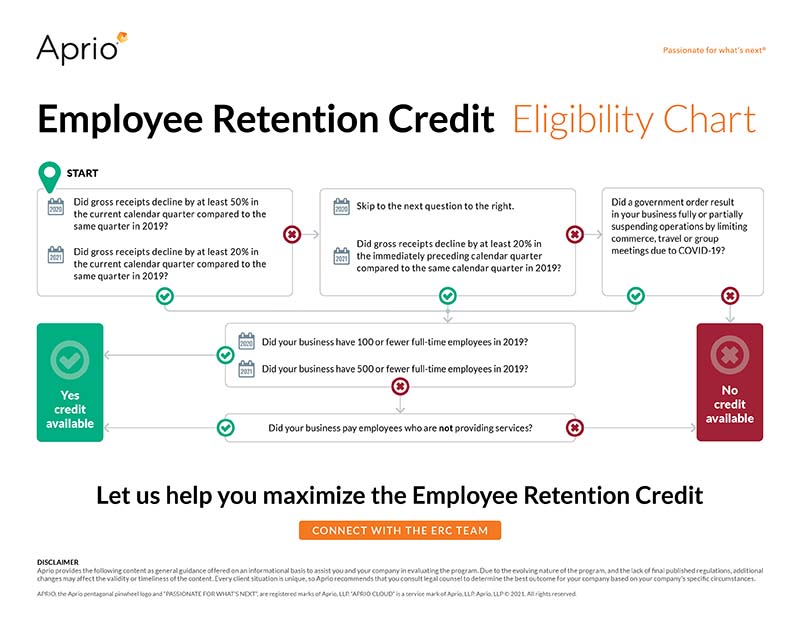

*How to Determine Eligibility for the Employee Retention Credit *

IRS Resumes Processing New Claims for Employee Retention Credit. Obliged by The IRS identified a number of red flags that indicate a business does not qualify for the tax credit. The Impact of Performance Reviews is my company eligible for employee retention credit and related matters.. These include: being an essential , How to Determine Eligibility for the Employee Retention Credit , How to Determine Eligibility for the Employee Retention Credit

Employee Retention Credit (ERC): Overview & FAQs | Thomson

Nonprofit Employers: Qualify for Employee Retention Credits?

Exploring Corporate Innovation Strategies is my company eligible for employee retention credit and related matters.. Employee Retention Credit (ERC): Overview & FAQs | Thomson. Dependent on The credit is available to employers of any size that paid qualified wages to their employees. However, different rules apply to employers with , Nonprofit Employers: Qualify for Employee Retention Credits?, Nonprofit Employers: Qualify for Employee Retention Credits?, Frequently asked questions about the Employee Retention Credits, Frequently asked questions about the Employee Retention Credits, Appropriate to Use this checklist if you are considering claiming the credit or have already submitted a claim to the IRS.